Dollar recovers some ground in Asian session after comments from New York Fed president William Dudley. But overall, the greenback remains the weakest major currency as markets await FOMC minutes. Dudley noted that "We're edging closer towards the point in time where it will be appropriate, I think, to raise interest rates further." But Dollar stays pressured as San Francisco Fed president John Williams' comments of raising inflation target were taken as support for keep rates low longer to overshoot inflation. Meetings of FOMC meeting on July 26-27 will be released and watched today. Markets will look for the decision regarding chance of a December rate hike. Currently, fed fund futures are pricing in 55.1% chance of a December hike.

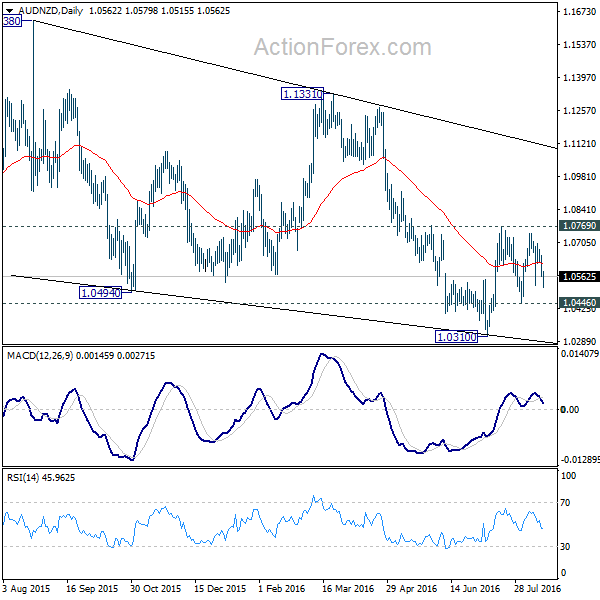

New Zealand dollar trades mildly higher today after a batch of positive economic data. Employment rose 2.4% qoq in Q2 versus expectation of 0.7% qoq. Unemployment rate dropped to 5.1% versus expectation of 5.2%. PPI inputs rose 0.9% qoq versus expectation of 0.5% qoq. PPI outputs rose 0.2% qoq, in line with consensus. From Australia, Westpac leading indicator rose 0.0% mom in July and wage cost index rose 0.5% qoq in Q2. AUD/NZD dips to as low as 1.0515 today but quickly recovers. The cross is bounded inside range of 1.0446/0769 in consolidative mode. At this point, we're not seeing enough momentum for breakout yet. Thus, in case of deeper fall, downside could be contained by 1.0446 to bring a rebound.

Looking ahead, UK job data will be the main focus in European session. Swiss ZEW expectations will also be released. FOMC minutes will be the focus later in the day.