Traders are cautiously awaiting the employment data from US today. Dow 30 edged up to historical intraday high overnight at 16604.15 but pared gains to close nearly flat at 16572.55. S&P 500 also hit new high at 1893.8 but closed mildly lower at 1888.77. Dollar maintains the post ECB gains against while dollar index is consolidating above 80.5 after taking out 80.35 resistance yesterday. Economists are expecting NFP to show 190k growth in March while unemployment rate is expected to drop to 6.6%.

The leading indicators for NFP were mildly positive. ADP report showed 191k growth which was inline with expectations and was an improvement to prior month's 178k. Employment component of ISM manufacturing dropped from 52.3 to 51.1, which was negative. But employment component of ISM services improved drastically from 47.5 to 53.6 and that was positive. The 4 week moving average of initial claims dropped from 338.5k to 319.25k. The conference board consumer confidence improved sharply from 82.3 to 78.3, hitting a six year high. We'd likely get solid figures from NFP today.

The dollar index's break of 80.35 resistance affirmed the case that consolidation pattern from 81.48 has already completed with three waves down to 79.27 already. More importantly, this affirmed that 79.00 was a bottom and rebound from there is going to extend higher. Bias is back to the upside and we'd see further rally to 81.39/48 resistance zone next. Outlook will stay bullish as long as 79.75 support holds. This argues that EUR/USD could drop back to 1.3476 support correspondingly.

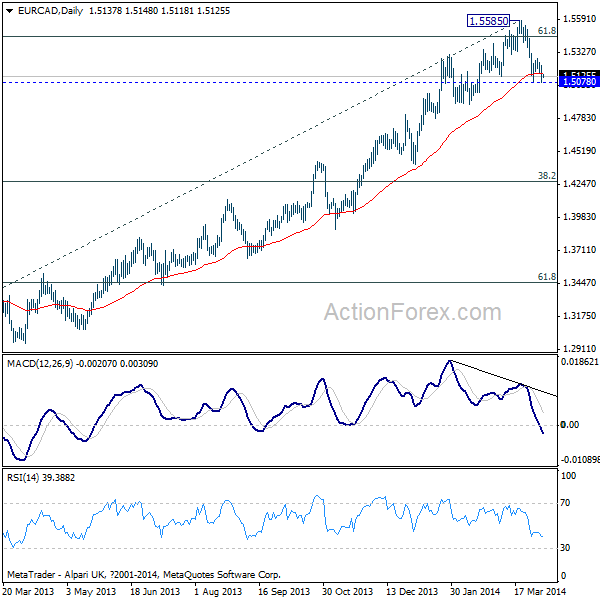

Canadian dollar will be another main focus today. Employment report is expected to show 25.3k growth in March while unemployment rate is expected to be unchanged at 7.0%. Ivey PMI is expected to improve from 57.2 to 58.3 in March. The price actions in USD/CAD are dependent on both set of key data from US and Canada today and could be quite volatile. Thus, for trading the economic data from Canada, we'd turn to EUR/CAD instead. As noted before, the pair could have formed a medium term top at 1.5585 on bearish divergence condition in daily MACD. Strong Canadian data today would trigger a break of 1.5078 to resume the fall fro 1.5585. And in the case, the correction would resume towards 38.2% retracement of 1.2126 to 1.5585 at 1.4246.

Yesterday, the ECB refrained from adding stimulus to market but indicated that it's open to further easing. President Mario Draghi also gave strong indication that the members are prepared to implement QE to prevent deflation. We do not expect the central bank to make any move in coming months as the overall economic outlook is improving in the region, unless inflation fails to rise back close to 1%. While the ECB explicitly indicated the use of QE to combat deflation, further questions to be asked are: What are the triggers of QE? Are policymakers unanimous on the triggers? What unconventional measures would be used? Do policymakers unanimously agree on the use of the measures?