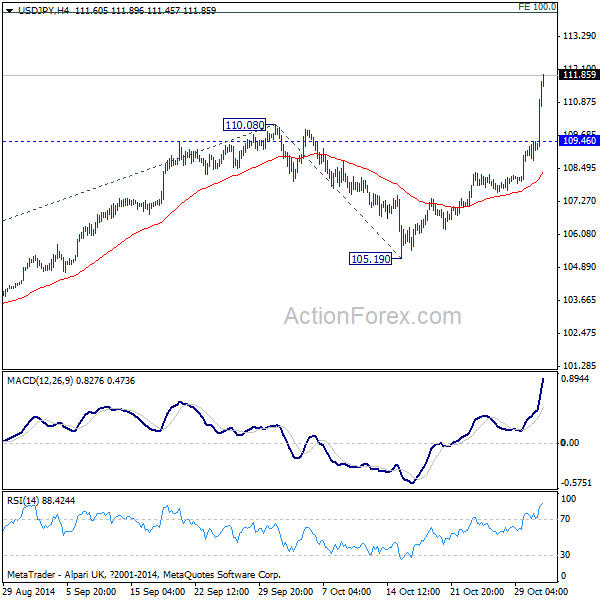

Dollar extends recent rally as the week starts and as markets prepare for a busy week ahead. Three central banks will meet including RBA, ECB and BoE. Meanwhile there are a number of key economic data from US this week, which is crucial for maintaining dollar's momentum. ISM manufacturing will be release today and is expected to drop slightly to 56.5 in October. Trade balance will be featured tomorrow. US will release ADP employment and ISM services on Wednesday. The major event is Friday's non-farm payroll which is expected to show 228k growth in October with unemployment rate unchanged at 5.9%. Technically, EUR/USD's break of 1.2500 last week and USD/JPY's strong break of 110.08 already confirmed trend resumption. This week's major focus will be on 1.5876 in GBP/USD, 1.1385 in USD/CAD and 0.8642 in AUD/USD.

Talking about Aussie, it opened the week sharply lower on broad based strength of the greenback. It's also weighed down by disappointing data ahead of a busy week down under. Building approvals dropped sharply by -11% mom in September versus expectation of -0.9% mom. TD securities inflation rose 0.2% mom in October. The Aussie was so far rather resilient recently as markets were very volatile elsewhere. Nonetheless, there are some market moving events scheduled this week which could finally trigger a breakout in AUD/USD. RBA would very likely keep rates unchanged at 2.50% tomorrow and maintain a neutral bias. Retail sales and trade balance will be featured tomorrow too while employment data will be released this Thursday.

Sterling will also face the test of some key economic data this week. EUR/GBP's downside acceleration last week now put 0.7755/66 key support zone back into radar. UK will firstly release PMI manufacturing today, the construction PMI tomorrow, services PMI on Wednesday, industrial production on Thursday and trade balance on Friday. BoE rate decision on Thursday could be a non-event. GBP/AUD is a cross that is worth a watch this week. The price actions from 1.8682 are clearly corrective in nature. The correction from 1.9185 should also be finished at 1.7214 too. Hence, we'd anticipating an eventual upside breakout. Above 1.8441 will turn bias to the upside for 1.8682. Break will target a test on 1.9185. A downside breakout in AUD/USD could trigger this move in GBP/AUD.

Here are some highlights for the week:

- Monday: Eurozone PMI manufacturing final; UK PMI manufacturing: US ISM manufacturing

- Tuesday: RBA rate decision, retail sales, trade balance; UK construction PMI; EU economic forecasts, PPI; Canada trade balance; US trade balance

- Wednesday: Eurozone services PMI final, retail sales; UK service PMI; US ADP employment, ISM services

- Thursday: Australia employment; UK productions, BOE rate decision; ECB rate decision; US jobless claims; Canada Ivey PMI

- Friday: Swiss unemployment, foreign currency reserves, retail sales; UK trade balance; Canada employment; US non-farm payroll