- Investors defy Fed, expecting rates to peak soon

- ECB appears hawkish, lifts the euro

- BoJ maintains loose policy, hurts the yen

- Wall Street rallies on hopes Fed hiking cycle is ending

Dollar slides as traders believe rate peak is near

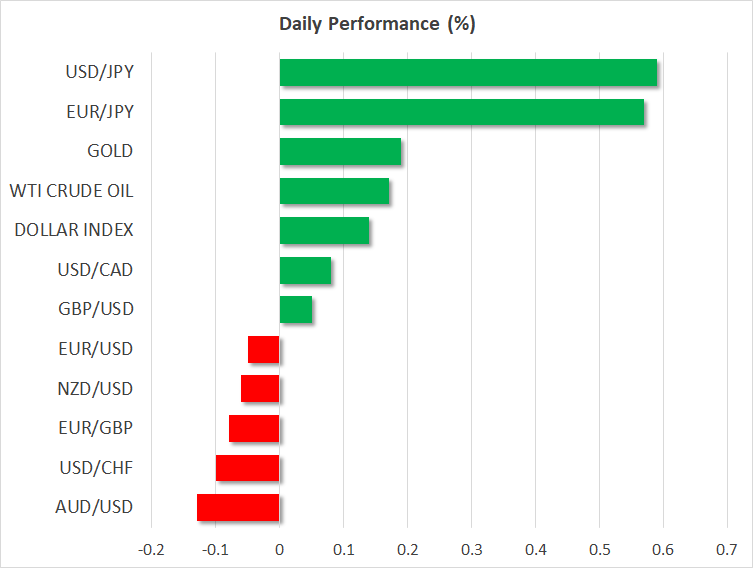

The US dollar traded lower against all but one of the other major currencies on Thursday, with the aussie and the euro taking the lead. The only currency against which the greenback gained some ground was the yen.

Despite the Fed signaling that two more quarter-point hikes may be on the cards for this year, investors remained unconvinced, and yesterday’s data confirmed their choice not to listen. Yes, retail sales unexpectedly rose in May, but jobless claims for last week came in higher than expected. They held steady at 262k, very close to May’s peak of 264k, which is the highest since January 2022. What’s more, import prices for May fell by the most in three years.

Coming on top of Tuesday’s data, which showed that consumer prices slowed by more than expected, yesterday’s releases did not allow investors to add to their hike bets. Just as before the Fed’s decision, they continue to price in only one more hike this year and slightly less than two quarter-point cuts by March next year.

Yesterday’s tumble in the dollar corroborated the view that its latest recovery was not the beginning of a full-scale reversal but rather a corrective phase. That said, the technical chart of the dollar index continues to paint a neutral picture. The move signaling the resumption of the prevailing downtrend may be a decisive dip below the 100.70 zone, which provided strong support in February, April, and May.

ECB lifts the euro, BoJ hurts the yen

The euro was the second in line winner yesterday, as traders were encouraged to initiate new long positions after the ECB appeared more hawkish than expected. With inflation in the Euro area standing at 6.1%, more than three times the Bank’s objective, policymakers increased rates by 25bps, taking the deposit rate to 3.5%, the highest level in 22 years.

That said, the hike was already more than fully priced in. What prompted euro traders to jump into the action may have been the upwardly revised inflation outlook and President Lagarde’s remarks that they will be restrictive as long as needed to achieve their objective, with a pause not being discussed at all. “We have not begun thinking about it because we have work to do,” she added.

The strength of the euro and the weakness of the dollar allowed euro/dollar to break above the 1.0900 barrier, probably putting an end to its latest downside correction. Nonetheless, an uptrend continuation could start being examined upon a break above the key resistance zone of 1.1090.

The main gainer was the Australian dollar, perhaps benefiting from the People’s Bank of China’s decision to proceed with more stimulative action on Thursday, while the main loser was the yen, which extended its slide during the Asian session today after the BoJ announcement. The Bank kept its ultra-loose monetary policy untouched, maintaining its pledge to continue “patiently” with monetary policy easing, which disappointed those expecting some sort of normalization hints as inflation hovers above the BoJ’s target of 2%.

Stocks cheer chance of Fed ending tightening soon

With the Chinese central bank determined to support the local economy and investors believing that the Fed may not need to do much more to bring inflation to heel, Wall Street extended its rally yesterday. All three of its main indices gained more than 1% and it seems that, should data continue to point to slowing price pressures at a time when growth-related numbers are more than satisfying, the uptrend may continue.

Yes, the risk of a correction continues to increase as Nasdaq has been in a straight run north since mid-March, and the catalyst for that could still be liquidity drain due to US Treasury issuance. However, a potential slide may just be a counterwave within the broader uptrend, perhaps providing investors the opportunity to buy at more attractive levels.