- Headline CPI rate drops by a full percentage point, core ticks up

- Investors still expect another 25bps hike, but maintain rate cut bets

- Fed minutes reveal that some officials considered pausing

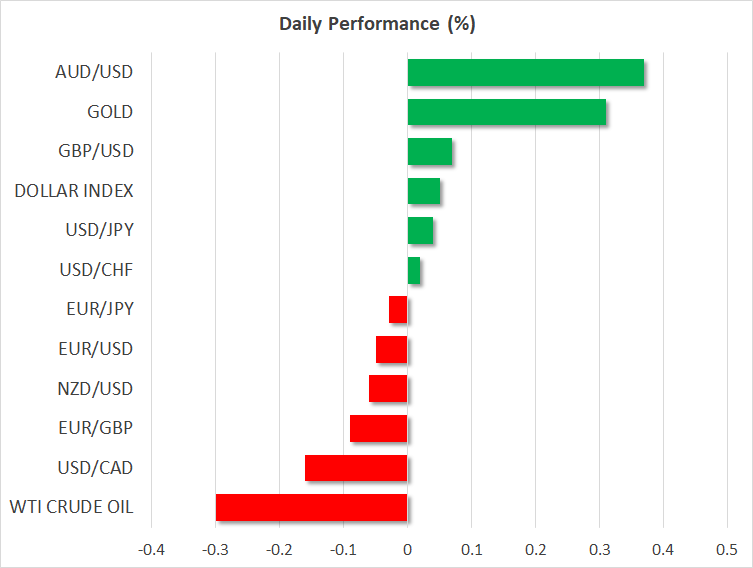

Dollar slips as investors continue to see rate cuts later this year

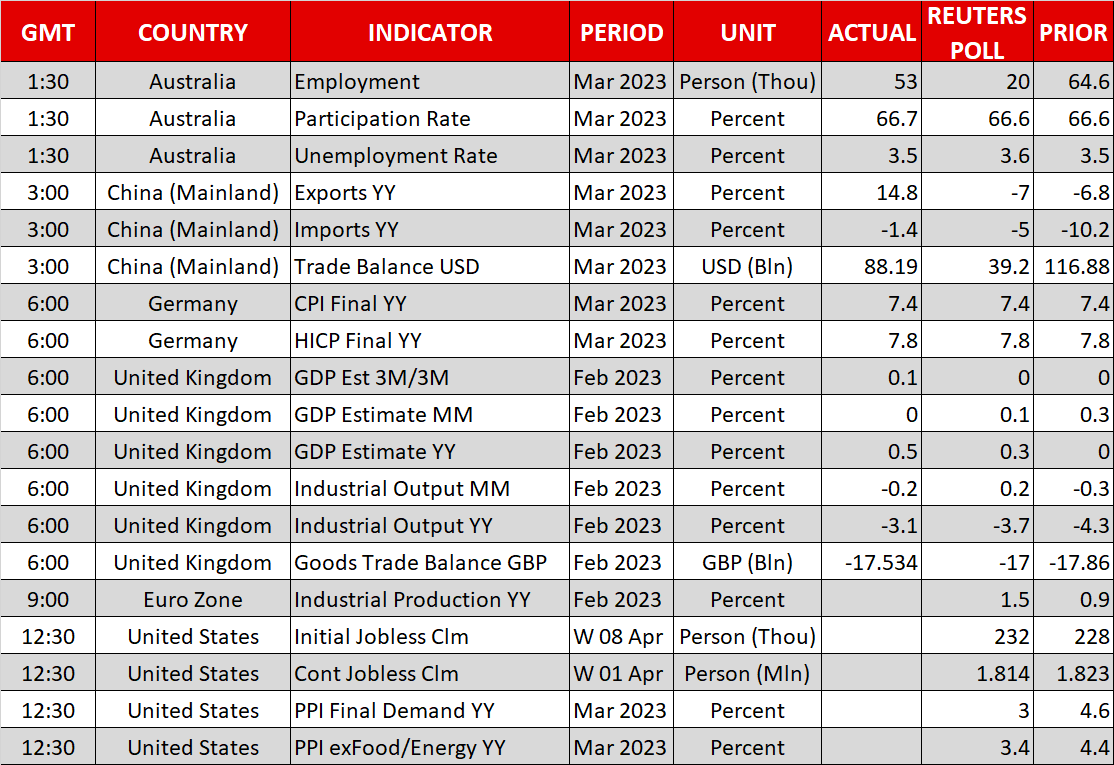

The US dollar extended its slide against all the other major currencies yesterday after the March CPI data revealed that headline inflation in the US slowed by more than anticipated and after the minutes from the latest FOMC decision showed that following the collapse of two regional banks, several policymakers were considering hitting the pause button.

The headline US consumer price index slowed to 5.0% y/y from 6.0%, the lowest rate since May 2021, but the core rate ticked up to 5.6% from 5.5%. This is the first time since December 2020 where the core rate is higher than the headline, confirming the notion that the slowdown in headline pressures is more likely due to volatile items, like energy.

That’s maybe why investors kept firmly on the table bets that another rate hike may be needed in May, assigning a 70% probability to that case. However, the slowdown in the headline rate by a full percentage point combined with the minutes’ dovish flavor allowed them to continue expecting more than 50bps worth of rate reductions by the end of the year.

With the ECB expected to deliver around 75bps worth of additional rate increments without pressing the cut button at all this year, euro/dollar may be poised to continue drifting north. A decisive break above 1.1035 may allow the bulls to aim for the high of March 31,2022, at 1.1175.

Wall Street closes in the red on banking crisis concerns

All three of Wall Street’s main indices closed in the red, despite the miss in the headline CPI and despite the minutes of the prior Fed meeting revealing that some officials wanted to stop raising rates.

As soon as the inflation numbers were out, the S&P 500 jumped but hit the key resistance territory of 4,150 and pulled back, extending its retreat after the minutes were released. It seems that the concerns about the banking turmoil revealed in the minutes and evidence of a mild recession later this year did not allow equity investors to cheer the prospect of lower interest rates for much longer. With that in mind, investors will now lock their gaze on the earnings season for Q1, which kicks off on Friday with results from major banks.

Gold continued to be the safe haven of choice in this environment, benefiting not only from the dollar’s weakness yesterday, but also from the retreat in Treasury yields and the worries about the state of the US economy. The metal got closer to the high of April 5 at $2,033, the break of which could pave the way towards the $2,070 zone, marked by the high of March 2022, or even the record peak of around $2,075, hit on August 7, 2020.

BoC sticks to a hawkish pause

Apart from the US CPIs and the Fed minutes, dollar/loonie traders had another reason to sell the pair and that was the BoC decision. The Bank decided to stand pat for the second meeting in a row as it was largely anticipated. However, it did not satisfy those expecting a cut later this year, with the statement revealing that policymakers are still prepared to raise rates further if deemed necessary.

At the press conference, Governor Macklem clearly said that “The implied interest rate cuts that are built into the market curve later this year don’t look like the most likely scenario to us.” Nonetheless, investors are still seeing a 25bps rate reduction even after Marclem’s remarks. This means that although the loonie may continue performing well against its US counterpart for a while longer, it may resume its slide against currencies whose central banks are expected to continue raising rates without cutting, like the euro. In simple words, the euro/loonie uptrend may resume very soon.