The US dollar rally lost momentum during the week and recorded its third day of depreciation versus other major pairs. The USD continues to gain versus emerging market currencies as more signs of a global growth slowdown appear. The US consumer price index (CPI) came in under expectations and raised concerns on how many rate hikes could the Fed get way with in 2018. Retail sales data will be published on Wednesday, May 15 at 8:30 am EDT. The changes to the tax code are touted as a victory for the White House but consumers will have the final say on its impact on spending.

- US Retail sales expected to keep rising at steady pace

- Oil prices to keep rising as uncertainty remains in the Middle East

- NAFTA negotiations to continue as US President Trump still critical of deal

USD Loses Momentum with Retail Sales Hurdle Ahead

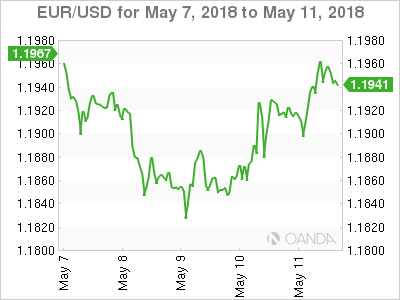

The EUR/USD lost 0.08 percent in the last five days. The single currency is trading at 1.1950 as the USD depreciated as investors closed their long dollar positions. European Central Bank (ECB) President has stated that there are concerns about European growth, which could translate into lower rates for longer even as the U.S. Federal Reserve keeps tightening monetary policy with an expected 2 to 3 more rate lifts this year.

European indicators to keep a look out this week include the preliminary figures of German Gross Domestic Product (GDP) due on Tuesday, May 15 at 2:00 am. The EU will also publish the flash GDP figures at 5:00 am EDT. Both numbers are expected to show a gain of 0.4 percent. German Economic Sentiment published by the ZEW had a shock drop last month and that trend is expected to continue with a –8 reading as institutional investors and analysts remain pessimistic about the German outlook.

The final estimate of the European consumer price index (CPI) will be released on Wednesday, May 16 at 5:00 am EDT with a forecast of 1.2 percent.

Canadian Dollar Higher Due to Oil Price Lift

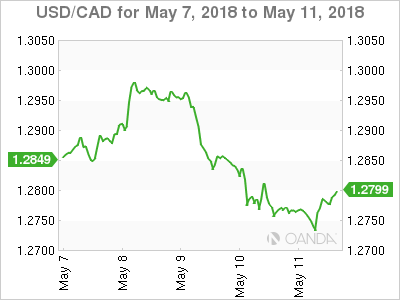

The USD/CAD lost 0.52 percent during the week. The currency pair is trading at 1.2781 as the loonie had a volatile week after the US announced it would be pulling out of the Iran nuclear deal. The price of oil pushed higher and took the CAD along for the ride. The USD lost momentum with the release of weaker than expected inflation data on Wednesday. Less inflationary pressure could end up with the Fed shelving a third rate hike from the already priced in 2 upcoming ones this year.

The Canadian dollar closed the week on the wrong foot with employment data missing the forecast with a lost of 1,100 positions instead of the gain of 18,000 jobs. Wages rose at a 3.3 percent clip and buried in the report was the fact that Canada had added 28,800 full time jobs. The data continues to be mixed but could put the Bank of Canada (BoC) off from hiking rates just yet. The market expects at least a rate hike in 2018 so the central bank can close the gap with the U.S. Federal Reserve.

Inflation will be key at the end of the week with the release of the Canadian CPI data on Friday, May 18 at 8:30 am EDT. Inflationary pressures have been positive as the Canadian economy seems to have gotten out of the growth slump, but outside factors remain on the BoC radar. The NAFTA renegotiation has accelerated in the last month, but now it has reached a difficult point as the US deadline approaches. The deadline is an arbitrary date on May 17, but if all three nations can’t agree on a way moving forward the hard deadline of the Mexican Presidential elections on July 1st could push any probabilities of a new round of negotiations until next year.

US President Donald Trump continues to criticize the deal as he met with representatives of the auto sector on Friday. The US team has softened its hardball tactics, but to reach an agreement it might have to do more to guarantee the other partners agree to its demands.

Negotiators from Canada, Mexico and the United States were working throughout the week and although they all mentioned great progress a deal remains out of reach. Negotiations will resume next week .

Oil Continues Upward Trend on Uncertainty of Iran’s Supply

The price of West Texas Intermediate remains above $71 in the aftermath of the US pulling out of the Iran nuclear deal. The greenback rose as investors looked to the currency as a safe haven. US President Donald Trump announced that the US would be pulling out of the 2015 nuclear agreement and would reimpose economic sanctions on Iranian exports. The move was not unexpected as the Trump administration had criticized the deal but allies were hoping the US would remain, as it stands there are still 5 nations who are backing the deal. The United Kingdom, France, China , Russia and Germany remained committed to the deal where Iran will receive no sanctions as long as it complies with stopping its uranium enrichment program.

It is still unclear what the true effects of the US ending its participation in the deal. Although sanctions will come into effect, the fact that support remains from other nations as long as Iran continues to uphold its end of the deal take some of the pain from lost oil export revenue.

Global supply is not an issue. Demand has not increased significantly which is why the biggest factor before this geopolitical event was the Organization of the Petroleum Exporting Countries (OPEC) and other major producers limiting output. The US shale industry is ready to step in and cover any shortfall from Iranian supply.

Market events to watch this week:

Monday, May 14

9:30pm AUD Monetary Policy Meeting Minutes

Tuesday, May 15

4:30am GBP Average Earnings Index 3m/y

5:00am GBP Inflation Report Hearings

8:30am USD Core Retail Sales m/m

8:30am USD Retail Sales m/m

9:30pm AUD Wage Price Index q/q

Wednesday, May 16

8:30am USD Building Permits

10:30am USD Crude Oil Inventories

12:00pm CHF SNB Chairman Jordan Speaks

9:30pm AUD Employment Change

10:00pm NZD Annual Budget Release

Friday, May 18

8:30am CAD CPI m/m

8:30am CAD Core Retail Sales m/m