Dollar tumbled sharply last week as the surprising weak non-farm payroll report put Fed's June hike off the table. But the greenback was overwhelmed by weakness in Sterling, triggered by renewed Brexit fear. Yen led the way higher followed by strong rebound in Aussie and Kiwi. Euro was mixed after an unspectacular ECB meeting. Other major currencies were mixed too. In other markets, US indices were stuck in tight range last week without any direction. But treasury yields dropped sharply on Fed expectations. WTI crude oil continued to struggle to take out 50 handle firmly. Gold rebounded strongly on dollar weakness.

NFP showed only 38k growth in May, the lowest since September 2010. Prior month's figure was also revised down from 160k to 123K. Unemployment rates, however, dropped to 4.7%, lowest since November 2007, and beat expectation of 5.0%. But that was due to people leaving the labor force as participation rate dropped from 62.8% to 62.6%. Average hourly earnings met expectations and rose 0.2% mom. After the release Fed fund futures are just pricing 4% chance of June hike and 31% chance of July hike. It should be noted that considering the key global event of EU referendum in UK, there is no chance for Fed to hike rate in June now. However, a "remain" result in the referendum, followed by a set of solid June data, would still give Fed policy members the confidence for a hike in July. Current weakness in the greenback might just be temporary.

As widely anticipated, ECB left the monetary policy unchanged in June and remained confident over the effectiveness of the measures implemented and to be implemented. President Mario Draghi announced at the meeting that the corporate sector purchase program (CSPP) would begin on June 8 while the first TLTRO2 auction will be launched on June 23. The staff adjusted only modestly the economic projections. Draghi sees downside risks to growth diminished as a result of the policy measures adopted. He reiterated that ECB is ready to add more stimuli to the market when needed. He also added that, besides monetary policies, other measures at the country and the European level are needed to boost growth. More in ECB Announces To Begin Corporate Bond Buying Next Week, Downside Risks Diminished As Stimulus Effective.

Dollar index was rejected from medium term falling channel resistance and dropped sharply last week. Rebound fro 91.91 should have completed and deeper fall should be seen. However, overall, the choppy decline from 100.51 is seen as the third leg of the consolidation pattern from 100.39. The price structure still suggests that it's completed at 91.91 already. Hence, we'd look for support for the index below 61.8% retracement of 91.91 to 95.96 at 93.46 to contain downside. The second preferred case is that while fall fro m100.51 might extend, the break of 91.91 low should be brief and shallow.

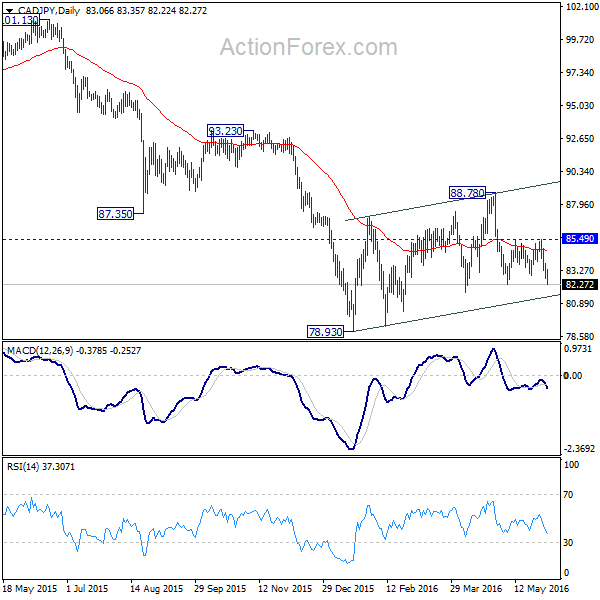

Regarding trading strategies, our NZD/USD short was stopped out at 0.6810 on strong rebound in the pair. Another main development last week was the strong rally in yen. EUR/JPY took the lead and resumed the medium term down trend already. USD/JPY and GBP/JPY both look set to retest recent lows at 105.54, 151.64 respectively. CAD/JPY's breach of 82.23 support also suggests that fall from 88.78 is resuming for a test on 78.93 low. Also, WTI crude oil might finally have a pull back after failing 50 on multiple attempts. Hence, we'll sell CAD/JPY at market this week with stop at 85.50.