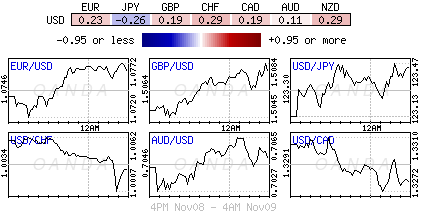

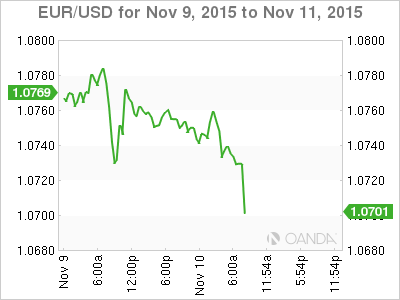

It seems that the reality of a coming U.S Fed hike next month is starting to really kick in. Not surprisingly, the U.S equity market managed to grab the “bearish baton” from its global counterparts after fully digesting Friday’s stellar non-farm payroll report (NFP) yesterday. U.S indices have now officially fallen back into the red for the year. Even the fixed income dealers are doing their bit and backing up the U.S curve, benchmark 10-year treasuries now trade atop of their four-month high (+2.35%). In forex, the dollar’s rate differential trading strategy remains the dominant theme. Higher U.S rates will always attract yield hungry investors to the greenback. However, with so many investors betting that the dollar will grind higher over the coming weeks, the natural market risk is that some of the weaker long dollar positions will be at risk to sharp market reversals should the U.S economy stall.

The Fed is adamant that their rate decisions are data dependent: Hence, why the dollar is trapped in a relatively tight range with investors unwilling to take strong positions amid a lack of fresh trading incentives (This Friday’s U.S Retail Sales print would be the next key benchmark for the dollar). There is the small factor of the USD appreciating too quickly. The last time the Fed voiced its concerns about a stronger greenback weighing on U.S exports and growth, the market witnessed an aggressive unwinding of long dollar positions. With the dollar index trading atop of its 13-year highs, expect investors to proceed more cautiously. Perhaps, the dollar's biggest gains may not actually appear until after the first rate hike, but then again, a “token” Fed hike will play right into the dollar bears hands.

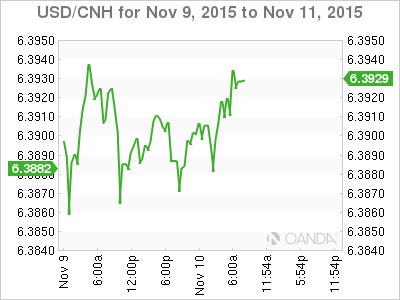

Market volatility to play a key role: Despite the current optimistic outlook for the U.S. economy – encouraged by continuing improvements in unemployment and the key housing sector – market volatility could end up being one of the very variables that dissuades the Fed from pulling the rate trigger next month. The unusual level of volatility, especially amongst the equity and fixed income class, is not indicative of a “normal” market environment. Furthermore, the ongoing slowdown in China and emerging market economies remains a key risk factor for investors globally. Data from the world’s second largest economy continues to provide a challenge for global investors.

Further slowdown in Chinese inflation keeps the door ajar for more PBoC measures: In the overnight session, softer China CPI raises the concern over buildup in deflationary pressure (Oct CPI y/y +1.3% vs. +1.5%e – six-month low, Oct PPI y/y -5.9% vs. -5.9% e – 44 straight-month of decline). Coupled with the weekend’s soft China trade components, the overnight inflation data only heightens the markets concerns over domestic consumer demand. The weaker data certainly add fuel to further policy easing by the PBoC to stimulate growth. Analysts do note that a couple of comments from PBoC Governor Zhou in his recent five-year plan statement did suggest that Chinese authorities would look to “intensify targeted measures and also improve economic policy coordination on fiscal and monetary policies.” It’s not if, but when the PBoC will announce their next stimulus package.

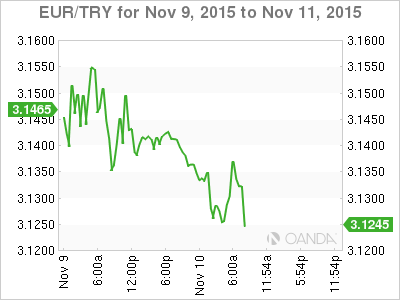

EM Fallout: Aside from China and market volatility, there are two conceivable factors that may dissuade the Fed from hiking in December, first, the possibility of emerging market currency fallout and second, October non-farm payroll (NFP) revisions. Investors should take note of the handful of EM currencies in particular that are under imminent threat now that the market increasingly believing that the Fed will start to raise rates next month:

• TRY – political pressure on the CB “not” to hike rates

• IDR – increasing current account deficit and falling trade

• BRL – low commodity prices and credit risk downgrade

• KRW – weak growth and dovish CB

• ZAR – weaker economic outlook and low commodity prices