The U.S. dollar declined against most majors after the release of weak economic data reduced demand for the greenback. The U.S. currency dipped against the Euro after the Federal Reserve Bank of Philadelphia stated that the Manufacturing Index posted a drop of 16.5 points to -107 this month, indicating that it contracted at the fastest pace in four months.

Other data showed that the New York Federal Reserve’s Index of Manufacturing improved somewhat this month, although it continued to post in contraction territory. Meanwhile, the U.S. Department of Labor announced that the number of people filing for Unemployment Benefits in the week that ended on November 10th climbed by 78,000 to a seasonally adjusted 439,000. This is the highest number since April of 2011. And lastly, releases confirmed that the cost of living rose in October at the slowest pace in three months.

Official figures indicated that Consumer Price Inflation went up 0.1 percent, just as analysts anticipated. Canada’s Dollar gained against its U.S. counterpart after crude oil, the country’s biggest export, traded at $87.09 a barrel in the New York Mercantile Exchange. The loonie was also supported by unexpected increases in Manufacturing Sales.

Despite continued concern over the euro regions’ debt crisis, which weighed on the shared currency, the euro managed to rally against the U.S. dollar following the release of less than stellar U.S. economic data. However, the euro’s advance was limited as figures revealed that the economy of the eurozone contracted by 0.1 percent during the months between July and September. Prior metrics had shown that the economy shrank 0.2 percent in the second quarter. Due to this, economists are saying that the region has entered into a technical recession.

Other reports showed that the E.U.’s biggest economy also slowed down, and that Consumer Price Inflation remained the same. The British pound slipped to a two-week low versus the 17-nation currency subsequent to government reports which concluded that U.K. Retail Sales fell more than economists anticipated for the month of October. The Sterling traded at the lowest price in over two months against the U.S. dollar after the Bank of England suggested that it may still consider increasing its asset purchasing program to bolster economic growth. But given the lackluster metrics issued out of the U.S., the pound rebounded against the greenback later in the day.

The yen weakened further after the leader of the Japanese opposition party indicated that he’d like to work in conjunction with the Bank of Japan in order to lower the value of the yen and thus improve the economic outlook. He also suggested that further easing may be necessary to overcome deflation and that the BOJ ought to set the benchmark interest rate at zero or below zero.

Lastly, in the South Pacific, the Australian dollar plunged to an eight-day low against the greenback subsequent to the announcement of less than positive domestic economic data. However, the New Zealand dollar advanced versus the U.S. currency as demand for the greenback ebbed in the market following the release of weak U.S. economic reports.

EUR/USD- Economy Continued To Shrink

The euro advanced against the U.S. dollar following the release of economic data that reduced demand for the greenback. In the euro region, data revealed that the economy contracted 0.1 percent and YoY Gross Domestic Product slipped 0.6 percent, when the year before it only contracted 0.5 percent. Reports also indicted that the region’s largest economy slowed 0.2 percent, while the French economy grew 0.2 percent.

Separate releases confirmed that Consumer Price Inflation remained at 2.5 percent in October. And lastly, Core CPI which doesn’t take into account food, energy costs, alcohol or tobacco remained unchanged at 1.5 percent. According to sources, Spain may be preparing to request a line of credit from the International Monetary Fund instead of requesting for a full bailout. The shared currency benefitted from these rumors as well as from the weakness of the U.S. monetary unit. EUR/USD" title="EUR/USD" width="703" height="394">

EUR/USD" title="EUR/USD" width="703" height="394">

GBP/USD- Sterling Rebounds After Poor Data

The British pound rebounded against the U.S. dollar after it dipped the most in over two months following official data issued by the Office For National Statistics which showed that Retail Sales fell 0.8 percent in October. The sterling recouped early session losses as the U.S. released weak economic reports which dampened demand for the greenback. Analysts have indicated that the previous positive reports may suggest that the U.K.’s economy only improved for a short time as a result of the Olympics. GBP/USD" title="GBP/USD" width="703" height="390">

GBP/USD" title="GBP/USD" width="703" height="390">

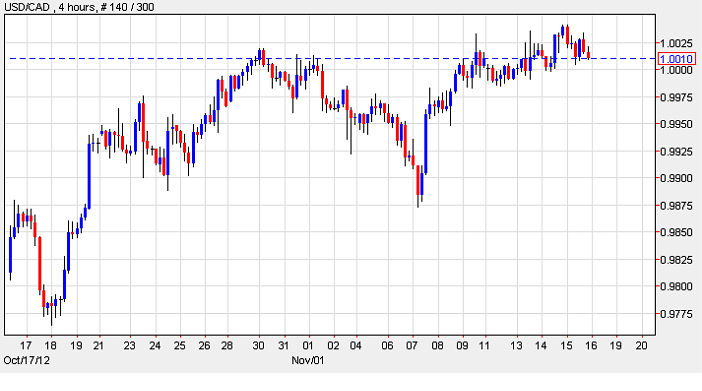

USD/CAD- Loonie Climbs As Crude Rises

Canada’s dollar strengthened against its U.S. peer as higher crude oil prices increased demand for the commodity-related currency. The loonie’s advance was somewhat limited after the U.S. reported a huge increase in Unemployment Claims. And on the data front, official figures showed that Manufacturing Sales climbed more than forecast in Canada. According to the numbers, these went up 0.40 percent after they spiked 0.90% in the prior month. USD/CAD" title="USD/CAD" width="702" height="391">

USD/CAD" title="USD/CAD" width="702" height="391">

AUD/USD- Aussie Declines On RBA Comments

The Australian dollar declined against the U.S. currency after the country’s Reserve Bank indicated that new buyers, including foreign central banks bought more Australian dollars. But the aussie’s advance was limited as market investors continued to worry about global growth, and as the Israeli airstrike on the Gaza Strip reduced demand for high-risk assets. On the data front, the Melbourne Institute reported that Inflation Expectations dropped to 2.2 percent in October. Furthermore, automobile sales dipped by 2.8 percent in October. AUD/USD" title="AUD/USD" width="702" height="392">

AUD/USD" title="AUD/USD" width="702" height="392">

Today’s Outlook

Today’s economic calendar shows that the E.U. will report on the Trade Balance. Canada will issue data on Foreign Securities Purchases. And the U.S. will release figures on Industrial Production and TIC Net-Long Term Transactions.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Dollar Declines As Weak Economic Data Reduces Demand

Published 11/17/2012, 01:07 AM

Updated 09/16/2019, 09:25 AM

Dollar Declines As Weak Economic Data Reduces Demand

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.