- Dollar advances against risk-linked currencies, helped by rising yields

- Stocks retreat, investors face ‘reality check’ on expensive valuations

- European PMIs point to fading recession risks, RBNZ decision next

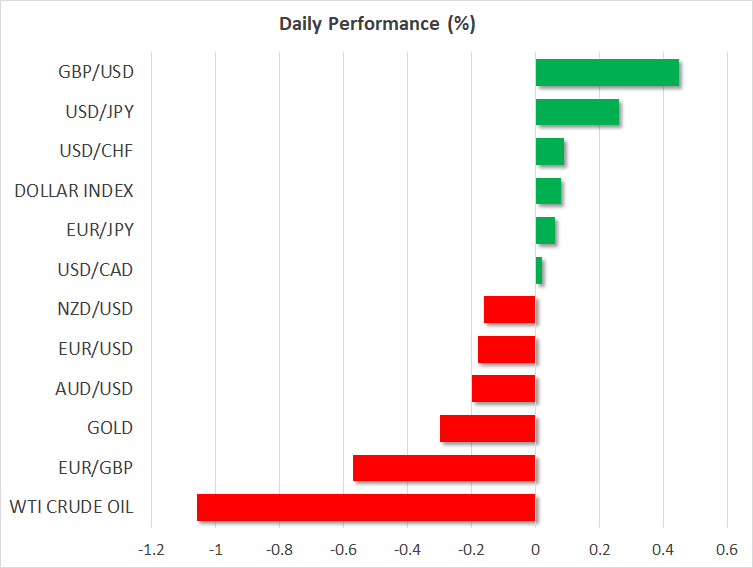

Dollar gains as risk appetite sours

A theme of dollar strength is coursing through the FX market, driven by the relentless advance in short-term US yields and the cautious tone in equity markets. Expectations around Fed policy underwent a massive repricing lately, after a string of encouraging US data releases convinced investors that interest rates will need to remain elevated for a longer period to crush inflation.

This repricing has seen the one-year US Treasury yield climb to 5.03%, which has tremendous repercussions for global markets since it is a risk-free rate. Investors can now earn more than 5% for waiting out the economic storm, something that in theory should be detrimental for riskier assets but beneficial for the US dollar.

In reality, these effects have not been very clear. While the dollar has capitalized on the appeal of higher US yields, its recovery has not been impressive, despite the stream of bullish news. How the reserve currency reacts to this week’s events - most notably the Fed minutes tomorrow - will reveal whether this inertia was just a temporary anomaly or a sign of things to come.

The fundamentals certainly favor the notion of a stronger dollar given the resilience of the US economy and the unfolding ‘higher for longer’ Fed theme, although the charts don’t tell the same story yet.

Stock markets face reality check

In the equity market, there is a sense that the music is about to stop. The recovery that started almost five months ago has been fueled entirely by valuations becoming more expensive, to the point where valuations have become divorced from economic fundamentals.

The S&P 500 currently trades at 18 times this year’s estimated earnings, a valuation so premium it can only be justified if earnings are growing rapidly or interest rates are extremely low. Neither is the case today - corporate earnings are contracting and yields are spiraling higher instead.

This exuberance might reflect some enormous liquidity injections from China and Japan in recent months, as well as the proliferation of short-dated options among retail traders that has helped suppress volatility.

In any case, the risk/reward profile for US equities is not attractive here. The disconnect between fundamentals and valuations will resolve itself eventually, most likely in a painful manner, since investors can now park their cash in risk-free instruments yielding 5%, rather than taking chances in stocks.

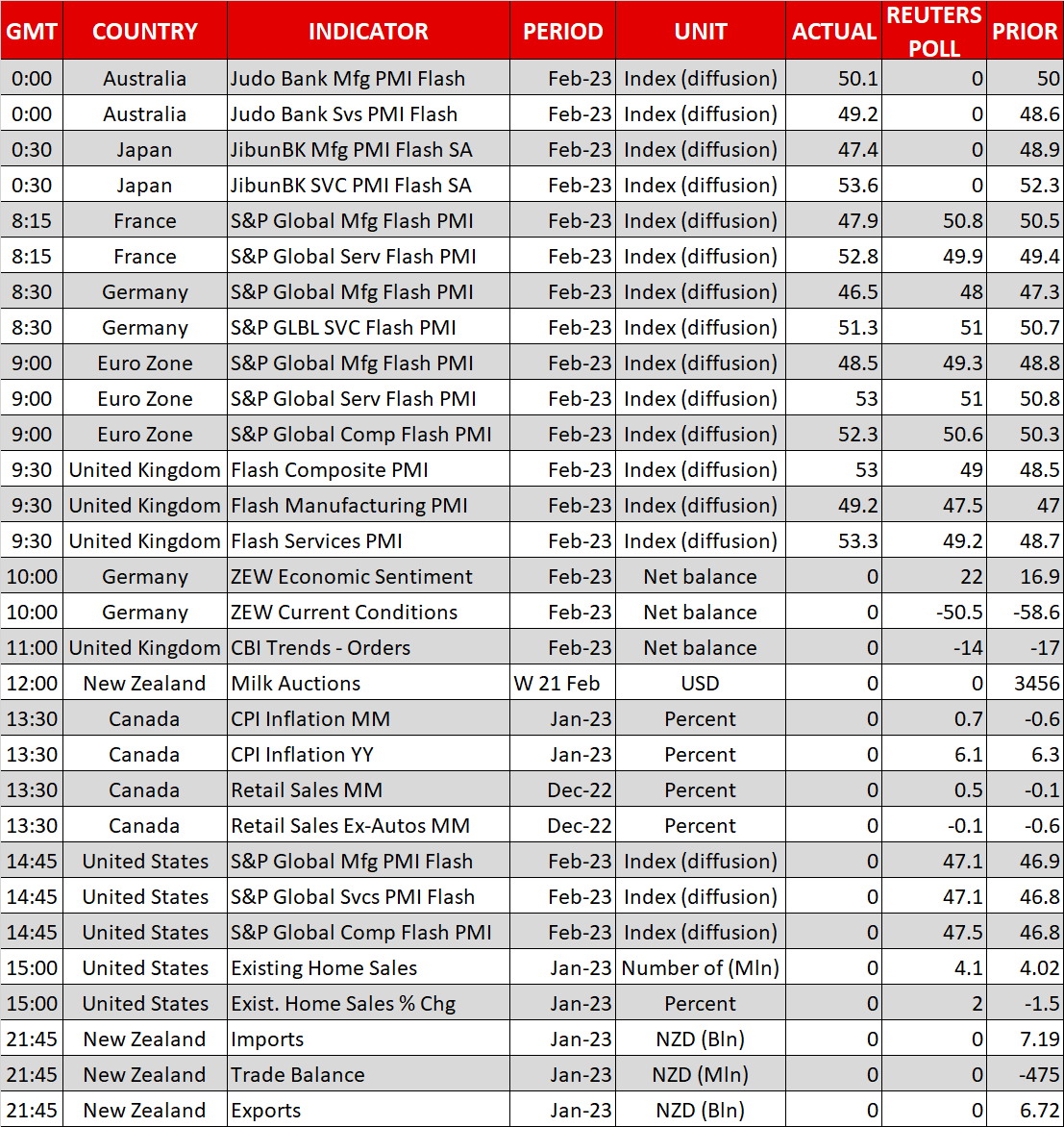

European PMIs beat forecasts, RBNZ in focus

One reason for the dollar’s recent sluggishness has been the improving sentiment around Europe, which incoming business surveys continue to endorse. The Eurozone will most likely dodge a technical recession, with the February PMIs pointing to growth of around 0.3% this quarter.

Nerves around the energy crisis have calmed down and inflation continues to moderate, feeding hopes that the worst has passed both for the Eurozone and the United Kingdom. The reaction in sterling was much greater though, as the signs of economic resilience likely surprised many investors who took the Bank of England’s forecasts of a prolonged recession at face value.

The next major event for FX traders will be the Reserve Bank of New Zealand’s rate decision early on Wednesday. A 50-basis-points rate hike is already fully baked into the cake, so the market reaction will come mostly from the economic commentary and whether the ‘terminal’ rate is revised higher.