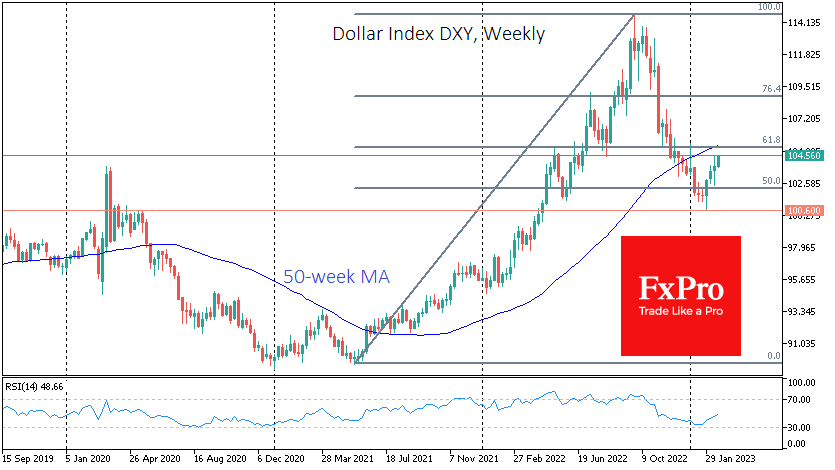

The US Dollar Index has risen 3.8% to 104.5 from its lows in early February. Prior to that, the greenback had been falling since late September, giving back half of the gains from the global rally triggered by the Fed's sharp monetary tightening.

Although the dollar's decline in recent months has been deeper than a typical Fibonacci retracement, this move looks like a profound correction within an uptrend. Early this month, the Dollar got support on the decline to the 100 area, a significant round level that acted as almost impregnable resistance in the pandemic. This time it proved to be no less solid support.

In addition, the dollar looked oversold, which provided initial support in early February. However, the US currency's momentum against its rivals no longer looks like a technical fluctuation but rather a deliberate buying of dollar-denominated securities.

The fundamental reason for buying the US currency is the strong macroeconomic data, with inflation still alarmingly high, which should strengthen the central bank's will to tighten. Judging by the tone of officials' comments, the Fed is ready to do so.

The minutes of the last meeting showed that FOMC members felt that a 25-basis point hike was appropriate but that they were prepared to consider a sharper hike if needed. Even with the standard step, the Fed intends to stop tightening policy later than the markets have been expecting in recent months, which has helped to boost equities.

The long-term bullish trend in the dollar suggests that the DXY will return to multi-year highs near 115 by the end of this year.

Even without taking such a global view, the near-term outlook for the dollar remains bullish. Since the beginning of the week, the rally has taken the corrective pullback to a new level.

A consolidation of the DXY above 104 opens the way to 106, a retreat to 61.8% of the last four months' failure after failing to reverse downside resistance at 76.4% of that move. There is a 200-day moving average of 106. We will unlikely see a real bull-and-bear battle for the USD until these levels.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Dollar Creeps Higher

Published 02/23/2023, 05:49 AM

Updated 03/21/2024, 07:45 AM

Dollar Creeps Higher

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.