- US dollar heads for weekly losses after inflation shocker curbs rate bets

- Oil prices and yields tell a different story though, stocks lose some steam

- Sterling shrugs off UK economic contraction, Michigan survey coming up

Dollar vs yields

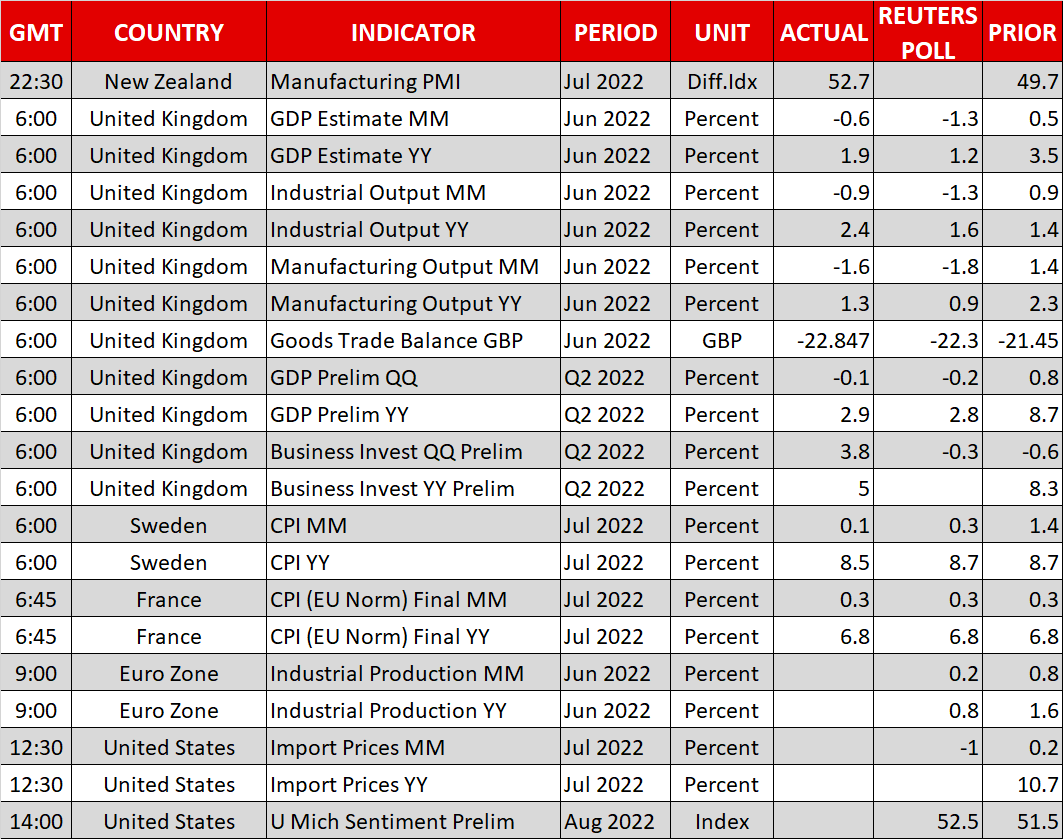

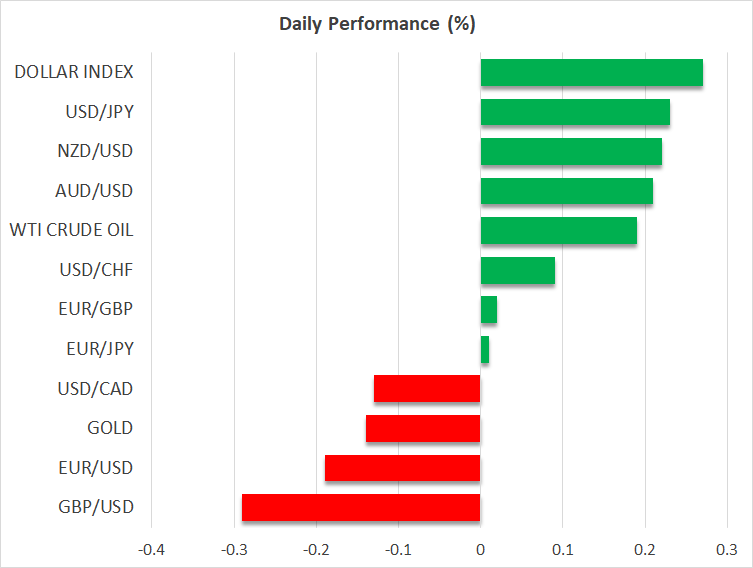

It has been a strange week for financial markets, filled with conflicting signals. The cooldown in both consumer and producer prices sparked hopes that the worst days of inflation were behind us and the Fed wouldn’t need to be quite so aggressive in raising rates, dealing a blow to the US dollar.

But the bond market refuses to endorse this narrative. Yields at the longer end of the curve are about to close the week with solid gains instead, fueled by recovering energy prices and a sense that a trigger-shy Fed today could translate into higher inflation down the road.

As such, we are left in a strange situation where the dollar is on the slide despite long-term rates rising, as forex traders focus on the near-term prospect of the Fed easing off the brakes whereas bond traders take a more holistic view that the inflation battle is not nearly over.

FX market outlook

In the big picture, it’s still difficult to call for any trend reversal in the dollar. Inflation might have peaked but even if the monthly CPI keeps printing zero for the remainder of the year, the yearly rate would remain above 6%, far too high for the Fed to declare victory. Most importantly, there is no real alternative.

The euro is feeling the burn of the energy crisis with regional natural gas prices approaching record highs and business surveys warning Europe will be at the epicentre of any global downturn. Meanwhile, the yen has been ravaged by the Bank of Japan’s dedication to yield curve control, sterling has transformed into a proxy for risk sentiment, and the commodity dollars are exposed to the meltdown in China’s debt-saddled property sector.

Even if the threat of recession ultimately forces the Fed to pivot, safe-haven flows could still keep the reserve currency afloat in case the situation in the rest of the world is even gloomier. The charts add credence to the view that nothing has really changed, as euro/dollar for instance remains trapped in a clear downtrend with the 50-day average rejecting the latest bounce.

Equities stall, oil snaps back

Wall Street erased an early advance to close virtually unchanged yesterday, although all the major indices are still headed for solid weekly gains, defying the bond market’s vocal warnings that the coast is not clear. At some point this dichotomy between Treasury yields and equity markets will reach a breaking point - both cannot keep rallying in tandem for long, unless investors truly become confident in a soft landing.

Oil prices capitalized on the cheerful mood too, bouncing like a spring from near their July lows to rally more than 7% this week despite the risk of lost Iranian barrels returning to the market soon. There has been some radio silence on this front, but the latest reports suggest European diplomats offered some more concessions to Tehran in an attempt to seal the deal.

In the UK, the economy contracted by less than the Bank of England expected in the second quarter, providing a glimmer of hope that the central bank’s forecasts for a prolonged recession next year might have been too apocalyptic. Sterling barely reacted though, reaffirming that monetary policy developments are secondary to any shifts in the global risk tone, as funding the UK’s twin deficits overrides other factors.

Finally, the University of Michigan’s preliminary consumer survey for August will hit the markets today. The inflation expectations component of this survey has become a top-tier indicator ever since the Fed based the decision to accelerate the tightening cycle on it back in June.