Now that the May month-end pricing and rebalancing shenanigans are finished, this market can get back to watching the Nikkei continue to paint the town ‘red,’ along with a stronger yen that’s now worrying a few of the weaker short positions out there. This week the global data schedule is again busy. Market risk appetite will once again be considered the primary market driver that’s expected to be heavily influenced by bond auctions and rate decisions.

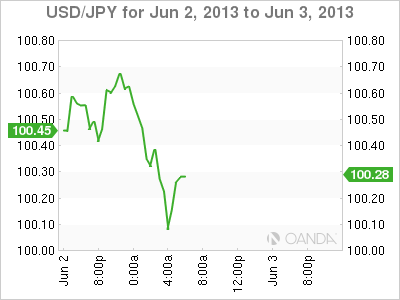

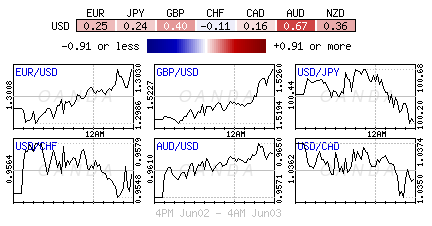

The capital market’s two most crowded trades continue to make headlines – long the Nikkei, short yen. Last night, the Tokyo bourse managed to record its fourth decline in eight sessions amid the yen’s continuing strength. The stock average pared another -3.7%, to a six week low, mostly pressured by domestic Japan selling interest. In ten day’s the Nikkei has fallen -17% as the dollar claws its way back towards that much watched psychological ¥100 mark. Japanese equities are not alone; investors and the Bank of Japan also have their work cut out with JGB’s.

The BoJ Governor recognizes that caution is also needed as JGB volatility remains high and that excess volatility must be avoided. Japanese authorities must now be officially concerned with both the recent volatile price movements and with yield backing up – very much counter productive to what Abenomics is all about. The governor, not specifically calling out yields, believes that the volatility can be contained by flexibly conducting market operations. It remains to be seen how these market operations will be implemented and until then the market will remain uncertain as to whether the BoJ is committed to holding long-term rates down – leading to a volatile JGB market.

Earlier this morning the UK manufacturing sector happened to expand at its fastest pace in 12-months (51.3 vs. 50.2). This would suggest that the outgoing BoE Governor King is less likely to be announcing any further stimulus at the two-day policy meeting midweek. The positive expansion was broad based with producers of consumer, intermediate and investment goods all reporting stronger output growth. Along with the service sector, the UK manufacturing recovery will add further weight to the BoE wait-and-see approach before policy makers will add any further stimulus. Digging deeper, improved new orders and output happened to lead the pickup in the headline print, again allowing sterling to catch its second wind.

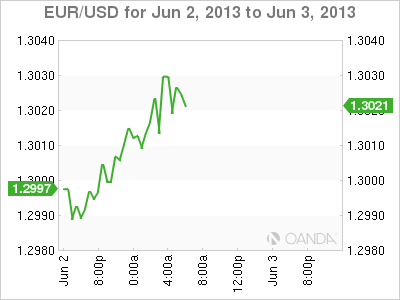

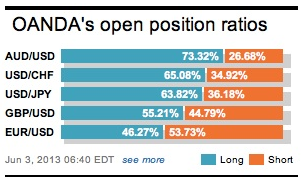

The 17-member single currency is starting this week confined to a fairly tight range. For the most part it has held a small bid on gains made on the back of a slight improvement to a few Euro-zone members PMI’s. The overall market view still remains EUR negative, supported by fundamentals and expressed by the number of speculative shorts in the market place. The US ISM will be the next market focus point later this morning. Investors continue to monitor US Treasuries and the Bund spread – any further widening suggests that the EUR remains a sell strength play.

However, there is the issue that the IMM’s massive dollar longs could see an extended squeeze. According to the most recent CFTC report the world is long of dollars. Investors have managed to add another +$18-billion since May 7 for a combined total of +$42.6-billion net long vs. G10 mostly. However, many of these recent longs have been added at bad levels ahead of a week with key event risk. Certainly not a healthy sign for “long dollar” position holders is to see US yields back up and the dollars back down.

The obvious two key event risks this week will be the ECB meet and the US employment report. The European Governing Council is expected to leave its main policy rates unchanged at the June 6 meeting after having lowered its refinancing rate by -25bp at the last go around. The market should expect policy makers to argue “the conditions are in place for a recovery in economic activity during the second half of 2013.” While Stateside the markets attention will be on this Friday’s jobs report for May—especially since recent labor market news has been mixed. The FX market will be looking at the ISM and NFP data for confirmation of the strong USD rally of the past few weeks. The weak dollar longs will be hoping that they will not be squeezed out before the reports.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Dollar Bulls Weary Of Yields Backing Up, Buck Backing Down

Published 06/03/2013, 07:11 AM

Updated 07/09/2023, 06:31 AM

Dollar Bulls Weary Of Yields Backing Up, Buck Backing Down

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.