Volatility will be the name of the game as US nonfarm payrolls are due for an early release. A technical setup combined with an expected positive result sees the dollar bulls staring at a red flag ready to charge.

The US Nonfarm payrolls are due out tonight (Thurs 2nd July) thanks to the US observing Independence Day tomorrow because it falls on Saturday. This is going to increase volatility more than usual because we essentially have two days of trading crammed into one day with nonfarm, the single biggest event in the forex calendar, thrown into the mix. The market is expecting a result of 232k, but I would not be surprised to see it come to the upside of that.

Unemployment claims have been beating forecasts with three out of the four results in June coming in better than expected. Also we have not seen a result over the 300k mark since March which shows the relative strength in the US Jobs market. Add to this the fact that summer has begun and the seasonal jobs that will be included in the labour results could add a nice little boost to the figure.

Earlier this week the CB Consumer Confidence figure pushed back over the 100 mark at 101.4 after dipping in April and May. When consumers feel good, they spend which creates jobs. The manufacturing sector has had its own strong results with yesterday’s ISM Manufacturing PMI lifting from 52.8 to 53.5 and when manufacturers expand they hire people. So some good results in June are likely to see the nonfarm result come to the upside and the move is likely to be a sharp one.

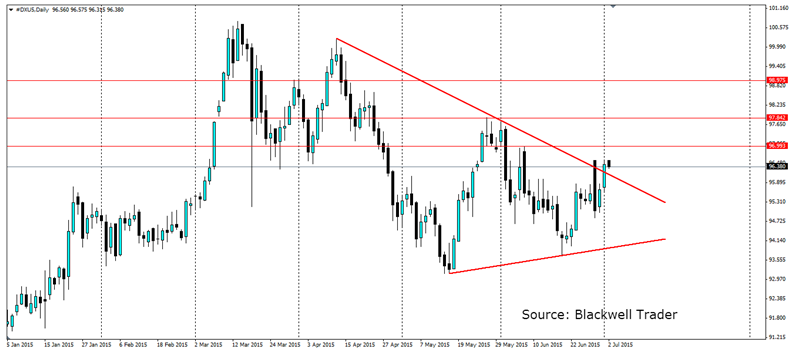

From a technical perspective the index looks to be breaking out of the pennant shape which could lead to a large bullish run. The pennant shape has been forming since the swing high in early April that failed to push beyond the top of the previous bull trend. The swing low in May is the beginning of the bottom line of the shape that the index has been consolidating above.

A double bottom on the daily chart also confirms a reversal of the recent short term downward trend. The two points of the double bottom form the bottom line of the pennant and a higher low is a good sign the tide is turning. A breakout of the shape looks like it is underway already, but we may see a pullback to the shape and it act as support. From there look for a larger extension higher that will target resistance at 96.993, 97.842 and 98.975.

The US dollar looks set for a bullish push out of the technical pattern that has formed on the daily chart. An increase in volatility thanks to nonfarm payrolls could see that happen rather quickly.