The ECB has remained dovish at the end of last week and could look to cut deposit rates at their next meeting, while FOMC members continue to hint at a December rate rise. The weakness in the euro is largely coming from the US dollar bulls as they place their bets on what the Fed will do.

There was little to get excited about in the European economic calendar last week, but further threats of terror attacks led to some fear induced selling. ECB President Mario Draghi spoke and remained dovish which also helped the euro end the week close to the seven month low. He hinted again at the possibility of a cut to deposit rates when the ECB next meets early in December.

More hawkishness from several FOMC members led the US dollar bulls to drive the euro down to a six month low. This has continued at the open of the week’s trading, and will only continue leading into mid-December FOMC meeting. The odds of a rate rise has steadily risen and is now over 70%.

This week will see European PMI results that will give a good indication of the health of the EU economy, and could help sway the ECB into cutting deposit rates if the results are poor. German business climate and EU economic sentiment will also be interesting figures to watch.

From the US side, keep an eye on a surprise FOMC meeting at the beginning of the week that could take the market by surprise if the Fed were to act on rates before their scheduled December meeting. The Fed is holding a “closed meeting” where they will “review and determination by the board of Governors of the advance and discount rates to be charged by the Federal Reserve Bank”. The discount rate is typically the premium above the Federal Funds Rate that is applied to commercial loans from the Fed to banking institutions.

The unscheduled meeting later tonight has seen the US dollar turn active in early trading this week, as traders place bets on the outcome. There is a strong chance the Fed will look to lift the deposit rate, or at least signal to the market that they will. This will be a big surprise, but will soften the blow of a lift in the Federal Funds Rate, if they do lift, in December. The US dollar bulls are betting on a hawkish move by the Fed, and that has seen the euro weaken in early trading this week.

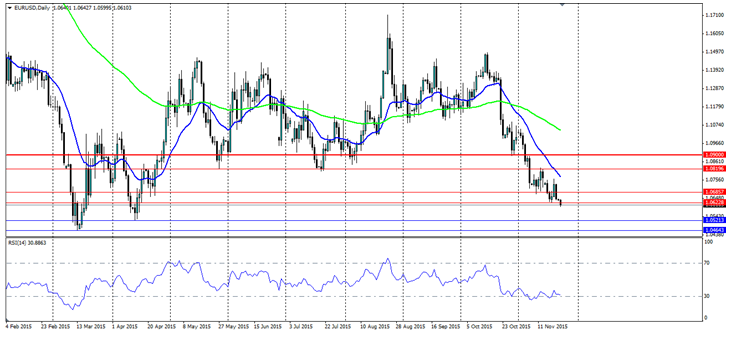

The euro has broken through the support at the 1.0622 level which was a point of interest earlier this year. The bear trend is still the dominating feature and will likely continue given the fundamental outlook. The swing lows from March and April around the 1.05 mark are beckoning the pair, and an RSI moving back out of oversold opens the door for further downside. The failure of the support at 1.0622 early in the week could see price quickly target support at 1.0521 and 1.0464, but not before a pull back to it where it should act as resistance. Look for further resistance at 1.0685, 1.0819 and 1.0900.