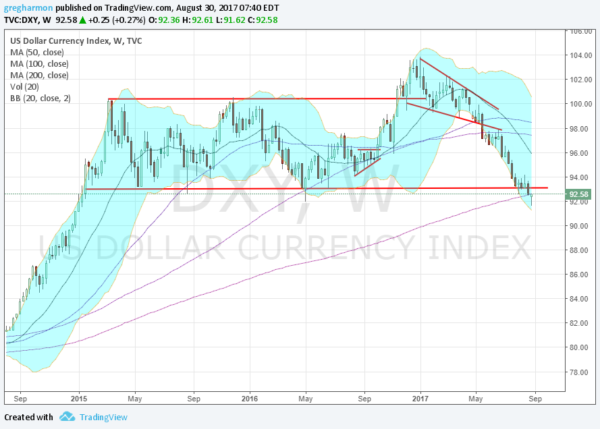

Last week I noted here that the US Dollar was on the edge of a critical breakdown. The end result of the analysis was that there was a critical range between 92.50 and 94 for the Dollar Index, and a break out of that range could be followed.

The break happened Monday to the downside. It continued lower Tuesday, passing through the May 2016 low at 91.92 and making a new 17 month intraday low at 91.62 after touching the 200 week SMA. The drop takes the Index out of the long channel that had been in place since the move higher that ended at the beginning of 2015!

So how much more downside is there? A measured move from the latest consolidation that occurred in August would suggest a target to about 90 on this leg. But there may be a reversal brewing in the chart. That move lower Tuesday printed a Hammer candle. This is where the price opens near the high, moves lower and then rises back to close near the high. It is recognizable by the long lower shadow or tail. This is significant as it can signal a reversal of a downtrend when confirmed with a higher close the next day, in this case Wednesday.

As I write in the early hours of the market the Dollar Index is doing just that. Not a major move, but a move higher. A close above 92.33 would confirm a reversal. But don’t too excited yet. First it is often that a breakdown retests the break level before continuing lower. Second the Hammer candlestick pattern does not give a target to the upside. The confirmation day could be the entire move.

A higher close gives the bottom to trade against cautiously. Continuation through the prior range and above 94 would give a lot more confidence to the rescue mission succeeding. And a lower close Wednesday or any close under 92.10 after would signal failure.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.