The real trends tend to emerge (or reemerge) a few days after the Fed meeting (see headline below), especially during expiration weeks. The dollar's decline and euro's sharp rise should not surprise readers. The US Dollar Index's strong bearish setup defined an unbalanced market since late 2014. The fact that the dollar continues to defy bearish expectation during the unwinding process should scare the bears.

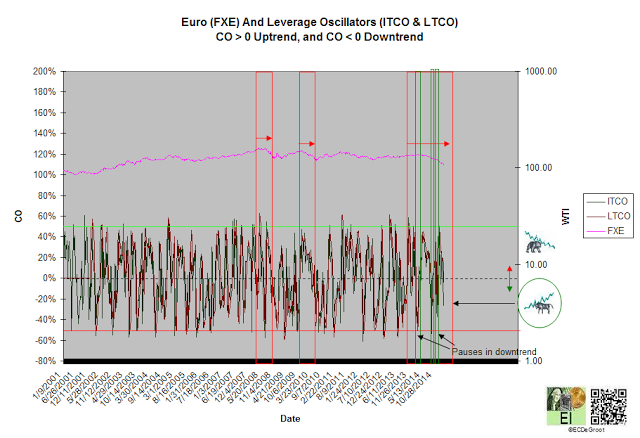

The euro's leverage oscillators (via Rydex CurrencyShares Euro Currency ETF (NYSE:FXE)), revealed in the COT Matrix and discussed in here, increased the odds of more unwinding this week. Since a lot of that unfolded yesterday, I've decided to open this review.

Fast forward to chart 3 for those that don't like charts.

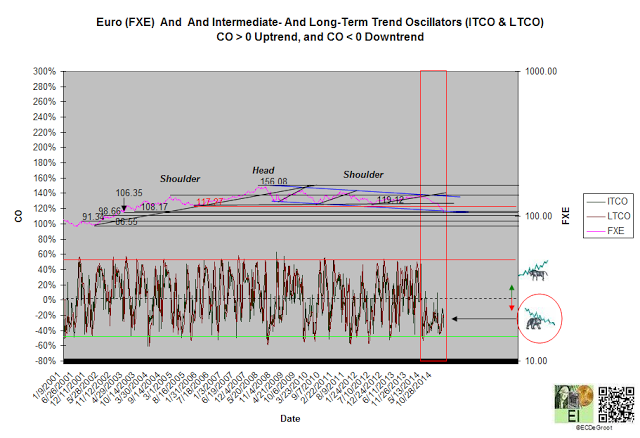

Trend (Bearish)

Negative trend oscillators define a down impulse (chart 1). The bears control the trend until reversed by a bullish crossover:

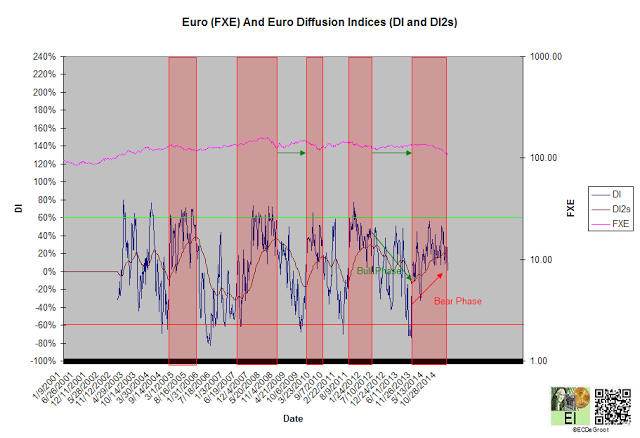

Leverage (Likely Downtick within Bear Phase/Bull XO)

The flow of leverage (red arrow) has defined a bear phase since December 2013 (chart 2). The recent downtick represents either a pause (most likely) or reversal of phase. The former maintains the expectation of falling prices, while the latter reverse it.

Negative leverage oscillators define inflows (chart 3). This supports the expectation of rising prices until reversed.

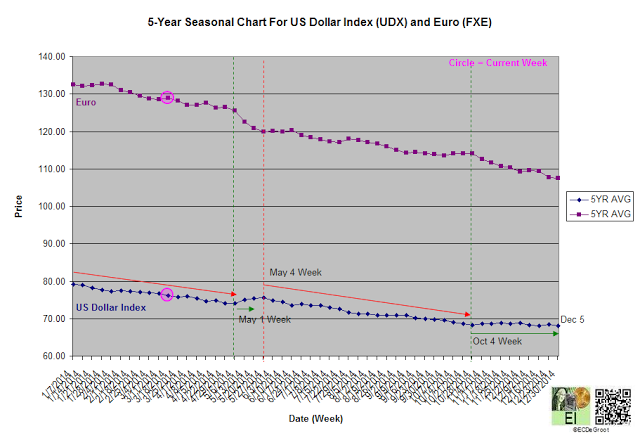

Time/Cycle (Weakness)

The 5-year seasonal cycle defines weakness nearly every month of the year (chart 4). The lack of a well-defined strength reflects the consistency of the decline since 2010. April displays limited upside bias.

Signs of weakness (SOW) distribution under the cycle of accumulation and distribution or complacent distribution (Euro's CAP) will be shorted by the bears until the message of the market turns decisively bullish.

Headline: US stocks rebound on dovish Fed, with Dow topping 18K

U.S. stocks closed sharply higher on Wednesday as investors cheered the Federal Reserve's statement that indicated a rate hike would come later rather than sooner. (Tweet this)

The Fed dropped the word "patient" from its March meeting statement , a subtle indication that the era of zero interest rates is about to end.