October is more than half over and the holiday season will be here before we know it. That will bring with it a renewed focus on things outside of the office, and hopefully a happier aura in the social media spheres. As year end approaches it is often a time of reflection. Time to sit back and think about the past year and plan for the next. It seems that the US Dollar is doing that right now.

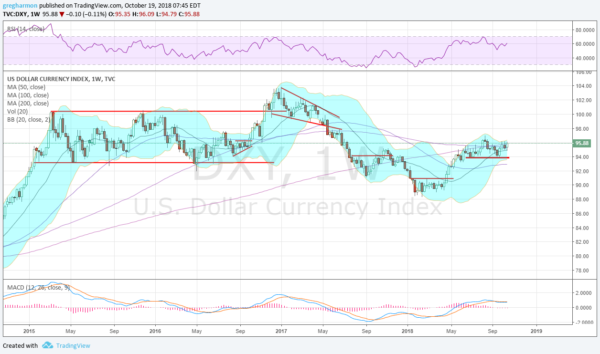

The US Dollar Index rose up out of a base in April and looked like it was ready to drive back to the 2016 highs. But as it reached the confluence of the 100 and 200 week SMA’s it stopped. It has been reflecting at this price zone since June. As it ponders the future the 20 week SMA has joined the others creating a tight bunching.

This tight grouping of SMA’s is often a spot where big moves start. Notice that the Bollinger Bands® are also very tight. Squeezed Bollinger Bands also are often a precursor to a big move. Which way will the US Dollar move? Momentum would suggest the easier path is to the upside. And a move over 96.50 in the Dollar Index would confirm this and give a target to around 100.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.