Last week I wrote about the long treasuries bumping resistance. This week it is the U.S. dollar and gold taking their turns testing critical inflection points.

U.S. Dollar

As you can see in Figure 1, on a seasonal basis the dollar is moving into a traditionally weaker time of year.

Figure 1: Courtesy Sentimentrader.com

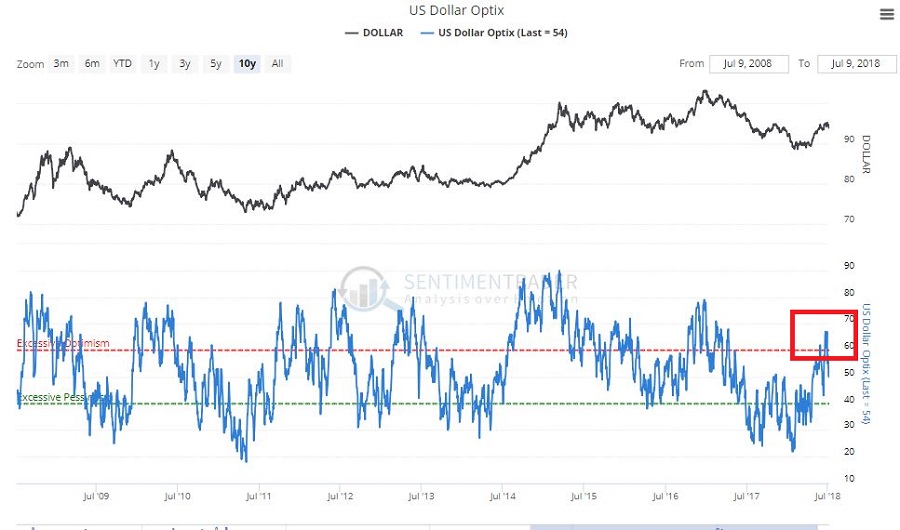

In Figure 2 you can see that traders have been and remain pretty optimistic. This is traditionally a bearish contrarian sign.

Figure 2: Courtesy Sentimentrader.com

In Figure 3 we see the “line in the sand” for ticker PowerShares DB US Dollar Bullish (NYSE:UUP) – an ETF that tracks the U.S. Dollar. Unless and until UUP punches through to the upside there is significant potential downside risk.

Figure 3: Courtesy AIQ TradingExpert

Gold

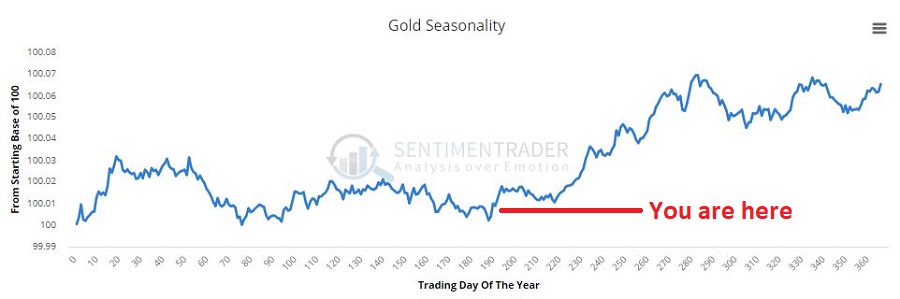

As you can see in Figure 4, on a seasonal basis the dollar is moving into a traditionally stronger time of year.

Figure 4: Courtesy Sentimentrader.com

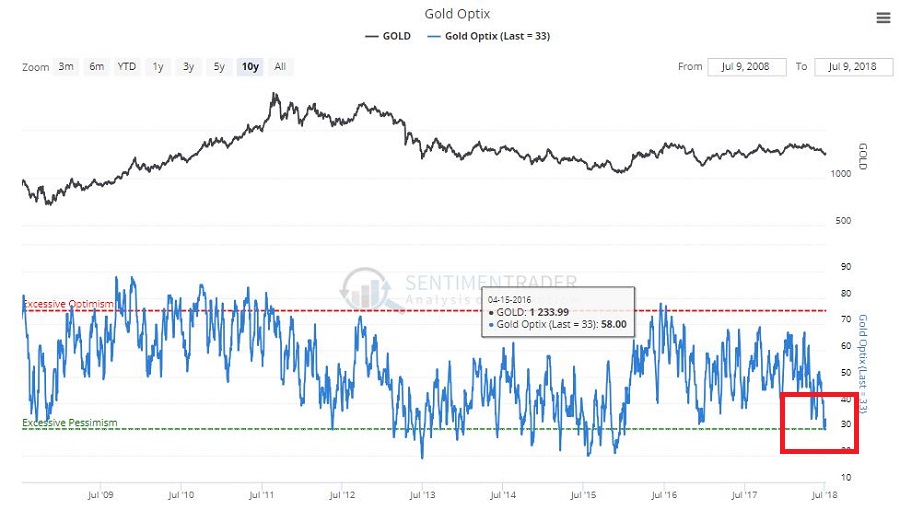

In Figure 5 you can see that traders have been and remain pretty pessimistic. This is traditionally a bullish contrarian sign.

Figure 5: Courtesy Sentimentrader.com

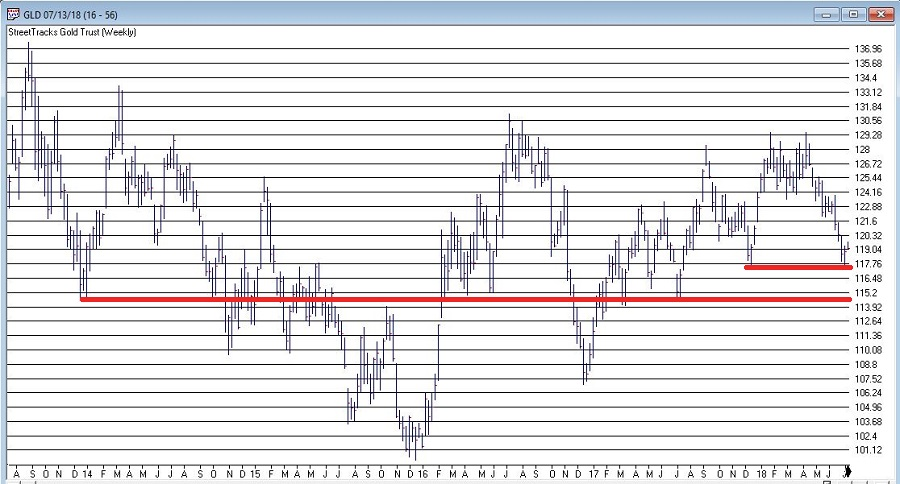

In Figure 6 we see the “line(s) in the sand” for ticker SPDR Gold Shares (NYSE:GLD) – an ETF that tracks gold bullion.

Figure 6: Courtesy AIQ TradingExpert

I would be hesitant about trying to “pick a bottom” as gold still looks pretty week. But if:

a) GLD does hold above the support area in Figure 6 and begins to perk up,

AND

b) Ticker UUP fails to break out to the upside

Things could look a lot better for gold very quickly.

Summary

As usual I am not actually making any “predictions” here or calling for any particular action. I mainly just want to encourage gold and/or dollar traders to be paying close attention in the days and weeks ahead, as the potential for a major reversal in both markets appears possible.

Likewise, if no reversal does take place – and if the dollar breaks out to the upside and gold breaks down, both markets may be “off to the races.”

So dollar and gold traders – take a deep breath; focus your attention; and prepare for action…one way or the other.