By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

- Dollar: Why the April Fed Meeting is a Big Deal

- AUD Surges 2% on Data and Tight Lipped RBA

- NZD: What to Expect from RBNZ

- USD/CAD Closes in on 1.20

- GBP Shrugs Off Weak GDP

- EUR/USD Closes in on 1.10

Dollar –: Why the April Fed Meeting is a Big Deal

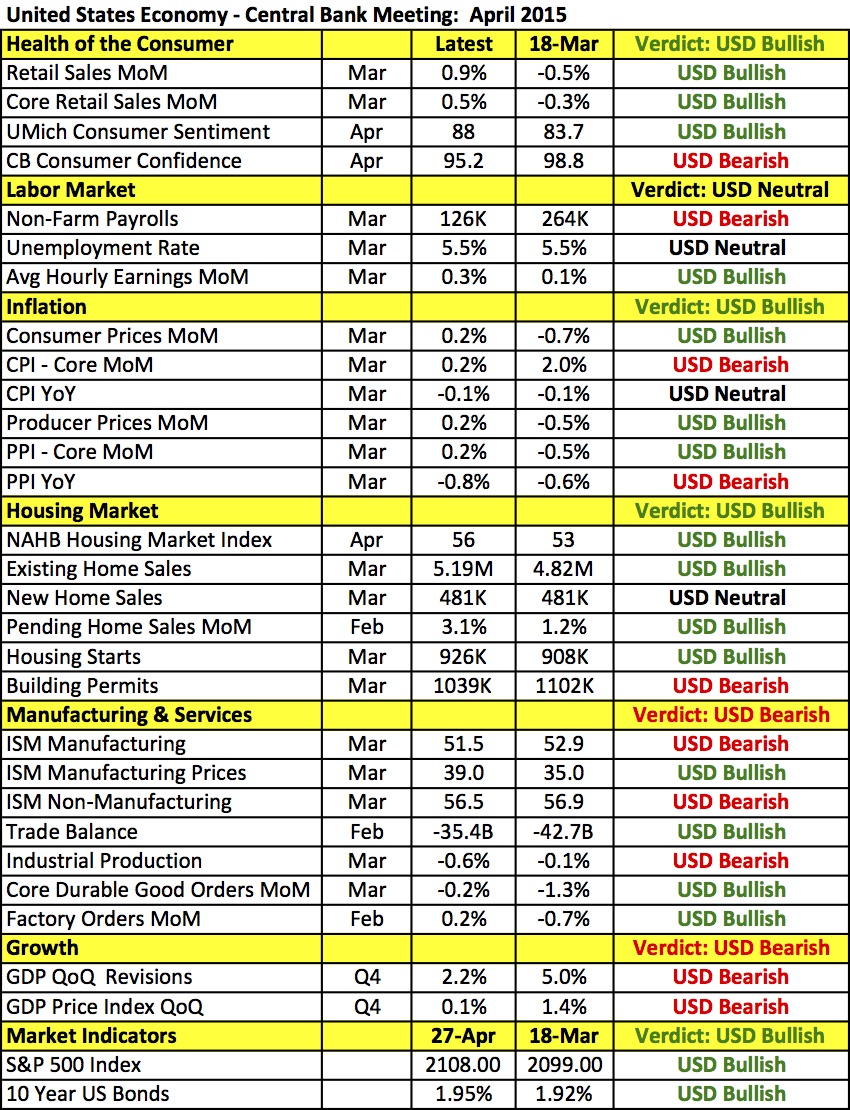

The U.S. dollar is getting crushed ahead of Wednesday’s Federal Reserve meeting. The greenback lost approximately 1% of its value versus the euro and over 2% versus the Australian dollar. The Fed meeting is hands down the most important event risk this week and based on how the dollar has been trading, investors are clearly positioning for less optimism. Since we won’t be hearing from Fed Chair Janet Yellen, if there are any changes to their outlook or guidance, they'll come in the FOMC statement. Considering there is no press conference and no expected change in monetary policy, Wednesday’s meeting would normally be a mundane. However when the market is leaning so heavily in one direction -- and that direction is counter to economic trends and Fed speak -- the reaction could be significant. The following table shows how there has been just as much improvement as deterioration in the U.S. economy since the March meeting. Of course the latest reports including the S&P CaseShiller house price index and consumer confidence surprised to the downside.

How to trade the Fed meeting?

If you want to trade the Fed meeting, it is important to realize that the focus is on whether the central bank will rule out tightening in June. They could do this by raising concerns about the slowdown in core price growth, hiring or the pullback in manufacturing- and service-sector activity. They could also lament about the strong dollar and, if they do any of these things, it could lead to a steep sell-off in the dollar that would take EUR/USD above 1.10 and USD/JPY to 118. However recent comments from Fed Presidents have been relatively upbeat and everyone from the doves to the hawks believe that liftoff will occur in 2015. The challenge for the Fed will be to ensure that the market expectation for tightening in September remains unchanged. There’s nothing in the FOMC statement that signals an imminent rate hike in June, so the Fed could realistically leave the monetary policy statement completely unchanged. Doing so would revive the rally in the greenback. With less 24 hours to go before the rate decision, your best bet is to wait for the FOMC statement to be released before taking a trade. If you're a short-term trader, a dovish FOMC statement could provide a 2-to-3 day opportunity to the downside. If you're a longer-term trader, use that move to buy the dollar at a lower level.

NZD: What to Expect from RBNZ

All three commodity currencies extended their gains against the greenback with the Australian dollar rising over 2% intraday on Tuesday. An uptick in leading indicators contributed to the rise in AUD but RBA Governor Glenn Steven’s refusal to discuss monetary policy was the main reason why the currency performed so well. The chance of another rate cut has fallen significantly in recent weeks and investors interpreted Steven's stance as a sign that the central bank will officially draw their easing cycle to a close in May. USD/CAD came close to reaching our 1.20 target level and we expect a test of that rate soon. Meanwhile, the focus for the next 24 to 36 hours will be on the U.S. and New Zealand dollars. Last week, RBA Assistant Governor McDermott said the central bank would consider lowering rates if prices fall further. Although NZD/USD rebounded since then, the currency extended its losses versus the Australian dollar. We expect the RBNZ statement to be more dovish and if we are right, we could see AUD/NZD hit 1.05. New Zealand’s trade balance was also scheduled for release Tuesday evening and while economists have been looking for a larger surplus, the decline in dairy prices and a strong currency means the risk has been to the downside.

GBP Shrugs Off Weak GDP

It seems like nothing could keep sterling down as it powered higher for the sixth consecutive trading day despite weak GDP numbers. The U.K. economy expanded 0.3% in the first quarter, which was not only slower than Q4 but also lower than the market’s forecast. According to our colleague Boris Schlossberg, “the preliminary GDP reading was disappointing on almost all levels with services output expanding only 0.5% vs. 0.9% eyed and industrial production contracting by -0.1% vs. 0.2% forecast. This was the weakest reading since Q4 of 2012 and likely reflects the general global slowdown in economic activity that was seen across the G-11 universe. In either case the news could not have come at the least opportune time for the government of David Cameron as the Torries are in the midst of a statistically even tie with Labor ahead of the UK election less that 2 weeks away. Yesterday, news of a poll that showed Torries pulling away helped boost the pound and propel it through the 1.5200 level. Irrespective of the polls, the UK election is unlikely to produce a workable majority for either party unless we see a massive change in voter preferences at the very last moment. A minority government is a recipe for instability and such an outcome could weigh on cable as we get close to the election. For now however, the markets remained relatively sanguine and cable quickly recovered to trade above 1.53 by the end of the European session. Part of the reason is the general dollar weakness as markets feel increasingly frustrated with the slow pace of U.S. growth and the lack of any urgency on the part of the Fed to normalize rates. Still cable remains vulnerable to political risk and the pair may find resistance at these levels until the election picture begins to clear up.”

EUR/USD Closes in on 1.10

With no Eurozone economic reports released Tuesday morning, the strength of the euro is purely a function of U.S. dollar weakness. While 1.10 is an important psychological level, 1.1052, the March 26th high, is key resistance for EUR/USD. The currency pair has not closed above this level in 7 weeks but if it breaks, the next stop should be 1.12. Eurozone sentiment and inflation reports are scheduled for release Wednesday but the primary driver of EUR/USD flows will be FOMC. The market’s appetite for dollars will determine whether EUR/USD breaks out of its range. In the meantime, investors continue to be encouraged by the recent personnel changes in Greece’s debt negotiation team. Tsakalotos is an economist known to have a good rapport with creditors and the hope is that progress will finally be made.