After a week of some truly violent moves in the Japanese Yen, forex markets seem likely to slow down in the week ahead. How might we trade such a slowdown?

DailyFX PLUS System Trading Signals

Volatility prices have dropped as markets seem likely to catch their breath after last week’s panic-driven forex moves. Yet everything’s relative -- even slower price moves haven’t stopped the USDJPY from rallying over 400 pips from last week’s lows. What’s our next move?

I wrote last week that it seemed we were in the early stages of a market deleveraging, and big volatility would likely result in substantial Japanese Yen strength. That forecast worked out better than I could’ve reasonably imagined as we saw carnage in the extremely crowded JPY-short trade (USDJPY long). If I’m right in calling for a slowdown in FX market moves, we’ll likely see (and have seen) the opposite: a USDJPY bounce and broader Dollar recovery.

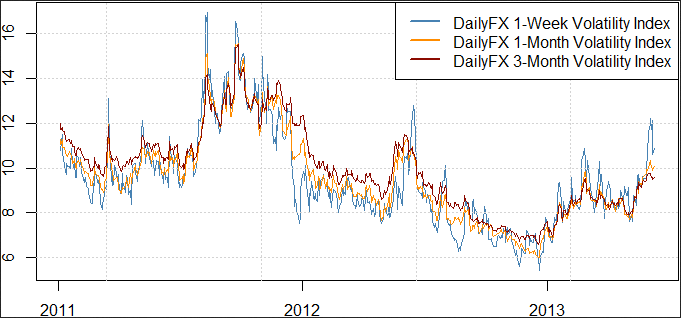

Short-dated forex volatility prices (chart below) have come off of recent peaks, while more medium-term expectations have remained relatively steady.

That makes short-term trading admittedly a bit confusing: we don’t want to lose sight of the fact that forex market conditions have likely seen a substantive shift.

Source: OTC FX Options Prices from Bloomberg, DailyFX Calculations

Past performance is not indicative of future results, but our sentiment-based trading strategies have done well amidst recent moves. The risk is obvious as nothing moves in a straight line, and it would be natural for the same strategies to give back some of their recent gains. In other words: now is probably not the time to press our trades.

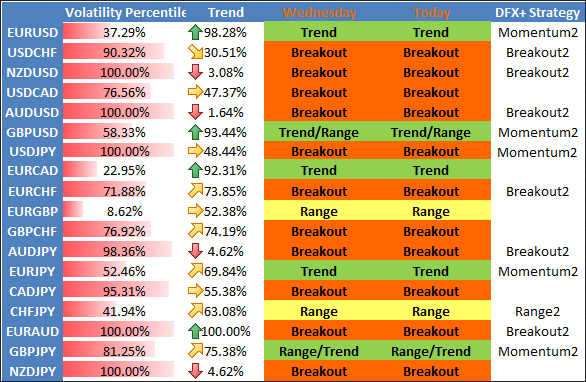

Strategy preferences remain roughly unchanged with a couple of key caveats. Our Breakout2 trading system had a banner week of performance on the massive Japanese Yen surge and could potentially do well across a number of pairs. But it would be poorly positioned for a JPY pullback (currently underway) as it has historically done poorly amid sharp market reversals.

Our major preference thus turns to the Momentum2 strategy -- also known as the “Tidal Shift” system. It was named “Tidal Shift” because it was designed to catch major market reversals. And if this is indeed the start of key short-term reversals, it could potentially do well across key JPY and US Dollar pairs.

View the table below to see our strategy preferences broken down by currency pair.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Dollar, Yen Likely to Slow --Here’s What We’re Watching

Published 06/10/2013, 11:40 AM

Updated 07/09/2023, 06:31 AM

Dollar, Yen Likely to Slow --Here’s What We’re Watching

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.