Investing.com’s stocks of the week

Overview

Headlines in the media suggest that EU should “win the first battle of Brexit talks” as the negotiations for the U.K. to leave the European Union have started on Monday, with the consent of the British team to the EU's timetable for talks.

According to the agreed timetable, the trade deal discussion will be held after the Brexit terms are agreed upon, which puts the UK in a weaker position. Theresa May will submit her first proposal on Brexit on Thursday while the political environment in the UK is tense following the General election outcome.

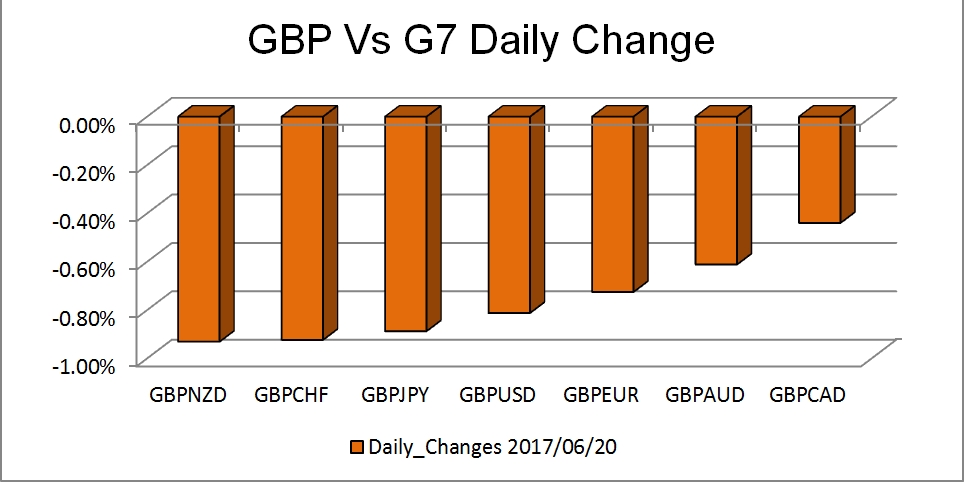

During Tuesday’s early EU morning, Governor Carney and Chancellor Hammond held a speech at the Mansion House which gave a downward push to the pound with the cable reaching the level of 1.267 and EURGBP going as high as 0.88 during the two speeches. The Governor stated that he does not see the reason for a rate hike at the current stage, especially now in the light of the uncertainty of Brexit negotiations while the Chancellor highlighted the need to protect the financial services sector which employs around 80% of UK citizens.

More specifically, Mark Carney said that in the coming months he would like to see the extent to which weaker consumption growth is offset by other components of demand, whether wages begin to strengthen, and more generally, how the economy reacts to the prospect of tighter financial conditions and the reality of Brexit negotiations before the BoE begins the adjustments. The dovish Governor pushed the pound down to the lowest levels since April 18th, around the psychological support of 1.26.

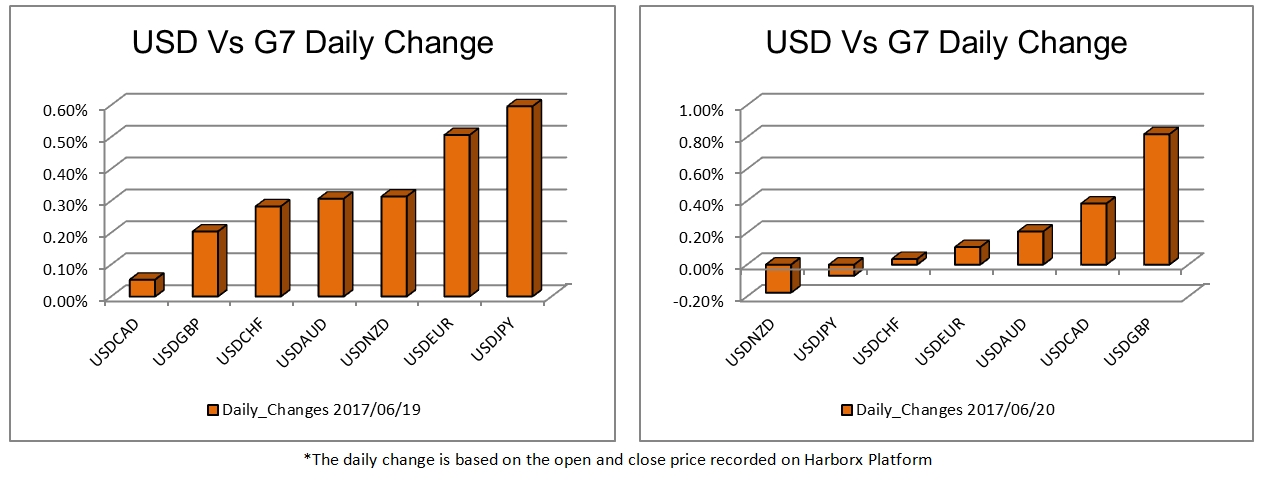

The US dollar regained some ground after Dudley’s hawkish comments on Monday that the strength in the US labor market can be translated in higher prices and salaries. Dudley also commented on the very high levels of confidence and the full employment situation in the US.

William Dudley is considered to be a dovish Fed member and hawkish comments from dovish members attract the attention of dollar’s bulls. The dollar has been trading at its higher level within the last two weeks despite the dovish comments from Kashkari and Kaplan last Friday and Evans’ on Monday. EURUSD flirts with the psychological support of 1.11 while commodity currencies show some first signs of trend reversal.

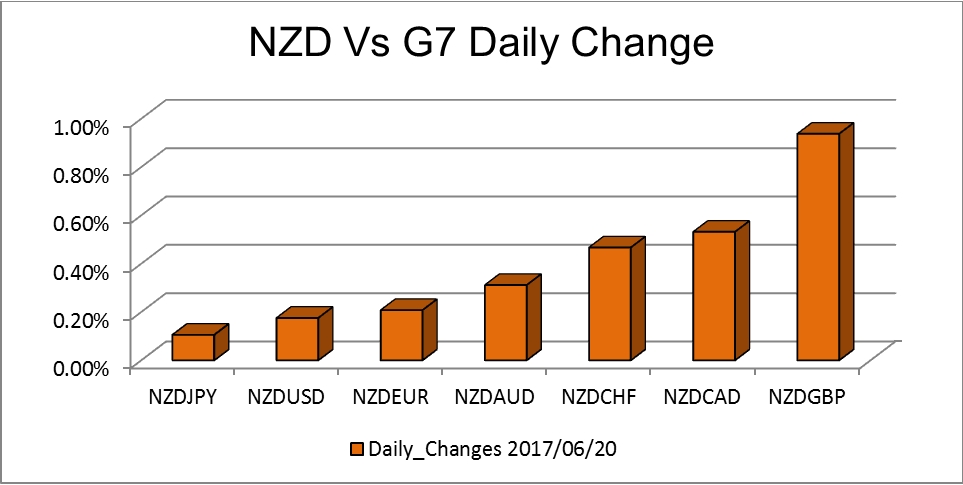

The Reserve Bank of New Zealand is having its policy meeting today at 21:00 GMT and it is expected to hold the interest rates steady at 1.75%. During the last monetary policy meeting of the RBNZ, the policymakers highlighted that the drop of the currency was a positive development; the currency was down 5% against the US dollar since the previous meeting.

However, the currency is now 4% up since May and since the biggest source of New Zealand’s economy is the exports, a depreciated currency supports the economy.

Meanwhile, the NZD was outperforming its peers the past few days but today in the light of the policy meeting it is steady around the range of 0.72 to 0.726. It is worth mentioning that on the daily and weekly timeframe, the NZDUSD seems to be near the top of the prevailing downtrend. A dovish policy statement would help the price to confirm the top on the daily timeframe and to dial back on the downtrend pattern.

*The daily change is based on the open and close price recorded on Harborx Platform

Technical View

GBPUSD

The cable recorded a 2-months low today at 1.2588 breaking the significant support of 1.26. The pair had a sharp upside correction up to 1.27 with no luck to break it and thus it is expected to revert back to 1.261.

ADX indicates negative directional movement while RSI and MACD are slopping downwards below their equilibrium levels. Moreover, the fact that the pair is trading below the triple SMAs is an additional short-term downtrend signal. The significant supports are near 1.26 and 1.2555 upon penetration. On the other hand, the resistances are near 1.27, 1.274 and 1.282.

However, on the daily timeframe the pair is still running on an uptrend. MACD and RSI are below their equilibrium levels but they are turning to the upside while ADX indicates no clear direction. The critical supports are near 1.26, 1.25 and 1.2375 while the resistances are near 1.27, 1.282 and 1.29.

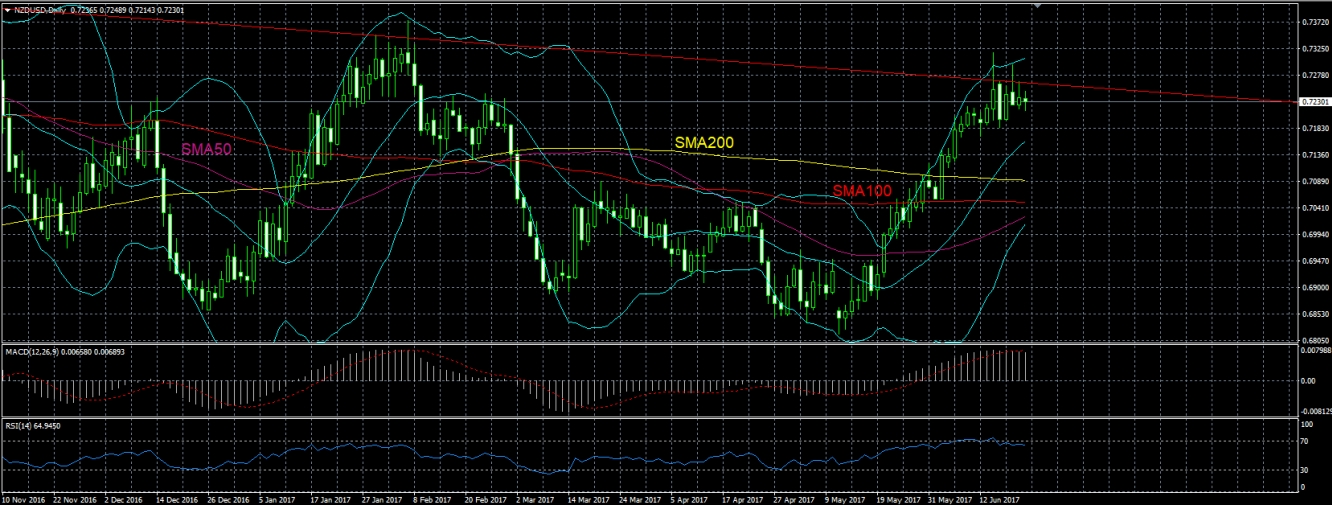

The Kiwi is running on a symmetrical triangle formation which is near to its corner and about to break. Usually, symmetrical triangles are continuation patterns of the prevailing trend. However, if the triangle breaks to the downside, then a further downwards move is expected of around 100 pips which is the distance of the triangle. The triangle breaking point is even more significant since it seems that it would most probably coincide with the triple SMAs cross. The valid target to the downside is the= support of 0.7185. On the flip side, the risks are near the resistances of 0.726 and 0.7315.

On the daily timeframe, it seems that the pattern is near its top. The top would be confirmed if the price is not able to break the level of 0.73 on a closing basis. MACD is moving on extreme bullish territories slopping to the downside while RSI has cross its overbought level to the downside and it is falling as well, which are both early signals of reversal. On the first place, the first daily target is near the support of 0.7185 and then the psychological support of 0.71 and 0.705 thereafter. The resistances to be watched are near 0.73 and 0.7375.

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.