No deal. Despite many of the 18 oil producers believing the meeting in Doha was merely a rubber stamp affair for an oil production freeze, Saudi Arabia managed to throw a spanner in the works. With Saudi Arabia fighting proxy wars with Iran in Yemen and Syria/Iraq, it is understandable that they had little inclination to freeze their own production and make way for newly sanctions-free Iran to increase their market share. Given the fairly clear-cut incentive structure for Saudi Arabia, it was surprising that the deal looked like such an inevitable affair.

Saudi Arabia had previously indicated they were happy for a deal without Iran, but Deputy Crown Prince Mohamed bin Salman has publicly driven the change of tone. And the big question is whether this is part of a move to dethrone octogenarian Saudi Arabian oil minister, Ali Al-Naimi. We will see if Al-Naimi is still around for the next OPEC meeting on June 2.

Oil is likely to suffer a sharp pullback when futures reopen at 8 am AEST. Given the strong correlation between the oil price and equities, Asian markets are not looking like they will have a good start to the week. The iron ore price declined on Thursday and Friday last week, after breaking above US$60 for the first time since March. Commodities are likely to drive the pullback in equities today, with materials and energy stocks in for a difficult session. We will quite likely see credit spreads widen again today, as the oil price has been a major driver for high yield credit.

And the big question is how far we may see the oil price fall today. The key technical level in play is US$38; a break through this level is likely to see a major pullback this week. If hopes of a Doha deal were the only thing driving oil, then a pullback to around the US$30 level seems quite likely.

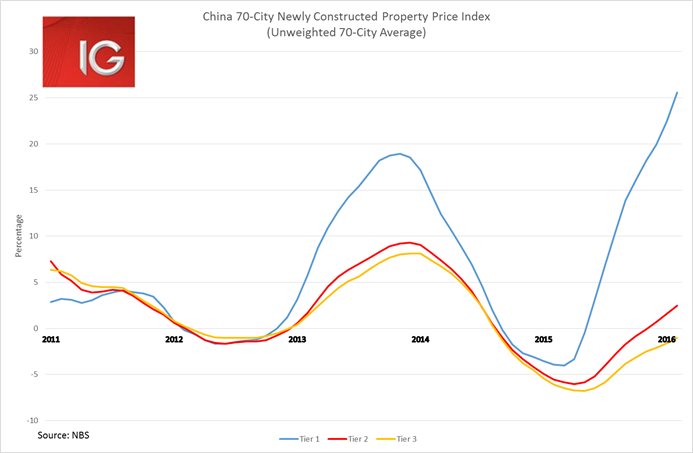

Chinese March property prices are the key data release for today’s Asian session, and the focus will be on dramatic divergence between tier 1 cities and tier 3/4 cities, which looks set to worsen. Australian auto sales and New Zealand CPI also come out, with the latter potentially moving the NZD as traders speculate on whether the RBNZ could cut rates again this month.

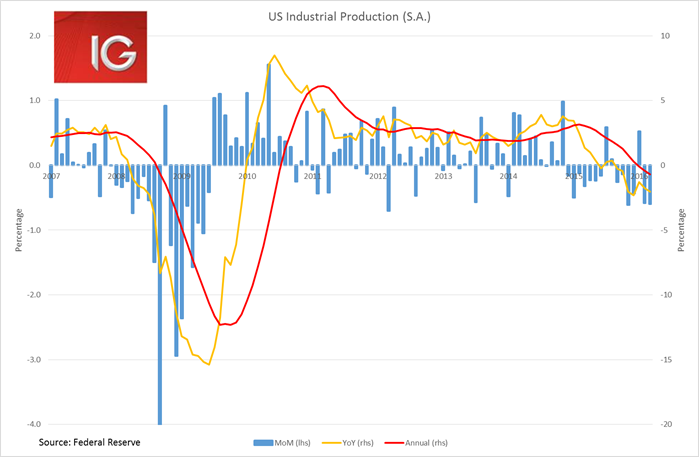

Further evidence of the dismal 1Q activity in the US was provided on Friday, as March industrial production fell 0.6% MoM, significantly below expectations of -0.1%.