It’s bleeding-heart pet owners like me that power the dividend and stock price of Zoetis (NYSE:ZTS), a maker of medicines for animals. Pfizer (NYSE:PFE) spun off the firm in 2013, and it’s been a “growth rocket” ever since. It’s the type of stock that we always watch and rarely get to buy because it is never cheap!

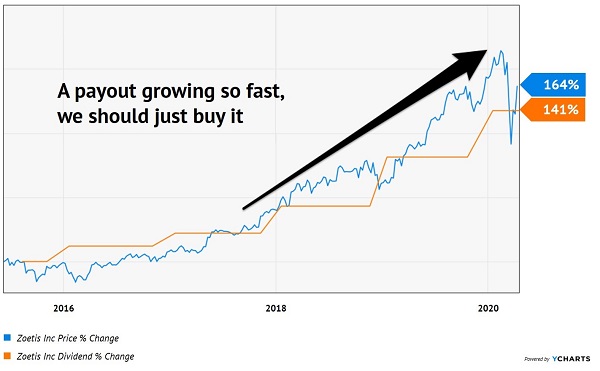

The firm had raised its dividend by 141% over the past five years. Its ever-rising payout acts as a magnet that pulls its share price higher. In our April edition of Hidden Yields, I pointed out that Zoetis was about as cheap as it ever gets, so we might as well buy it. (We’re up about 14% on that purchase.)

After all, when a dividend doubles in just a few years, its stock really can’t help but go higher:

Why Zoetis is a Great Buy

One positive effect of these lockdowns has been record levels of animal adoption and fostering. (Heck, we “fostered” Bianca’s grandniece six weeks ago. She has not yet left the premises and appears to be here to stay.) The pet-mania mega-trend was already in place, and it’s simply accelerated here in 2020.

Zoetis is the type of “asset-lite company” that we like here in 2020. It’s not relying on rents to be paid, gubernatorial statements or any other external factors. The firm makes money as long as pet owners are spending on their best friends, which is about as unstoppable a trend as I can see.

Plus, the firm is expanding its investment in fast-growing segments such as diagnostics and biodevices. These businesses are growing by double-digits and should support higher payouts for years to come.

Overall, I’m a fan of dividends powered by drugs. Do we (and now, our pets!) pop too many pills in America? Of course, we do. But I’m not your holistic health coach—I’m your income strategist, and we like cash flows that are impossible to disrupt.

Many pharma stocks are in the news today, thanks to the non-stop news flow of vaccine reports. We shouldn’t let this distract us. Vaccines are rarely money makers, whereas pills equate to profits. (Once someone starts taking them, they rarely stop. This applies to humans as well as pets…trust me on the latter.)

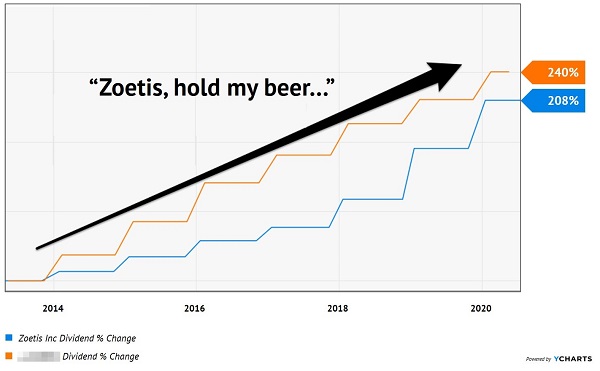

Back to Zoetis. Since the firm was spun off in 2013, it has increased its dividend by a total of 208%. This has powered price gains of 324%. There’s no “magnet” quite like a dividend magnet to drive a stock price higher!

But, there’s a drug development company that has been growing its dividend even faster—to the tune of 240%!—over this timeframe:

When 208% Dividend Growth is Slow

And unlike Zoetis, this stock price has “only” popped by 183%. It is actually undervalued with respect to its payout, a dividend that is also quite “2020-proof” and should continue to grow by double-digits in the years ahead.

For many publicly traded companies, the reemergence of lockdowns is a potential death sentence. For this drug maker, it’s a non-event. This company is growing its top line by double-digits annually and doubling its dividend every five years. It’s effectively immune to lockdown concerns.

This is a good time to be a stock picker! Computers are good at filtering the past and not so great at handicapping the future, even during “normal” times. And 2020 has been anything but! Tricky moments like these confuse computers, which means the human element is required to evaluate business models that are poised to keep delivering.

What are these human-picked winners? Well, the drug developer I mentioned above has 100% price upside in the years ahead. Its dividend is rock solid, too, which is why it’s our latest recommendation in Hidden Yields.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."