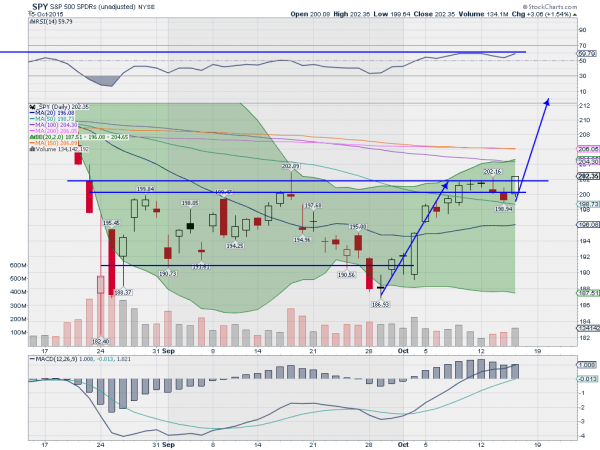

The symmetry played out. The market leaked up above the highs and through the cap that had been in place since the August fall. Now is the time for the bulls to take the market by the horns and launch it back higher. They have had this opportunity before though. August 28 and September 17, and late last week.

But on Thursday that changed. After a brief two-day pullback from resistance, it moved back higher. Turns out the small pullback was a bull flag and the 50-day SMA acted as a launching pad. Earlier this week I wrote about the importance of the SPY closing over 201.75. And now it has happened. A follow through Friday for a weekly candle over that level would be very bullish.

Nothing is ever certain in the market, but the strong bullish candle Thursday is something to pay attention to. On a Measured Move it could result in a move higher to 214. That would take it over the 20-day SMA and to a new high. Wouldn’t that be something. And the momentum indicators suggest that is a viable path for now as both are rising. For now, one step at a time. A weekly close over 201.75 first, then 204.40. From there buyers should stat flocking in.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.