This week's price action in the Economic Modern Family reminds me of a family of prairie dogs popping out of their holes to check if the surroundings are clear of threats.

If clear, they will venture out and look for food, and if not they will go back underground to chatter amongst themselves.

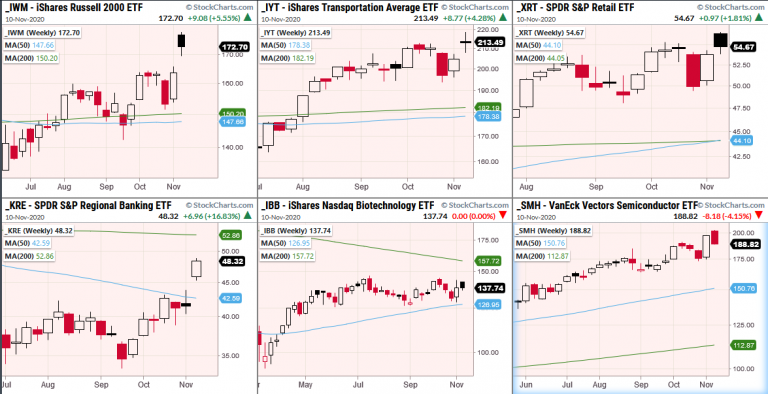

As a parental figure of the Family, Grandad IWM is keeping a good watch by holding his Monday gap, though he’s definitely looking worried.

Watching him hold over the high of January at 170.56 is a key level to watch for support to build.

Transportation IYT looks promising as it is holding last week’s highs and yesterday cleared back over the opening levels on Monday.

Granny XRT also made all-time highs, yet could not hold them.

If she can consolidate around the 53 to 54 level she looks to be in a good position to make another move out of the hole in search of upcoming treats from the holiday shopping season.

Regional banking sector KRE is the bravest of the bunch, though he's been still far behind his other prairie dog family members.

Clearing the 50-week moving means KRE is finally hungry enough to leave home.

On the other hand Big Brother Biotech IBB likes the safety of it’s range from 146 to 125.

This week gave tempting news for IBB with Pfizer (NYSE:PFE)'s covid announcement, yet it looks like it will take more for IBB to break out of the 146 area.

Then we have Sister semiconductors SMH, who made news highs, then quickly decided that it's best to stay underground before her next venture out.

With three days left in the week will the Modern Prairie Dog Family pop back up along with their brother KRE, or does the market still hold enough uncertainty to keep the family below ground?

S&P 500 (SPY) Holding 354 the high from 10/12

Russell 2000 (IWM) Inside day. Holding the gap.

Dow (DIA) Holding 292.36 support from 9/3

Nasdaq (QQQ) Bounced off 280 support from the 50-DMA

KRE (Regional Banks) Very close Inside day.

SMH (Semiconductors) Watching to hold the gap from 187.24.

IYT (Transportation) watching to build support at 213. Currently have a doji candle on a weekly basis.

IBB (Biotechnology) Third consecutive close at 137.

XRT (Retail) Holding over yesterday close. Needs to get back over 55.26 high from 10/16