On Friday morning, a trading friend of mine wrote me and asked me if I thought technical analysis worked anymore. His point—and it’s one I’ve considered many times—is, in this central-banker-planned world in which we now all live, do charts have predictive value anymore? I mean, let’s face it, technical analysis had its own shaky reputation to begin with. In this modern age, with Yellen at the helm, are charts just a waste of time?

I suppose it comes as no great surprise that my answer was “no, they aren’t a waste of time.” After all, I’ve devoted my adult life to this field, and in spite of what could be argued is a fair amount of personal bias, I still deeply feel that the underpinnings of technical analysis are still valid.

I will say, emphatically, that technical analysis is hampered greatly by central bank intervention, and I’ve noticed a marked improvement in its efficacy since QE was removed back in October.

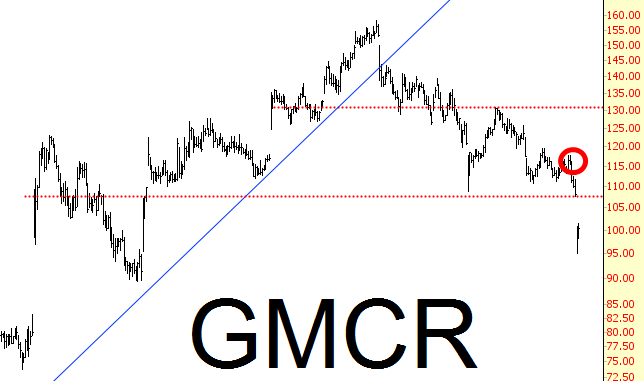

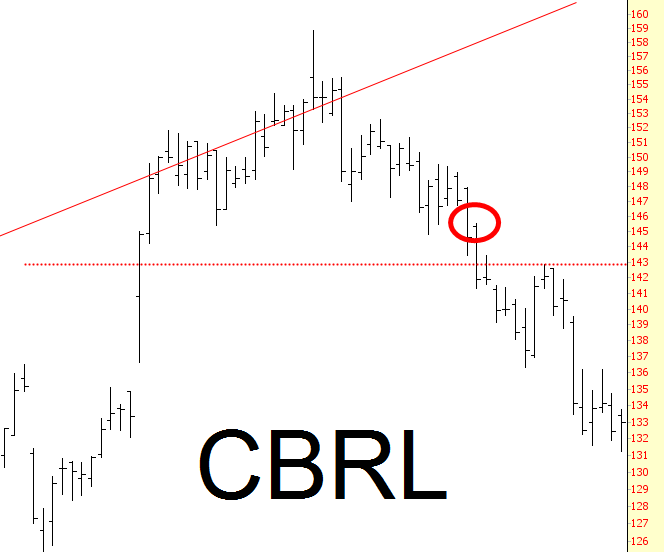

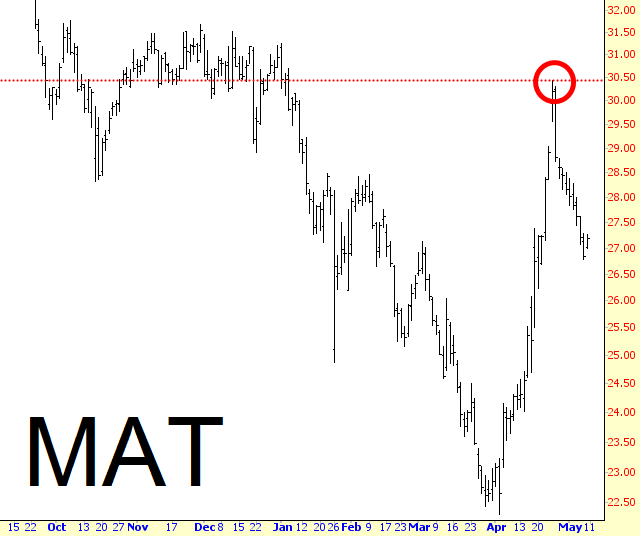

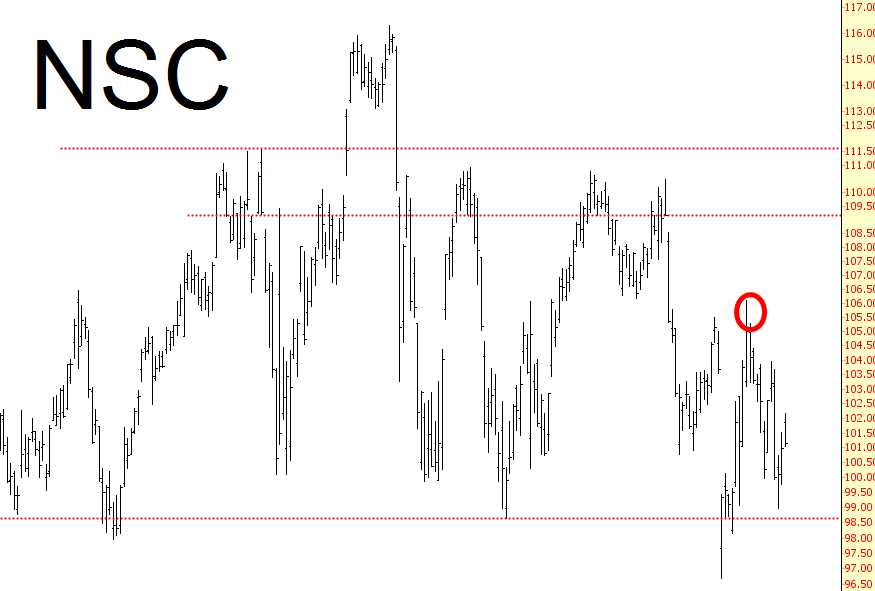

With one exception (which I’ll point out), these were all short ideas, and in spite of the market being near the highest levels of human history right now, I think you’ll agree they did pretty well (I’ve circled in red the approximate price level where I suggested the short idea). Here we go:

ImmunoGen Inc (NASDAQ:IMGN)

Keurig Green Mountain Inc (NASDAQ:GMCR)

Cracker Barrel Old Country Store (NASDAQ:CBRL)

Mattel Inc (NASDAQ:MAT)

Norfolk Southern Corporation (NYSE:NSC), this is the “long” idea

Guggenheim CurrencyShares Euro (NYSE:FXE)

I want to be clear I didn’t cherry-pick some “occasional winners” from a swamp of losers. On the contrary, the ideas I’ve offered up have been quite good lately, and the real stinkers (like a long iShares 20+ Year Treasury Bond ETF (ARCA:TLT) idea a few days ago) were stopped out long before the damage was bad.

In short, yes, I think technical analysis still works. I believe in it deeply, and the reason I’m still cranking out content in the eleventh year (!) of Slope is because I think charts matter. I’m trying to make a positive difference, and I hope I’m succeeding, at least most of the time.