Key Points:

- Oil has reached a likely point of reversal.

- Stochastics are oversold and Parabolic SAR is ready to switch bias.

- EMA activity could limit upsides in the near-term

Oil prices have been in decline for some time now but the commodity’s technical bias could mean that bullishness is back on the cards. Specifically, the long-term wedge pattern is likely to make itself felt this week, as could a number of other technical influences. However, the impending US crude oil inventories data shouldn’t be forgotten just yet which is largely due to a forecasted 1.13M build.

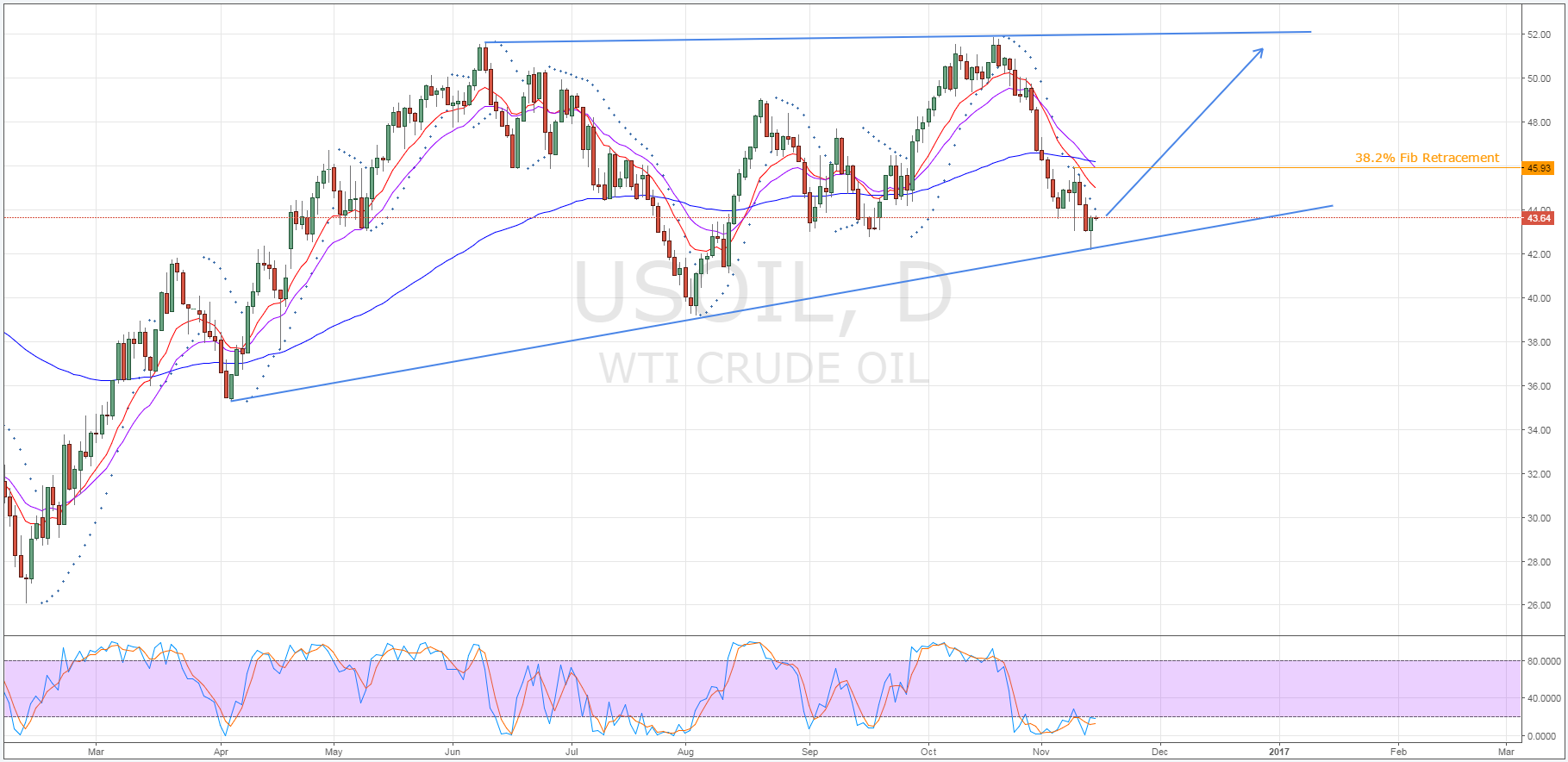

The rationale for some renewed bullishness is fairly patent when looking at the daily chart for crude oil. Primarily, it is the presence of the long-term rising wedge structure that should see a reversal to the upside within the next few sessions. The commodity’s newfound proximity to the lower constraint of said wedge has been providing some much needed buoyancy and is expected to continue moving forward.

However, there are also a number of other technical factors which should be encouraging some upward momentum. One such signal is being provided by the Parabolic SAR which is on the cusp of switching its bias from bearish to bullish. Furthermore, this switch seems to be supported by the stochastic oscillator which remains firmly in oversold territory. Combined with a rough “Hammer” candle from the prior session, a change in the near-term trend is looking like a likely prospect.

Despite this rather strong argument for a reversal, upsides could be somewhat limited in the absence of a major fundamental upset this week. The joint resistance offered by the 38.2% Fibonacci level and the 100 day EMA around the 45.93 price could prove to be quite formidable . As a result, any price action above this level might be dependent on an unexpected draw in the fast approaching US crude oil Inventories figure.

Moreover, the general bearishness of recent moving average activity could mean that oil prices simply crawl along the downside constraint of the wedge. Eventually, the 12, 20, and 100 day averages would level out which could give the commodity some room to move but that could take us well into December.

Ultimately, however oil prices rise moving forward, it does at least seem likely that they will rise. Of course, it remains decidedly less likely that any potential recoveries will take the commodity beyond the $50 handle anytime soon so keep an eye on oil prices as they converge on this level. Furthermore, monitor the ongoing OPEC-related news as if they can finally managed to rein in their member’s production, we are certain to see some solid gains as we move towards the end of the year.