Economists continue to warn that austerity is not the way to go for government spending. I am open to using austerity as one of the tools to balance an economy – just not the primary tool. You cannot hope to pay off sovereign debt by contracting the economy.

What would an economy look like if we taxed and pared spending to the bone? Lord Keynes answered, “We would have a depression”.

There is enough evidence to take Lord Keynes answer as a given – even though scientifically this “theorem” is based on a limited amount of iterations with situations that did not include a sovereign debt load of 100% of GDP. The USA economy could be in the zone of the no win scenario with all paths leading to an elevator shaft with no elevator present – as there is also enough evidence to conclude the debt load itself works against the economy outgrowing the debt.

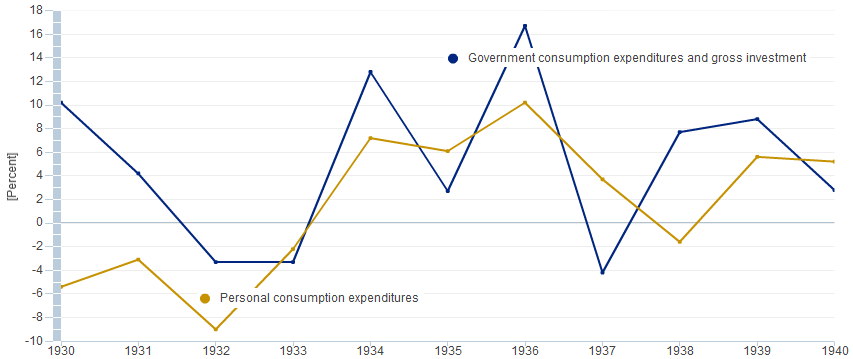

It is obvious that reducing spending anywhere in an economy provides a headwind to economic growth. The above graph showing percent change of spending (from previous period) from BEA.gov shows the infamous recession period of 1937 where a recession occurred within a depression. Please note that officially this recession is dated from May 1937 to June 1938. Also note the brown line on the above graph showing consumer spending.

As a consumer of empirical evidence, one could argue that the recession of 1937 was already baked into the economy – and a moderate contraction of government spending was icing on the cake. In any event, it is difficult to argue that contraction of government spending was a positive influence on the economy.

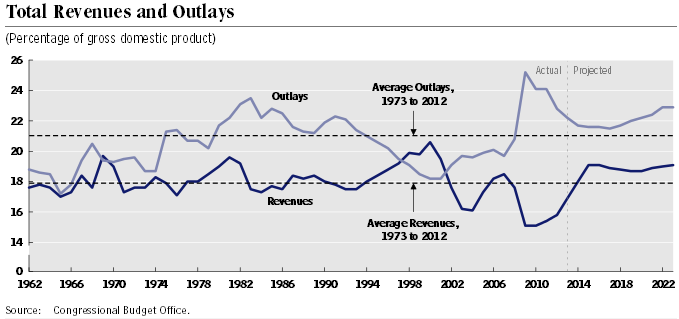

Debt itself is likely now the governing factor due to the way the economy is currently structured. However, under no scenario being discussed by the politicos – will the USA be reducing the debt; it will just continue to grow and grow. The graph below from the Congressional Budget Office (CBO) shows the gap between government revenues and government spending.

I find most of the economic dialogue appearing in the press about the debt and austerity disingenuous. The USA is faced with several paths, and all paths when extrapolated lead to failure. Captain Kirk changed the rules when faced with the no win scenario. The solution to the current situation in the USA is changing the rules of mainstream monetary and fiscal policy.

Pundits talk about the economy believing it works like an accounting balance sheet. If you want to believe this, the economy sooner or later will be falling down one of the elevator shafts. The USA cannot contract its way out of this debt crisis.

Other Economic News this Week:

The Econintersect economic forecast for March 2012 continues to show weak but somewhat improving growth. The supply chain contraction we saw last month has dissipated with all of our check methods of measuring the economy clearly in expansion territory.

ECRI now believes a recession began in July 2012. ECRI first stated in September 2011 a recession was coming . The size and depth is unknown. The ECRI WLI growth index value has been weakly in positive territory for over three months – but in a noticeable improvement trend. The index is indicating the economy six month from today will be slightly better than it is today.

Current ECRI WLI Growth Index

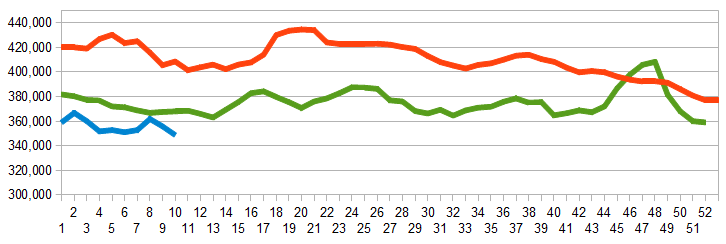

Initial unemployment claims fell from 344,000 (reported last week) to 340,000 this week. Historically, claims exceeding 400,000 per week usually occur when employment gains are less than the workforce growth, resulting in an increasing unemployment rate (background here and here

).

The real gauge – the 4 week moving average – also improved from 355,000 (reported last week) to 348,750. Because of the noise (week-to-week movements from abnormal events AND the backward revisions to previous weeks releases), the 4-week average remains the reliable gauge.

Weekly Initial Unemployment Claims – 4 Week Average – Seasonally Adjusted – 2011 (red line), 2012 (green line), 2013 (blue line)

Bankruptcies this Week: none

Data released this week which contained economically intuitive components (forward looking) were:

- Rail movements are somewhat improving.

- ISM services has a high correlation with the economy shows conditions improving.

Weekly Economic Release Scorecard:

Click here to view the scorecard table below with active hyperlinks.