Several days ago, one of my clients referred a friend to Pacific Park Financial, Inc. The elderly gentlemen came to my office with a familiar dilemma. Specifically, he struggled to see the value of holding different asset classes in his portfolio.

His investments had appreciated nicely over the years. What’s more, he was proud of the fact that a 65% allocation to income assets had helped offset the severe setback that growth assets experienced in the 2008-2009 financial collapse. Nevertheless, he couldn’t shake the feeling that “buying-n-holding” popular asset groups was starting to fail him.

Without knowledge of the particulars, my guest had stumbled onto an inconvenient truth; that is, the Federal Reserve’s quantitative easing program forced investors to move money to destinations that they ordinarily would not have considered. Moreover, the ever-changing uncertainty surrounding the future of the central bank’s dollar printing and subsequent bond buying may be minimizing the benefits of spreading one’s money across asset types.

Most advisers recommend a minimum of 20% of one’s stock holdings allocated to foreign countries. Other advisers are even more bold, suggesting that one weight their holdings by market cap such that 50% of one’s stock holdings represent foreign companies. Keep in mind, the so-called “lost decade” of 2000-2009 was a lost decade for U.S. “buy-n-holders,” not for those who owned emerging markets and foreign developed country stocks; international stocks compounded rather nicely in the period.

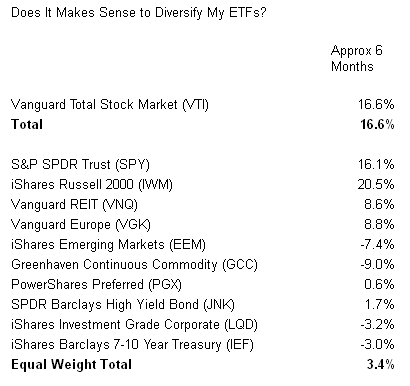

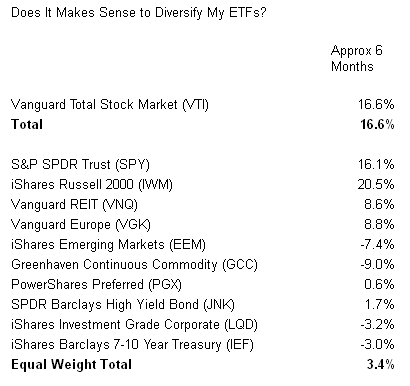

Over the last 6 months, however, the U.S. stock market has dramatically decoupled from world equities; holding-n-hoping has only contributed to portfolio drag, not portfolio growth. Granted, 6 months can hardly be construed as a long-term horizon. Yet even a bull market perspective demonstrates greater volatility/risk with foreign equities for significantly less reward. Note: The chart below compares the S&P 500 SPDR Trust versus the iShares All-World excl U.S. Fund (ACWX).

Commodities? The global growth slowdown from China to Europe has decimated the prospects for alternatives like metals, materials, fertilizer and other natural resources.

Investors had been doing alright with income investments like investment grade bonds, high yield bonds and preferred shares. On the other hand, the slightest hint by the Fed that they might start to taper has damaged the prospects of virtually all income producers. 30-year mortgages up from 3.4% to 4%-plus? A 10-year yield up from 1.60% to 2.25%? These are the types of 5-week moves that have sent shivers down the spines of REIT investors, as well as owners of many income-oriented ETFs.

Investors seem to be stuck, albeit temporarily, with the notion that the closest thing to a reasonable risk-reward exists with U.S. equities. Yet even that is showing plenty of signs of cracking; daily Dow swings of greater than 100 points is rarely a vote of confidence… even when the closing price does settle near the flat line.

In sum, I expect U.S. stocks to succumb to the selling pressure that has rattled virtually every other asset type. By the same token, I expect the Fed to strongly reassert its commitment to its current $85 billion per month in bond purchases in its upcoming June meeting. Fed officials will likely steer clear of the tapering talk that has rattled yield producers as well as the markets at large. The result? The investment community will eventually re-embrace funds like iShares Preferred (PFF), iShares High Dividend Equity (HDV), Vanguard REIT (VNQ) as well as PIMCO 0-5 Year High Yield (HYS).

Note: Don’t count on the Fed to help international equities or commodities. These assets will likely require foreign governments and foreign central banks to enact the easy-going fiscal and monetary policies that investors crave. Whether those ultra-accommodative policies are beneficial to respective economies is entirely another matter.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

His investments had appreciated nicely over the years. What’s more, he was proud of the fact that a 65% allocation to income assets had helped offset the severe setback that growth assets experienced in the 2008-2009 financial collapse. Nevertheless, he couldn’t shake the feeling that “buying-n-holding” popular asset groups was starting to fail him.

Without knowledge of the particulars, my guest had stumbled onto an inconvenient truth; that is, the Federal Reserve’s quantitative easing program forced investors to move money to destinations that they ordinarily would not have considered. Moreover, the ever-changing uncertainty surrounding the future of the central bank’s dollar printing and subsequent bond buying may be minimizing the benefits of spreading one’s money across asset types.

Most advisers recommend a minimum of 20% of one’s stock holdings allocated to foreign countries. Other advisers are even more bold, suggesting that one weight their holdings by market cap such that 50% of one’s stock holdings represent foreign companies. Keep in mind, the so-called “lost decade” of 2000-2009 was a lost decade for U.S. “buy-n-holders,” not for those who owned emerging markets and foreign developed country stocks; international stocks compounded rather nicely in the period.

Over the last 6 months, however, the U.S. stock market has dramatically decoupled from world equities; holding-n-hoping has only contributed to portfolio drag, not portfolio growth. Granted, 6 months can hardly be construed as a long-term horizon. Yet even a bull market perspective demonstrates greater volatility/risk with foreign equities for significantly less reward. Note: The chart below compares the S&P 500 SPDR Trust versus the iShares All-World excl U.S. Fund (ACWX).

Commodities? The global growth slowdown from China to Europe has decimated the prospects for alternatives like metals, materials, fertilizer and other natural resources.

Investors had been doing alright with income investments like investment grade bonds, high yield bonds and preferred shares. On the other hand, the slightest hint by the Fed that they might start to taper has damaged the prospects of virtually all income producers. 30-year mortgages up from 3.4% to 4%-plus? A 10-year yield up from 1.60% to 2.25%? These are the types of 5-week moves that have sent shivers down the spines of REIT investors, as well as owners of many income-oriented ETFs.

Investors seem to be stuck, albeit temporarily, with the notion that the closest thing to a reasonable risk-reward exists with U.S. equities. Yet even that is showing plenty of signs of cracking; daily Dow swings of greater than 100 points is rarely a vote of confidence… even when the closing price does settle near the flat line.

In sum, I expect U.S. stocks to succumb to the selling pressure that has rattled virtually every other asset type. By the same token, I expect the Fed to strongly reassert its commitment to its current $85 billion per month in bond purchases in its upcoming June meeting. Fed officials will likely steer clear of the tapering talk that has rattled yield producers as well as the markets at large. The result? The investment community will eventually re-embrace funds like iShares Preferred (PFF), iShares High Dividend Equity (HDV), Vanguard REIT (VNQ) as well as PIMCO 0-5 Year High Yield (HYS).

Note: Don’t count on the Fed to help international equities or commodities. These assets will likely require foreign governments and foreign central banks to enact the easy-going fiscal and monetary policies that investors crave. Whether those ultra-accommodative policies are beneficial to respective economies is entirely another matter.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.