Few investments hold as much sentimental value as the Walt Disney Company (NYSE:DIS). Kids have been raised on Disney movies for almost a century. The productions are a cornerstone of American culture.

But nowadays, Disney is much more than a film studio. In the last 30 years, it’s bought television networks, overseas resorts and massive entertainment brands like Star Wars and Marvel. More recently, it made a short-lived bid to buy Twitter (NYSE:TWTR).

All this expansion is cause for excitement among owners of Disney shares - but also cause for concern. Big expansions and acquisitions are risky. And judging by Disney’s recent earnings performance, not all of those risks have paid off. It has struggled to meet earnings estimates for the last two quarters.

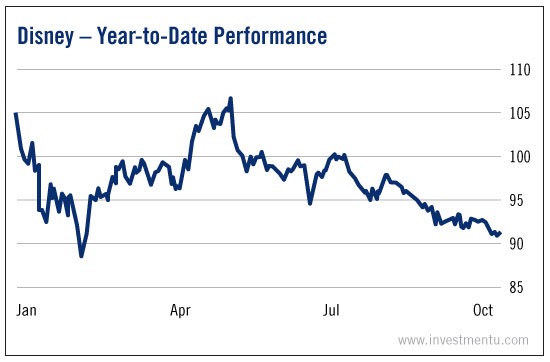

You can see this uncertainty in Disney’s stock price over the last year.

Today, a large part of Disney’s holdings are cable TV channels, including ABC, ESPN and A&E. Like many other media conglomerates, it’s trying to pivot in the age of cord-cutting.

As Disney struggles to define itself in the post-cable world, Disney shares have taken a beating. And Investment U readers want to know if they’re still a good buy.

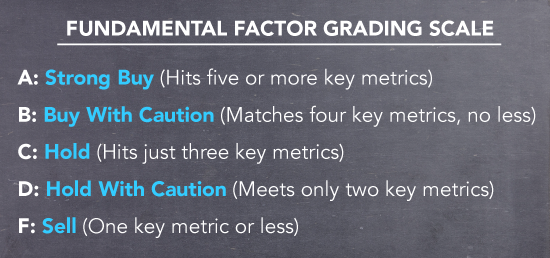

To find out, we ran Disney through the Investment U Fundamental Factor Test. (As a reminder, our checklist looks at six key metrics to diagnose the financial health of a stock.)

Today, a large part of Disney’s holdings are cable TV channels, including ABC, ESPN and A&E. Like many other media conglomerates, it’s trying to pivot in the age of cord-cutting.

As Disney struggles to define itself in the post-cable world, Disney shares have taken a beating. And Investment U readers want to know if they’re still a good buy.

To find out, we ran Disney through the Investment U Fundamental Factor Test. (As a reminder, our checklist looks at six key metrics to diagnose the financial health of a stock.)

- Earnings-per-Share (EPS) Growth: Disney is off to a rough start in terms of earnings, as we mentioned previously. Similar entertainment conglomerates have seen impressive earnings growth in the last year. Disney’s EPS growth of 9.59% pales in comparison to the industry average of 70.16%.

- Price-to-Earnings (P/E): Owners of Disney shares don’t have to worry about overvaluation. Disney’s price-to-equity ratio is just 15.71. That’s well below the industry average of 39.11, meaning the market is excessively bearish on the stock.

- Debt-to-Equity : Despite operating numerous film studios, theme parks and TV channels, Disney is actually pretty thrifty. Its debt-to-equity ratio is just 42.46%. That’s in comparison to an average of 266.49% leverage in the entertainment business.

- Free Cash Flow per Share Growth : Disney shares boast impressive cash flows compared to the rest of the industry. The company has seen free cash flow per share grow by 57.64% in the last year. Similar companies have seen negative cash flows averaging -251.35%.

- Profit Margins : All of Disney’s high-profile properties net it an impressive profit margin. Its profits of 18.19% are nearly double the entertainment industry’s average of 9.69%.

- Return on Equity : Finally, there’s the equity performance of Disney shares. The company has an annual return on equity of 20.35%. That’s just above the industry average of 18.78%. But it’s still quite impressive.

Disney’s earnings problems are not to be overlooked. It’s a TV-heavy company that must find a way to adapt to falling cable revenues. But altogether, Disney shares shouldn’t stay down for long...

The rest of the company’s fundamental metrics are quite strong. It has ample cash flows and profit margins, it’s undervalued by the market, and it has a low debt burden. It appears as though Disney has the resources and flexibility to turn its share price around.

For these reasons, Disney stock has earned a grade of A.

Fundamental Factor Test Score

A: Strong Buy (Hits five or more key metrics)