Investing.com’s stocks of the week

- In Q2, Chipotle revenue increased 17% and operating margin increased 15.3%.

- It plans to more than double its restaurant count in the coming years.

- The stock's higher growth outlook justifies its premium valuation.

In the last five years, Chipotle Mexican Grill (NYSE:CMG) has outperformed the S&P 500 Total Return Index generating a staggering return of over 450% compared to 85% for the S&P 500 index. And there are several factors that may contribute to the stock’s continued outperformance.

Impressive Performance

In the latest quarter, Chipotle Mexican Grill's revenue increased 17% year-over-year (yoy). Importantly, its operating margin rose to 15.3% from 13% yoy due to menu price increases.

The margin increase reflects Chipotle's ability to pass on higher costs—including increased commodity and labor costs—to customers without significantly denting revenue.

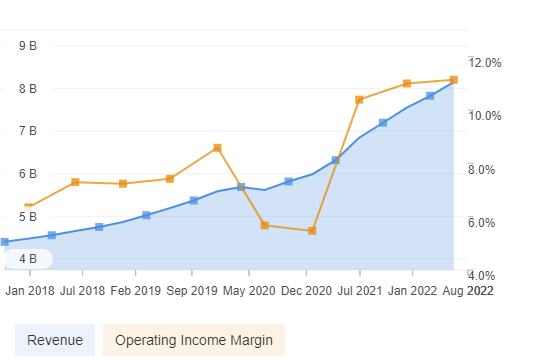

Chipotle’s longer-term performance is equally impressive. Revenue increased at a faster pace than operating expenses allowing a significant jump in operating income. Total revenue posted a compound annual growth rate (CAGR) of 15.7% from 2018 to 2021 while operating expenses increased 13.5% in the same period which resulted in a 46% CAGR in operating income from 2018 to 2021.

Expansion Plans Should Boost Earnings

Chipotle promises continued solid growth in the coming years. Management aims to grow the number of restaurants from around 3,000 currently to over 7,000. Apart from the US, Chipotle is focused on Canada and Europe. It has 29 restaurants in Canada and plans to increase this to several hundred. It opened five new restaurants in the UK and hopes that Europe can become a significant market for it. Another positive trend is Chipotle’s emphasis on drive thru lanes, called Chipotlanes.

Drive Thru Lanes Could Drive Margins Higher

Drive thrus benefit restaurants by increasing revenue without additional real estate costs, which is a significant component of operating expenses. In the latest quarter, Chipotle opened 42 new restaurants, including 32 with Chipotlanes.

Source: InvestingPro

In 2022, the company plans to open around 235-250 new restaurants and management is aiming for 8%-10% growth in new restaurants per year, 80% of these will be Chipotlanes.

On the recent earnings call, management re-emphasized that Chipotlanes generate higher average unit volumes and higher restaurant-level margins. Thus, we can expect further margin improvement going forward.

Premium Valuation

The stock trades at a high price-to-earnings (PE) multiple compared to its peers. However, compared to its own historical 5-year median PE of 74.36, the current valuation of 61.5, a 20% discount to its historical 5-year median, looks attractive.

The one-year forward PE of 50 also indicates higher earnings expectations in the coming quarters.

Analysts Raising Price Targets

In August, Stifel analyst Chris O’Cull raised the target price of Chipotle stock to $1,750 from $1,550 re-iterating a buy rating and adding that stable margin performance is likely in H2 2022.

In July, Morgan Stanley analyst John Glass raised the price target to $1,808 from $1,768 on the back of higher earnings estimates on "better than feared results in Q3-to-date, further incremental pricing actions and associated margin benefits.”

Likewise, Piper Sandler analyst Nicole Miller Regan is bullish on Chipotle stock with a price target of $2,500.

The average analyst price target for Chipotle Mexican Grill stock on InvestingPro, stands at $1,749, which implies an upside of 6% from current levels.

A Solid Long-Term Restaurant Pick

I think that even with higher a PE compared to its peers, Chipotle is a solid restaurant stock that looks well-placed to grow in the coming years. And the stock's valuation is low when compared to its own historical multiple.

Growth in the number of restaurants will drive the company’s topline growth and there is significant potential to improve operating profit margins with more outlets and with more Chipotlanes in the restaurant mix. The restaurant chain's ability to pass on cost increases to customers through menu price increases should also protect margins.

Note: Pricing data used in this article is as of Wednesday, August 24 close.

Disclaimer: The author has no positions in Chipotle Mexican Grill or any other stock mentioned.