The milder winter than previous years has left many a parking lot looking empty. And now that the Groundhog has told us winter is over you might think it is a doomsday scenario for companies like Burlington Stores Inc (N:BURL), the owner of Burlington Coat Factory. But despite this the stock price ($BURL) is sitting near break out territory.

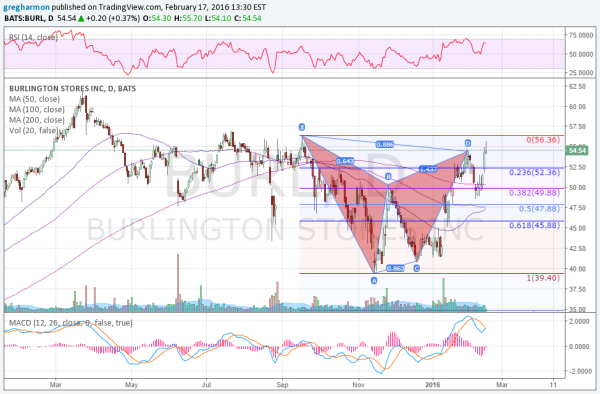

The chart below shows it back near 55, a level that has been resistance over the past year. But it also has a lot more to say. The price action traced out a bearish Bat harmonic from September through January. The price then retraced 38.2% of the pattern, resetting it, and has started back higher. This makes for a Cup and Handle like pattern that could extend to 70.

This is important for the stock and easier to understand if we zoom out a bit. The weekly chart below shows a long rally from the base near the IPO level in 2014 at 25.47 to the peak at 61.94 to start 2015. and that Bat along with the slow downturn into it, represents a 61.8% retracement of the entire leg up. An AB=CD pattern would put a target of 75.87.

When I see two different types of technical analysis give a result of major magnitude in the same direction I get excited. And when indicators like a RSI rising and on the edge of a move into the bullish zone, and a rising MACD support this, even more so. A conservative entry would be triggered on a move over 56.35.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.