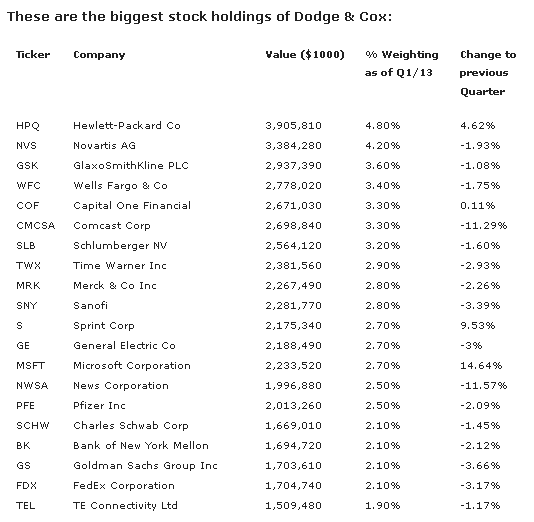

Dodge & Cox have a real focus on financial, healthcare and technology stocks. More than half of their funds (59.9 percent) are invested in these three stock categories. The biggest impact on the buy side was the technology sector which is now net 0.7 percentage points bigger compared to the previous quarter.

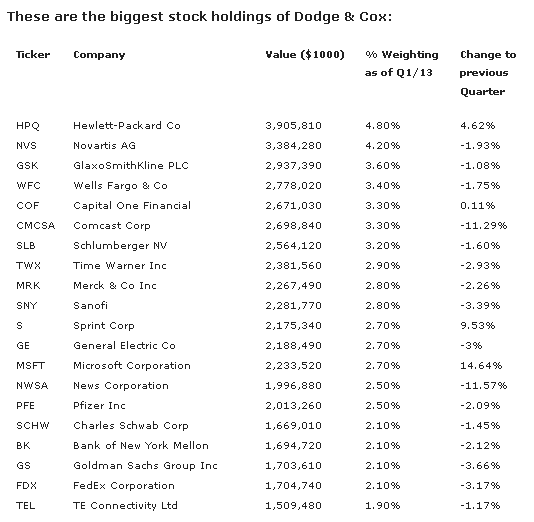

Dodge & Cox have a dividend focus and they like large cap stocks. Of their 20 biggest stock buys and sells in Q1/13, 17 pay a solid dividend and 17 have a valuation over USD 10 billion. Hewlett Packard is the biggest holding, worth around USD 4 billion. The latest big stock increases are up 26.03 percent year-to-date.

Chevron (CVX) has a market capitalization of $240.55 billion. The company employs 62,000 people, generates revenue of $241.909 billion and has a net income of $26.336 billion. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $59.975 billion. The EBITDA margin is 24.79 percent (the operating margin is 19.15 percent and the net profit margin 10.89 percent).

Financial Analysis: The total debt represents 5.23 percent of the company’s assets and the total debt in relation to the equity amounts to 8.93 percent. Due to the financial situation, a return on equity of 20.30 percent was realized. Twelve trailing months earnings per share reached a value of $13.23. Last fiscal year, the company paid $3.51 in the form of dividends to shareholders. CVX shares were added by 42.5 percent and had an impact to the full portfolio of .39%

Market Valuation: Here are the price ratios of the company: The P/E ratio is 9.38, the P/S ratio is 0.99 and the P/B ratio is finally 1.77. The dividend yield amounts to 3.22 percent and the beta ratio has a value of 0.80.

Microsoft (MSFT) has a market capitalization of $297.88 billion. The company employs 94,000 people, generates revenue of $73.723 billion and has a net income of $16.978 billion. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $30.714 billion. The EBITDA margin is 41.66 percent (the operating margin is 29.92 percent and the net profit margin 23.03 percent).

Financial Analysis: The total debt represents 9.85 percent of the company’s assets and the total debt in relation to the equity amounts to 18.00 percent. Due to the financial situation, a return on equity of 27.51 percent was realized. Twelve trailing months earnings per share reached a value of $1.94. Last fiscal year, the company paid $0.80 in the form of dividends to shareholders. MSFT shares were added by 14.64 percent and had an impact to the full portfolio of .34%

Market Valuation: Here are the price ratios of the company: The P/E ratio is 18.38, the P/S ratio is 4.04 and the P/B ratio is finally 4.50. The dividend yield amounts to 2.58 percent and the beta ratio has a value of 0.99.

CIGNA (CI) has a market capitalization of $21.69 billion. The company employs 35,800 people, generates revenue of $29.119 billion and has a net income of $1.624 billion. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $3.037 billion. The EBITDA margin is 10.43 percent (the operating margin is 8.51 percent and the net profit margin 5.58 percent).

Financial Analysis: The total debt represents 9.65 percent of the company’s assets and the total debt in relation to the equity amounts to 53.10 percent. Due to the financial situation, a return on equity of 18.27 percent was realized. Twelve trailing months earnings per share reached a value of $4.52. Last fiscal year, the company paid $0.04 in the form of dividends to shareholders. CI shares were added by 314.36 percent and had an impact to the full portfolio of .32%

Market Valuation: Here are the price ratios of the company: The P/E ratio is 16.83, the P/S ratio is 0.74 and the P/B ratio is finally 2.22. The dividend yield amounts to 0.05 percent and the beta ratio has a value of 1.38.

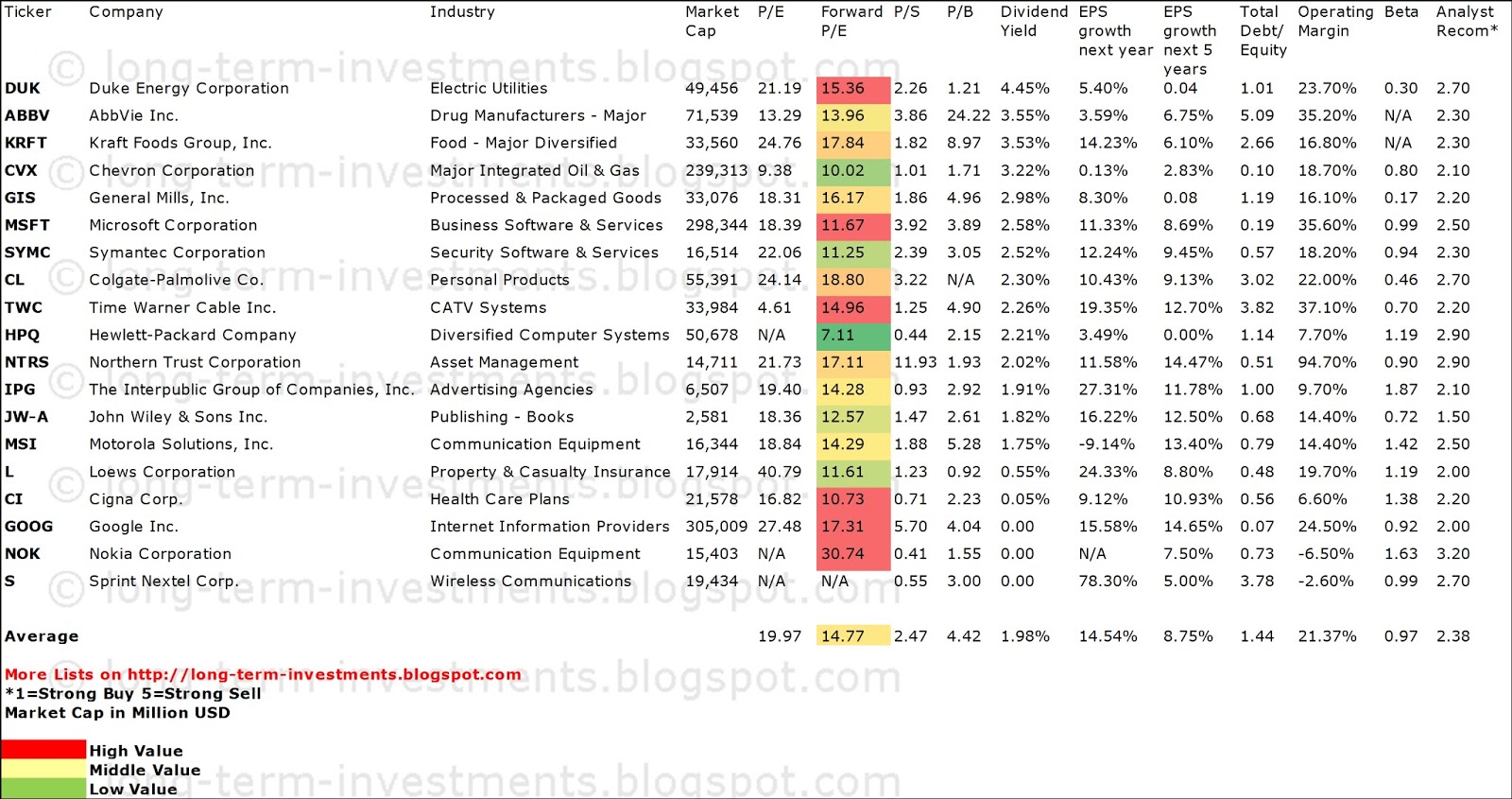

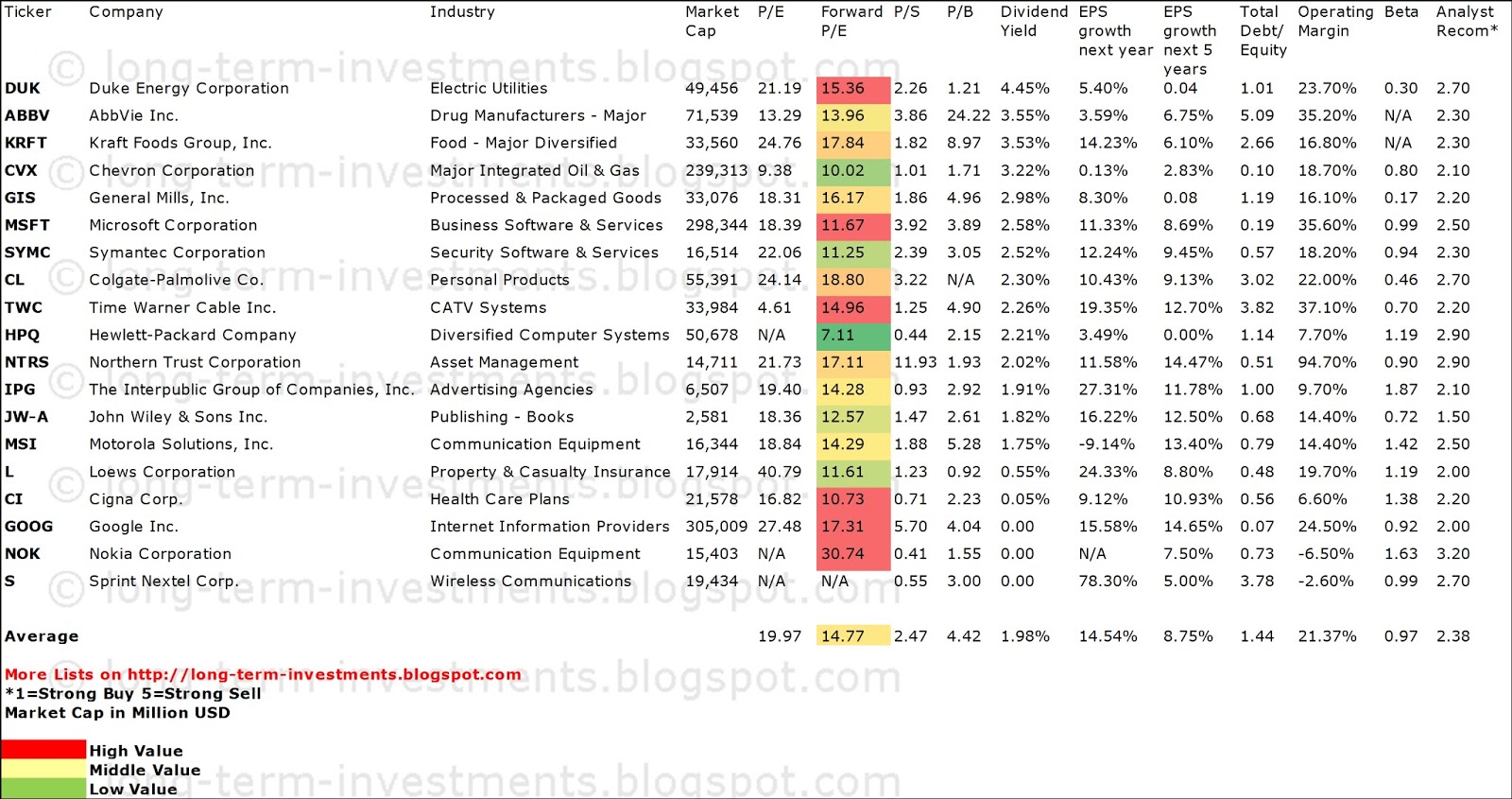

Take a closer look at the full list of the latest big portfolio transactions from Dodge & Cox and the 20 biggest stock holdings. The average P/E ratio amounts to 19.97 and forward P/E ratio is 14.77. The dividend yield has a value of 1.98 percent. Price to book ratio is 4.42 and price to sales ratio 2.47. The operating margin amounts to 21.37 percent and the beta ratio is 0.97. Stocks from the list have an average debt to equity ratio of 1.44.

Take a closer look at the full list of the latest big portfolio transactions from Dodge & Cox and the 20 biggest stock holdings. The average P/E ratio amounts to 19.97 and forward P/E ratio is 14.77. The dividend yield has a value of 1.98 percent. Price to book ratio is 4.42 and price to sales ratio 2.47. The operating margin amounts to 21.37 percent and the beta ratio is 0.97. Stocks from the list have an average debt to equity ratio of 1.44.

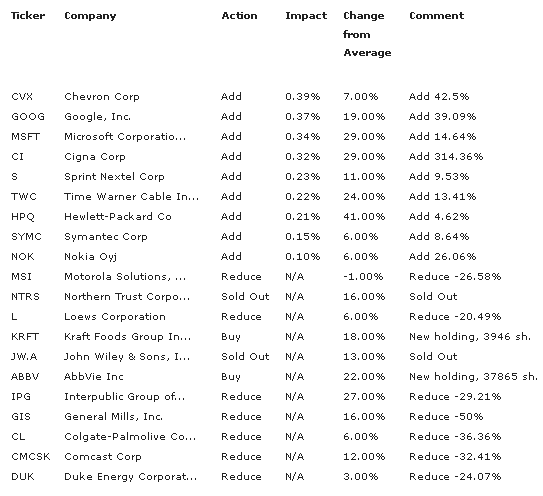

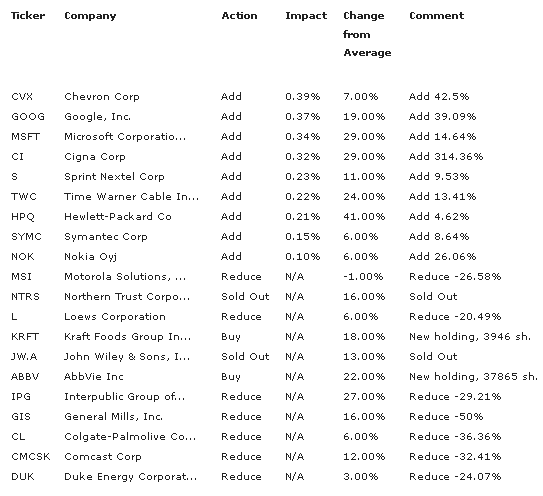

These are the 20 biggest stock transactions of Dodge & Cox:

Here is the full table with some fundamentals (TTM):

Related stock ticker symbols:

DUK, ABBV, KRFT, CVX, GIS, MSFT, SYMC, CL, TWC, HPQ, NTRS, IPG, JW-A, MSI, L,

CI, GOOG, NOK, S,

*I am long KRFT, GIS, CL. I receive no compensation to write about these specific stocks, sector or theme. I don't plan to increase or decrease positions or obligations within the next 72 hours.

For the other stocks: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I receive no compensation to write about any specific stock, sector or theme.

Dodge & Cox have a dividend focus and they like large cap stocks. Of their 20 biggest stock buys and sells in Q1/13, 17 pay a solid dividend and 17 have a valuation over USD 10 billion. Hewlett Packard is the biggest holding, worth around USD 4 billion. The latest big stock increases are up 26.03 percent year-to-date.

Chevron (CVX) has a market capitalization of $240.55 billion. The company employs 62,000 people, generates revenue of $241.909 billion and has a net income of $26.336 billion. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $59.975 billion. The EBITDA margin is 24.79 percent (the operating margin is 19.15 percent and the net profit margin 10.89 percent).

Financial Analysis: The total debt represents 5.23 percent of the company’s assets and the total debt in relation to the equity amounts to 8.93 percent. Due to the financial situation, a return on equity of 20.30 percent was realized. Twelve trailing months earnings per share reached a value of $13.23. Last fiscal year, the company paid $3.51 in the form of dividends to shareholders. CVX shares were added by 42.5 percent and had an impact to the full portfolio of .39%

Market Valuation: Here are the price ratios of the company: The P/E ratio is 9.38, the P/S ratio is 0.99 and the P/B ratio is finally 1.77. The dividend yield amounts to 3.22 percent and the beta ratio has a value of 0.80.

Microsoft (MSFT) has a market capitalization of $297.88 billion. The company employs 94,000 people, generates revenue of $73.723 billion and has a net income of $16.978 billion. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $30.714 billion. The EBITDA margin is 41.66 percent (the operating margin is 29.92 percent and the net profit margin 23.03 percent).

Financial Analysis: The total debt represents 9.85 percent of the company’s assets and the total debt in relation to the equity amounts to 18.00 percent. Due to the financial situation, a return on equity of 27.51 percent was realized. Twelve trailing months earnings per share reached a value of $1.94. Last fiscal year, the company paid $0.80 in the form of dividends to shareholders. MSFT shares were added by 14.64 percent and had an impact to the full portfolio of .34%

Market Valuation: Here are the price ratios of the company: The P/E ratio is 18.38, the P/S ratio is 4.04 and the P/B ratio is finally 4.50. The dividend yield amounts to 2.58 percent and the beta ratio has a value of 0.99.

CIGNA (CI) has a market capitalization of $21.69 billion. The company employs 35,800 people, generates revenue of $29.119 billion and has a net income of $1.624 billion. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $3.037 billion. The EBITDA margin is 10.43 percent (the operating margin is 8.51 percent and the net profit margin 5.58 percent).

Financial Analysis: The total debt represents 9.65 percent of the company’s assets and the total debt in relation to the equity amounts to 53.10 percent. Due to the financial situation, a return on equity of 18.27 percent was realized. Twelve trailing months earnings per share reached a value of $4.52. Last fiscal year, the company paid $0.04 in the form of dividends to shareholders. CI shares were added by 314.36 percent and had an impact to the full portfolio of .32%

Market Valuation: Here are the price ratios of the company: The P/E ratio is 16.83, the P/S ratio is 0.74 and the P/B ratio is finally 2.22. The dividend yield amounts to 0.05 percent and the beta ratio has a value of 1.38.

These are the 20 biggest stock transactions of Dodge & Cox:

Here is the full table with some fundamentals (TTM):

Related stock ticker symbols:

DUK, ABBV, KRFT, CVX, GIS, MSFT, SYMC, CL, TWC, HPQ, NTRS, IPG, JW-A, MSI, L,

CI, GOOG, NOK, S,

*I am long KRFT, GIS, CL. I receive no compensation to write about these specific stocks, sector or theme. I don't plan to increase or decrease positions or obligations within the next 72 hours.

For the other stocks: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I receive no compensation to write about any specific stock, sector or theme.