Virtually everyone I speak to touts the idea of contrarian investing. But true contrarian value investing can be lonely and entails career risk. Do you have what it takes?

Consider the following example today. Oil prices are cratering and decisively fallen through the $80 level. Saudi Aramco announced earlier in the week that it was cutting its US crude price. OPEC scaled down its global growth and crude oil demand two days later.

Following Warren Buffett

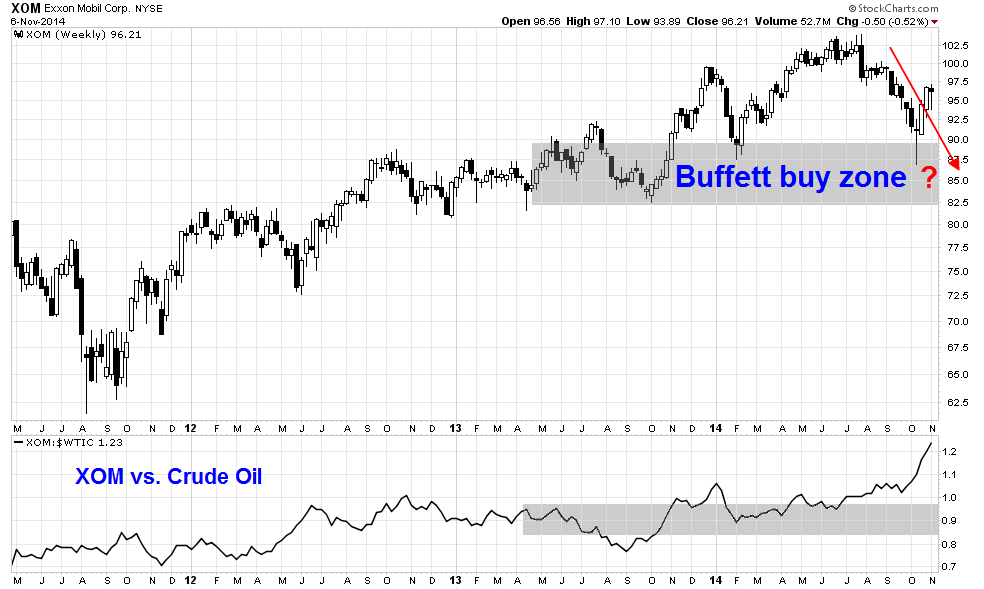

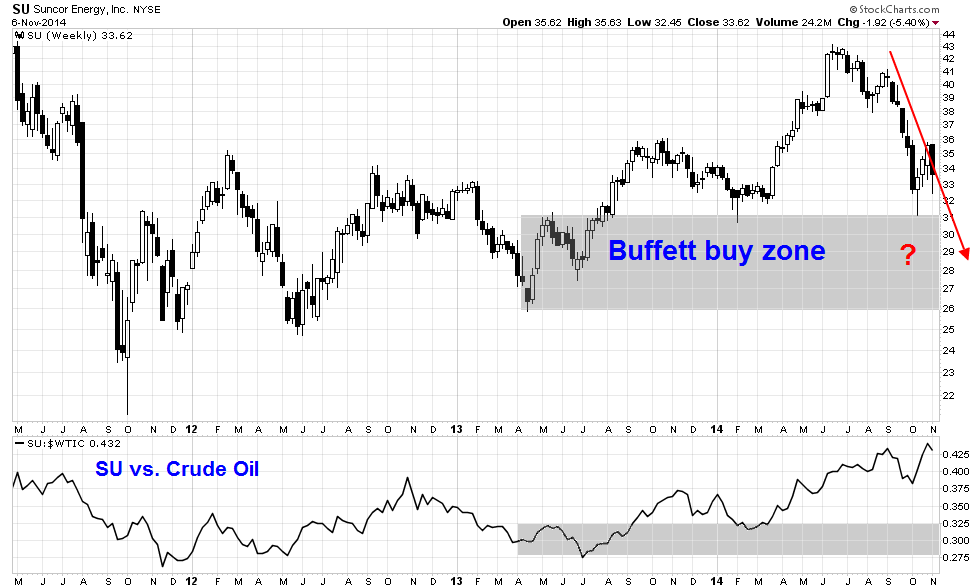

I can point to bargains in the oil patch. Most famously, Warren Buffett revealed large stakes in Exxon Mobil (NYSE:XOM) and Suncor Energy (NYSE:SU), both of which were bought in Q2 2013. The prices of XOM and SU have been declining and approaching the levels which Buffett bought. Would you buy them if they fell further to those levels in the near future?

Here is the XOM chart, with the zone at which Buffett bought shaded in grey:

Here is the Suncor chart:

If your answer to the question above is yes, then consider this question: Buffett bought his XOM and SU stakes when oil prices were a lot higher. The bottom panel of each of the charts above show the ratio of XOM and SU to the WTI price. If we were to consider the XOM/oil or SU/oil ratios, our buy targets for XOM and SU would have to be a lot lower than levels that Berkshire Hathaway acquired those stakes.

If oil prices were to fall off a cliff to $40 or $50 and the XOM/oil and SU/oil were to crater to those buy zones—which would likely mean a further 50% downside from current levels—would you be willing to step up and buy?

USD strength = Commodity weakness

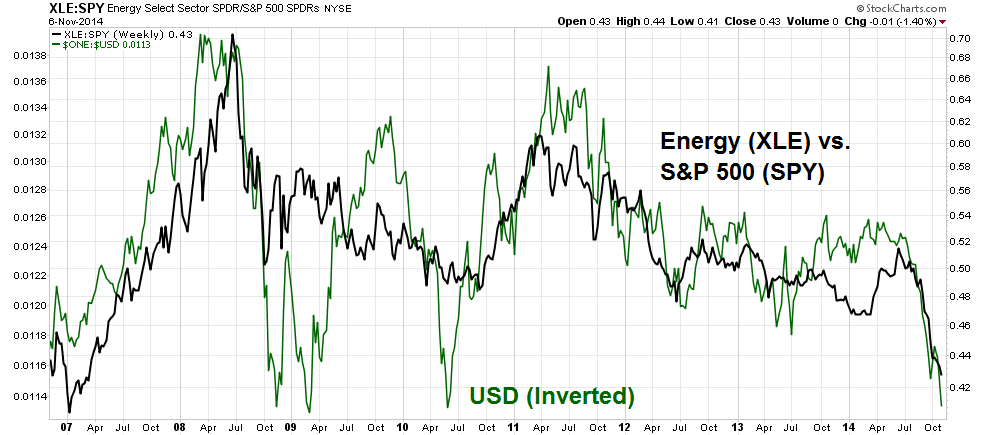

Before you answer that question, consider the kinds of macro headwinds that commodity prices and the Energy sector are facing with a strengthening US dollar. It seems that my call for a retracement of USD strength was either early or the weakness was too brief (see my previous post Overbought USD = Commodities poised to rally). The chart below shows the USD Index (inverted) and the relative performance of the Energy sector (via SPDR Energy Select Sector Fund (ARCA:XLE)).

Currently, bullish USD factors include:

- A hawkish Fed relative to other major central banks;

- A better US growth outlook relative to other major economies;

- The BoJ has launched QE9, which is an effort to devalue the yen;

- The ECB is talking dovishly, whose effect is to weaken the euro; and

- Chinese growth is slowing, which is putting downward pressure on commodity currencies like the AUD, CAD and ZAR.

With numerous bullish factors underpinning the USD (and therefore bearish for commodity prices), would you still be willing to buy large cap energy stocks? Now you see why contrarian value investing can be a very lonely activity and can involve considerable career risk.

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.