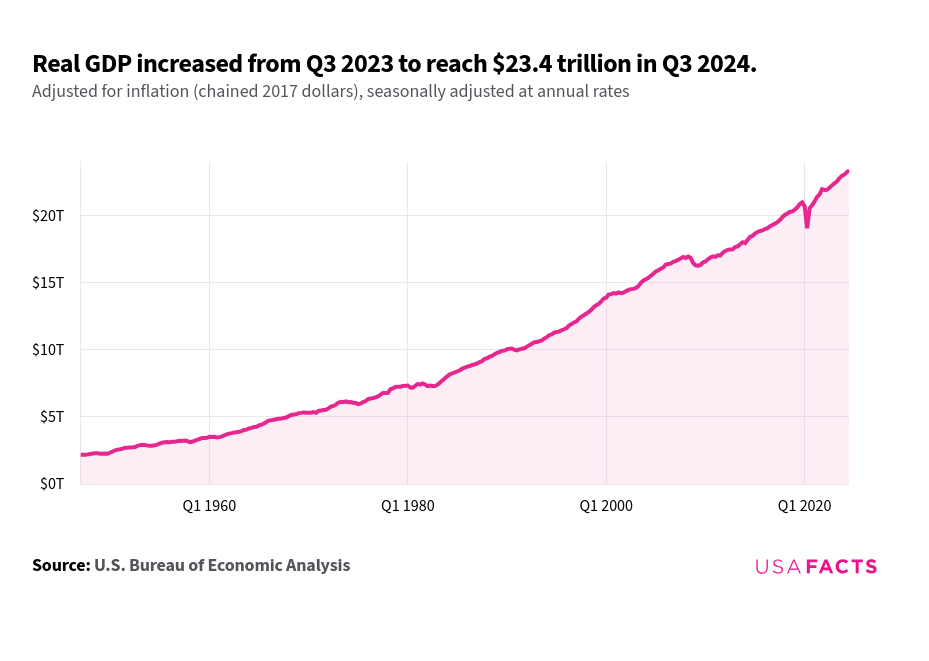

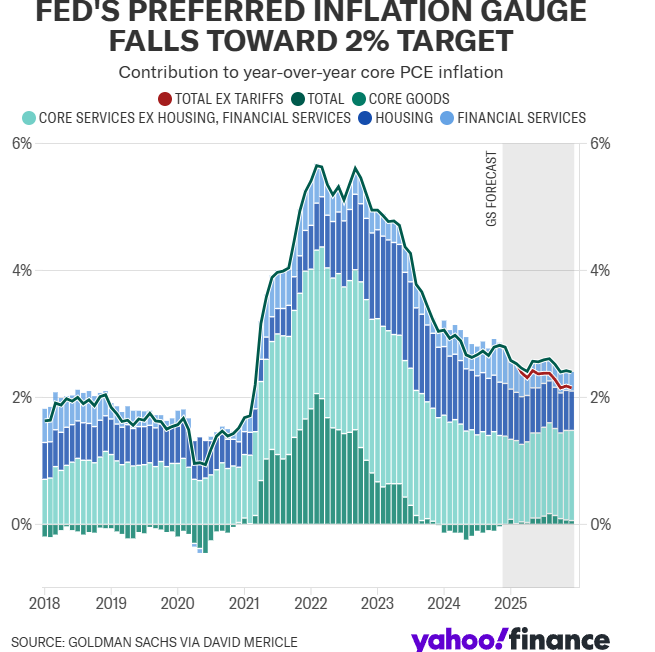

Do you believe the economy is heading towards inflation?

Well, the price will argue with that opinion.

Looking at my own trifecta of inflation barometers

They all say no inflation, at least right now.

Do you believe the economy is heading towards recession?

Well, the price will argue with that opinion.

- Yields would fall at the long end and short-term interest rates would decline via Fed policy.

- Copper would be declining

- The dollar would weaken

- The consumer would weaken

Well, the price will argue with that opinion.

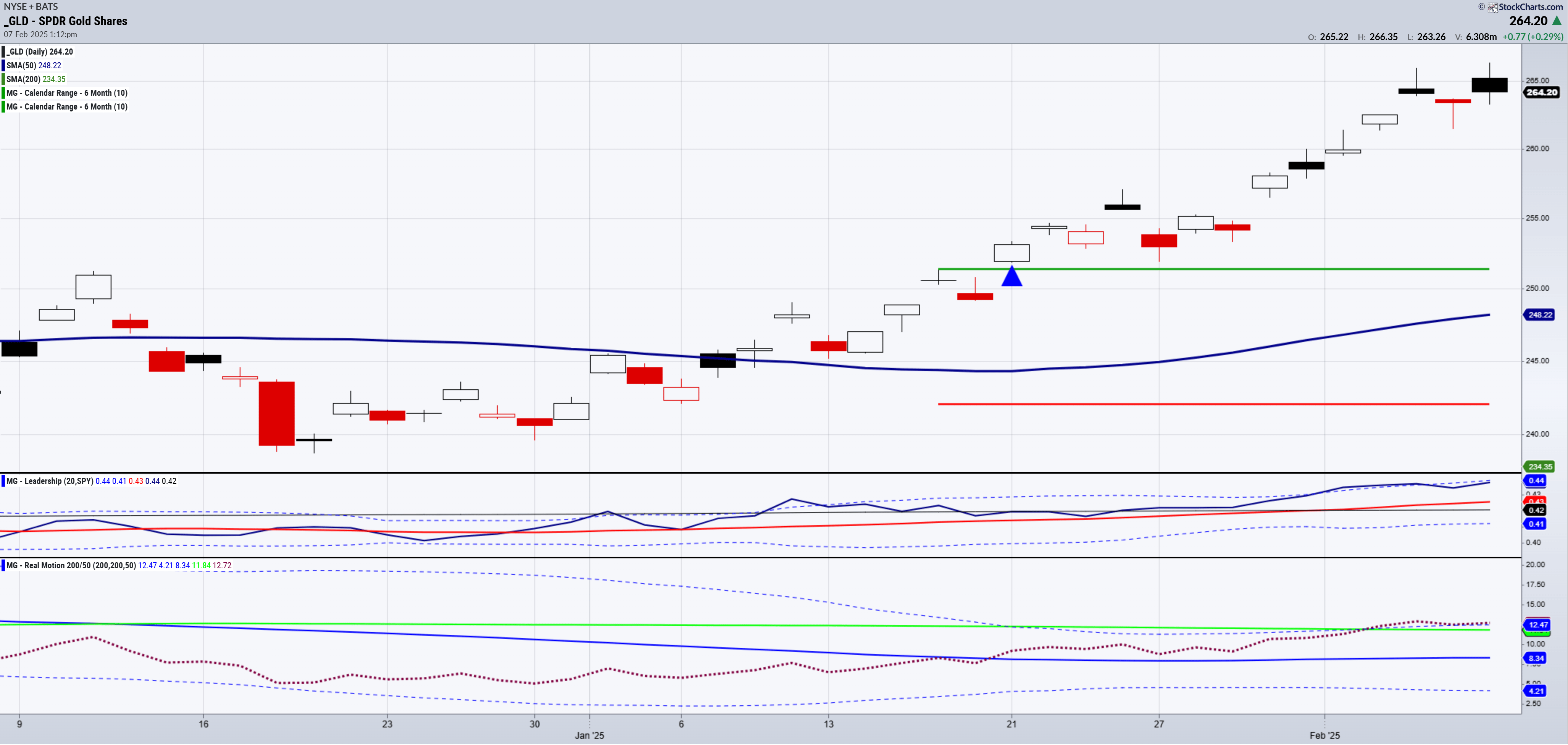

Do you believe that gold prices are sending a warning?

Well, price supports that opinion only, pick you warning

- Stagflation

- Tariffs and deglobalization

- Increasing global debt

- QE returning

- Geopolitical threats

- Fiat currency at risk

- Low supply

Do you believe we are heading towards substantial economic growth?

Well, here is where my Economic Modern Family tells the story..

Looking at the Economic Modern Family at large, the best one can say with current prices is that the economic picture or growth going forward remains unknown.

Gold loves uncertainty, so the only thing certain right now is uncertainty.

Considering that all the members except for Biotechnology IBB, are holding their 50-week moving averages, we can at least surmise optimism has not left the building.

Sister Semiconductors SMH sits on the 50-WMA. While money rotates out of chips, for US centric economic growth, we need her in the game, but not necessarily as a leader.

Transportation IYT held the 50-WMA and rallied mainly on strong UBER earnings. Nonetheless, transportation holding price is good.

The consumer or Granny XRT is most likely the biggest key to growth signals on price as the consumer is 70% of the GDP.

That blue line of 50-WMA is close but still holding. Want to sound like an economist? If that line breaks, start talking the R word.

As far as Granddad Russell 2000 and Regional Banks KRE, they are holding hence, the indecision as to the next move.

And Biotech IBB, began last week with so much promise. Now, IBB is back to the 200-WMA (green) and in need of some of its own medicine.

Price will dictate the narrative. The time is now for traders who understand this.

ETF Summary

- (Pivotal means short-term bullish above that level and bearish below)

- S&P 500 (SPY) 600 support

- Russell 2000 (IWM) Back to 225 support for now

- Dow (DIA) 439 support 452 now the resistance to clear

- Nasdaq (QQQ) 520 the 50-DMA support

- Regional banks (KRE) 64 now the support to hold

- Semiconductors (SMH) Back over the 50-Week MA that now needs to hold

- Transportation (IYT) 70 has to hold as this could not clear back over the Jan calendar range high

- Biotechnology (IBB) Back to critical levels around 137

- Retail (XRT) 77 area critical support

- iShares iBoxx Hi Yd Cor Bond ETF (HYG) Flashing risk on