ETF investors are always searching for unique strategies that offer promises of inflation protection or anti-volatility positioning. These funds are often drawn up using sophisticated back-testing analysis and touted as a strong “alternative” to compliment your existing portfolio of stocks and bonds.

However, there are some instances where the strategy either falls flat from the get-go or simply doesn’t work given the current circumstances surrounding global markets. There is a big difference between theory and practice when applied to investment instruments that follow a sophisticated index or other niche approach.

Let’s examine a few instances of ETFs that can’t seem to get in sync with the markets.

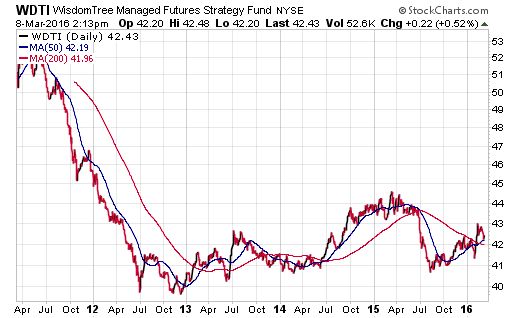

WisdomTree Managed Futures Strategy (NYSE:WDTI)

At the outset, a managed futures strategy fund sounds like a very complex vehicle, and WDTI is no exception. This ETF seeks to provide non-correlated returns to traditional stocks and bonds by investing in a quantitative rules-based index that seeks to identify rising or falling trends in commodity, currency, and Treasury futures.

My attempt to simplify that last sentence is that WDTI invests in long and short positions of various alternative asset classes to try and outperform the market. It’s known as an alternative strategy because it doesn’t correlate with the normal ups and downs of a conventional portfolio.

Of course, that also means it’s hard for investors to understand how the fund is constructed, how its underlying investments change over time, and why its expense ratio is so high at 0.95%.

According to the fund company website, WDTI has negative returns of -3.44% per year since its inception in January 2011 through January 2016. This equates to -16.25% overall during that time frame. In addition, the fund has paid no dividends to shareholders in the last four years.

This ETF currently has $198 million in total assets and was likely conceived as more of an institutional tool than for a typical retail investor. It may very well just be lying in wait for a perfect moment to turn on the afterburners. Nevertheless, I would be careful about fully understanding the methodology behind an intricate fund of this nature before committing capital to its cause.

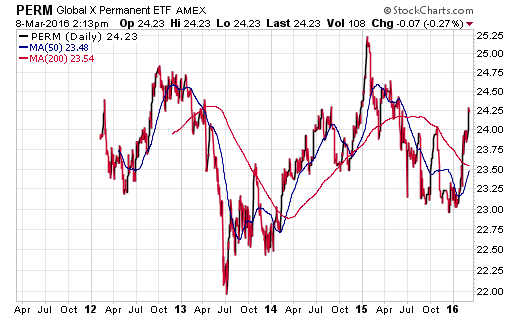

Global X Permanent (NYSE:PERM)

You would think that a fund with the word permanent in the name is something that you absolutely must hang onto. However, PERM has a decidedly unconventional approach to its portfolio construction methodology that makes it difficult to fall in love with.

This ETF is based on the Solactive Permanent Index, which allocates capital equally to four asset classes: stocks, gold/silver, long-term Treasuries, and short-term Treasuries. The end result is a diversified portfolio that experiences an internal tug of war between inflationary and deflationary assets.

Generally speaking, when the stocks in PERM go up, the bonds go down, which manages to offset much of the overall move. In addition, the stalwart 25% allocation to short-term Treasuries is akin to having a significant portion of your portfolio in cash or a “cash-like” solution that doesn’t fluctuate in value very much. The end result is a relatively low volatility portfolio that mostly just trades in a sideways range.

PERM debuted in 2012 and has managed to generate average annualized returns of +0.13% since its inception through February 29, 2016. The fund pays a meager dividend that is distributed on an annual basis as well, which doesn’t make it all that exciting for conservative income investors.

The good news is that PERM hasn’t lost a lot of money over its life-span. However, it hasn’t made a lot of money either. This fund would need a very unique environment of stocks, bonds, and precious metals in a simultaneous uptrend to really make significant forward headway. We’ll be on the lookout for that.

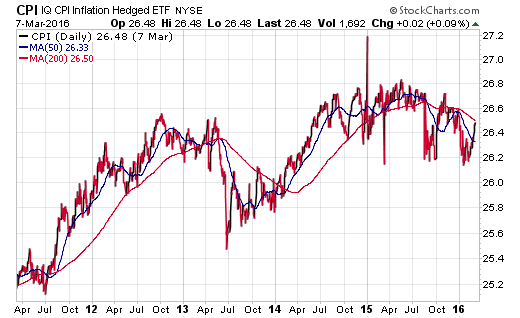

IQ Real Return (NYSE:CPI)

Another fund that focuses on a niche strategy of side-stepping inflation is CPI. This ETF takes a “fund of funds” approach by investing in a mix of other low-cost ETFs with the goal of providing a “real return” above the rate of inflation as measured by the Consumer Price Index.

To be fair, we have been in a low interest rate and low inflationary environment for virtually the entire existence of CPI. Since its inception in December 2009, the fund has had average annual returns of 0.89% per year through 2/29/16.

The good news is that its price history has shown a path of relatively low volatility (similar to PERM). However, its current overweight allocation to Treasury bills, alongside a small sliver of stocks and real estate, make for a very difficult portfolio to envision thriving in the near future. In addition, I am surprised that this strategy does not include a core allocation to treasury inflation-protected securities in its mix.

CPI may ultimately turn out to be a huge success in an era of rising goods and services prices such as the United States experienced in the 1970s. Nevertheless, it may fall short of many investors’ expectations given its 0.48% expense ratio and comparatively meager returns over its 6+ year history.

Disclosure: FMD Capital Management, its executives, and/or its clients may hold positions in the ETFs, mutual funds or any investment asset mentioned in this article. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.