So just like that, Australia has new Prime Minister! Welcome ex Goldman Sachs (NYSE:GS) executive director, Malcolm Turnbull.

Whether you agree that it is right for backroom politics to decide to oust a Prime Minister that has been voted in by the Australian people, Forex markets have reacted well to the coup that ousted Tony Abbott, with the Aussie Dollar rising to new weekly highs.

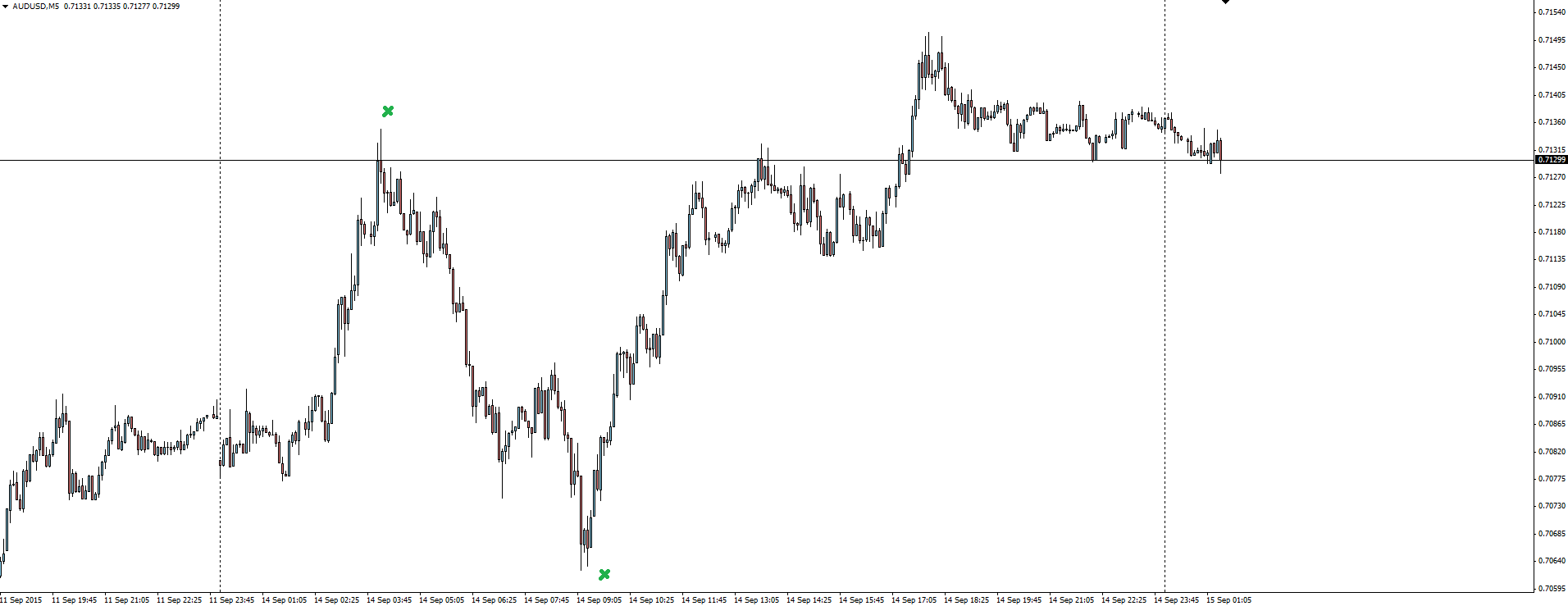

AUD/USD 5 Minute:

As you can see from yesterday’s AUD/USD 5-minute chart, the instability of a leadership challenge caused the Aussie to first sell off, but as it became more and more clear that a change was coming, the buyers came in.

Turnbull’s pitch to the voting Liberal Party members had a sharp focus on management of the flailing Australian economy, something that Tony Abbott and Treasurer Joe Hockey had struggled to win over both the business community and general public on.

The change in leadership is expected to now provide a short term boost to consumer and business confidence, hence the buying support coming into the Aussie.

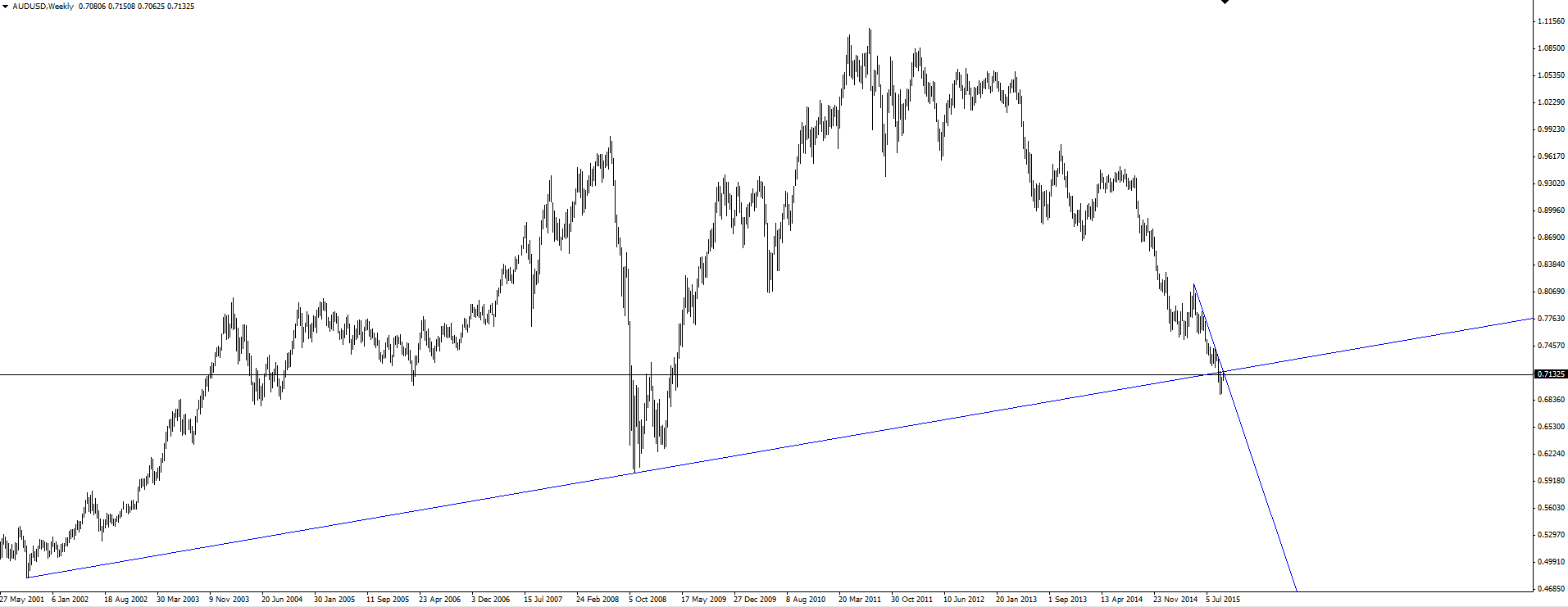

AUD/USD Weekly:

We’ve spoken about this AUD/USD weekly trend line a lot over the past few weeks, highlighting the subjectivity of trend line support both in the Vantage FX News Centre and on Twitter (NYSE:TWTR).

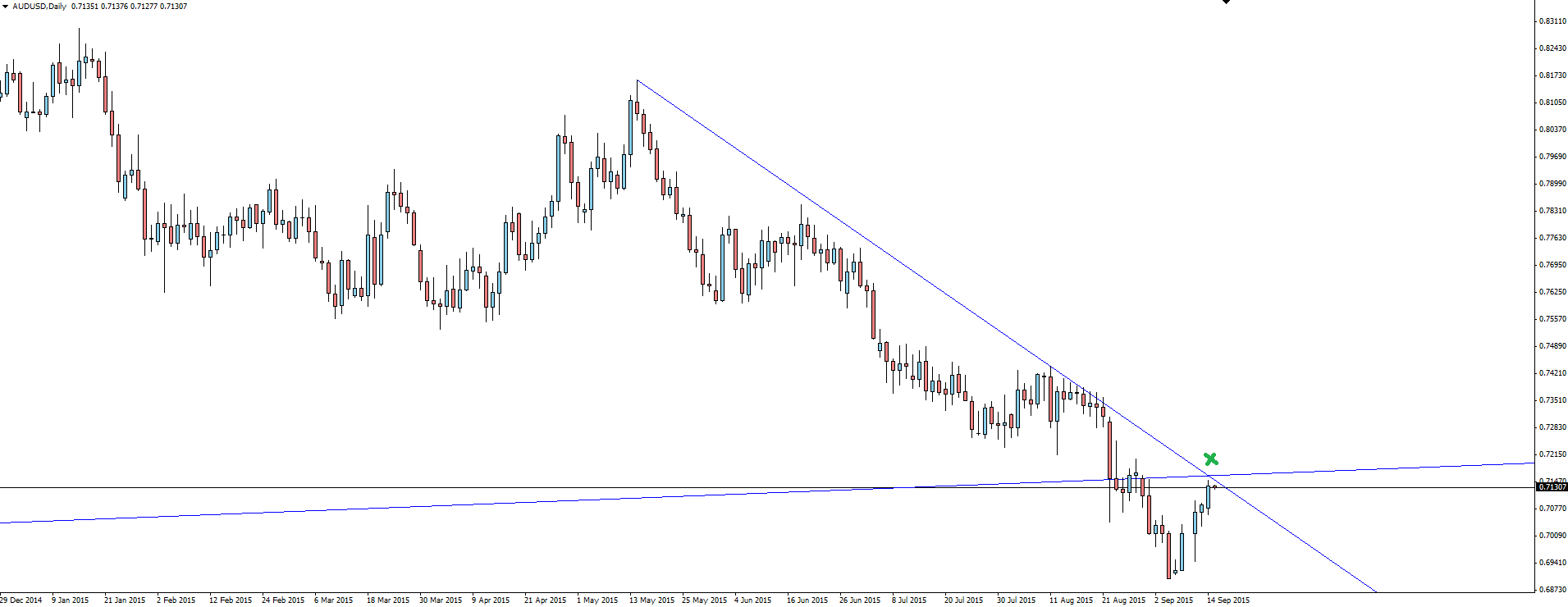

AUD/USD Daily:

We were not expecting any strong technical follow through after the weekly break due to the subjectivity issue explained in the post above and as you can see on the daily chart, price has come back to possibly re-test the broken level this time as resistance.

The RBA releases its Monetary Policy Meeting Minutes in Sydney this morning. With no fresh guidance on rates at the last meeting, I see the greater risk here being a hawkish surprise and a pop back above the weekly trend line. BTD?

FOMC Lead Up:

Elsewhere, markets stayed relatively quiet in the lead up to Thursday’s FOMC decision, with Thomson Reuters data indicating a huge drop in trading volumes across US markets.

“Trading was slow with about 5.4 billion shares changing hands on U.S. exchanges, below the 8-billion daily average for the previous twenty sessions.”

The narrative is playing out, now let the trades come to you.

On the Calendar Tuesday:

AUD Monetary Policy Meeting Minutes

JPY Monetary Policy Statement

JPY BOJ Press Conference

GBP CPI y/y

EUR German ZEW Economic Sentiment

USD Core Retail Sales m/m

USD Retail Sales m/m

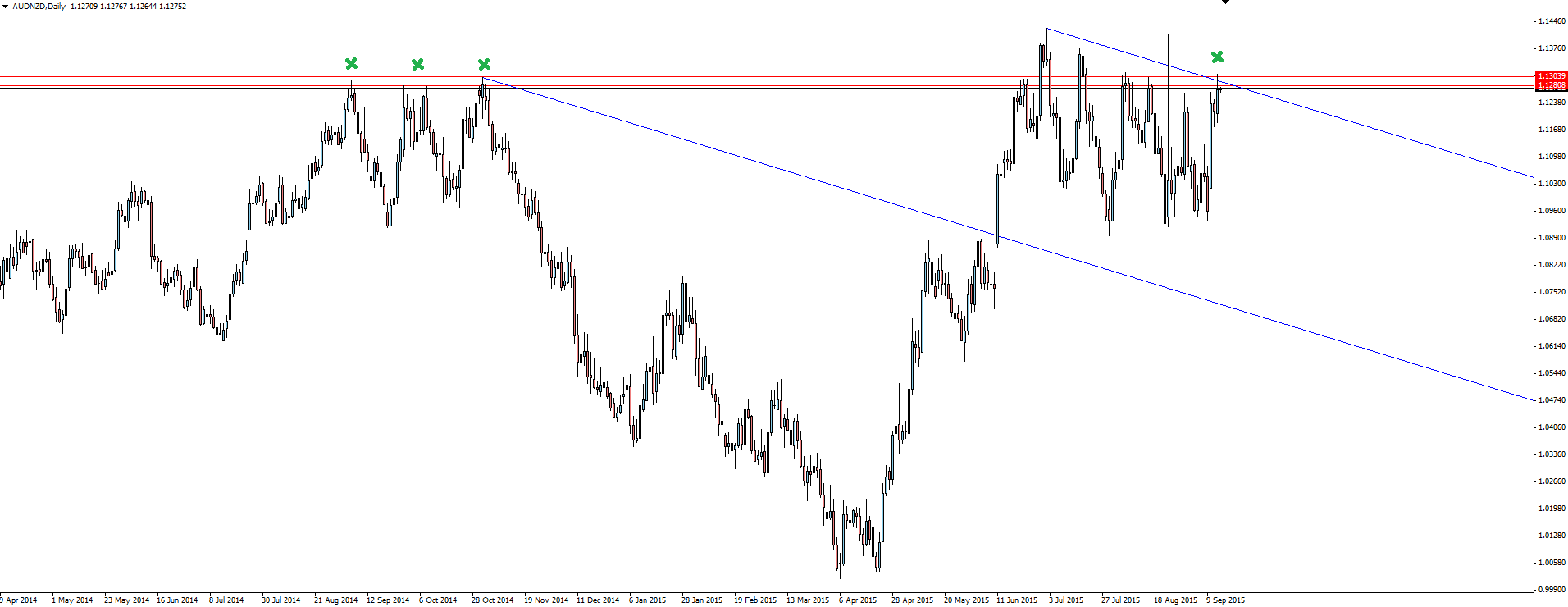

Chart of the Day:

Today’s chart of the day continues our look at the Aussie dollar, with focus turning to AUD/NZD.

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd, does not contain a record of our prices, or an offer of, or solicitation for, a transaction in any financial instrument. The research contained in this report should not be construed as a solicitation to trade Forex. All opinions, news, research, analyses, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on the service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.