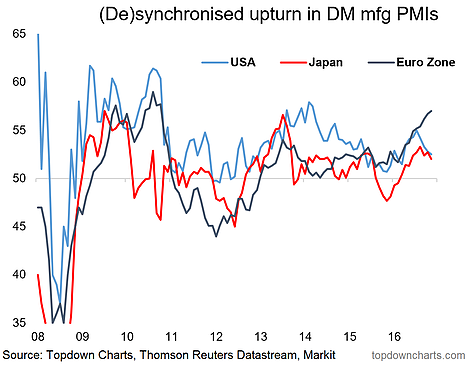

The latest round of flash manufacturing PMIs for May saw the Eurozone in the lead up +0.3 to 57.0 and USA trailing behind, down -0.3 to 52.5 and Japan off -0.7 to 52.0 and left the composite flash Developed Market manufacturing PMI down slightly. It highlights the slight loss of momentum seen in the global economic rebound that got underway last year, as we looked at last week with the OECD leading indicators.

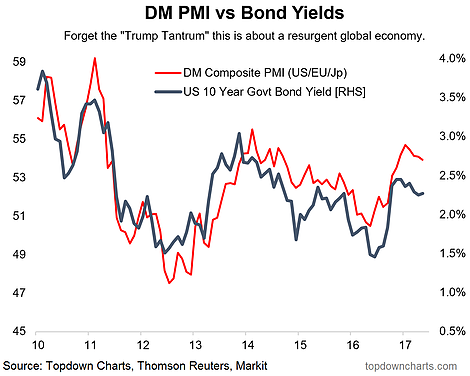

While the fact is that the composite DM manufacturing PMI has rolled over, it's still at solid levels, and provides a case for at least stable if not slightly higher bond yields, as shown in the chart below. It will be important for the PMI to hold at these levels should bond yields head higher. Supporting that case would be solid global trade growth, rising property prices in the major economies, and still stimulative monetary policy. So my base case would be that the global economic expansion continues, upside risk remains for inflation, and therefore my bias would be to expect higher bond yields, all else equal.

The rebound from the slowdown last year saw a synchronized acceleration in the manufacturing PMIs of the major developed market economies, but this has given way to more desynchronized growth.

While the composite Developed Markets manufacturing PMI has rolled over from the peak, it remains much stronger than a year ago, and is still supportive for higher bond yields at this point.