Danmarks Nationalbank (DN) has updated data on the Danish life insurance & pension (L&P) sector's exposure in USD and EUR.

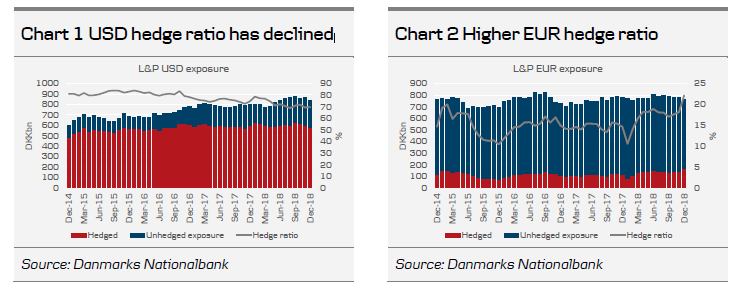

In December last year, Danish L&P hedged 70% of its USD exposure and 22% of its EUR exposure.

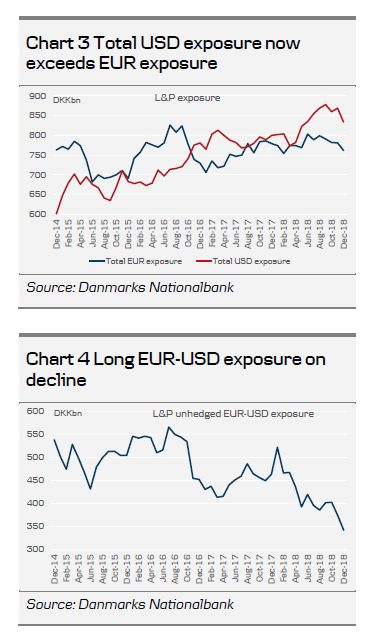

The total exposure in USD now exceeds the total exposure in EUR in the Danish L&P sector.

Danmarks Nationalbank (DN) has updated data on the Danish life insurance & pension (L&P) sector's exposure in USD and EUR (note Danmarks Nationalbank plans to start publishing data regularly from Q4 this year). In December last year, Danish L&P companies had a total USD exposure of DKK834bn and a total EUR exposure of DKK762bn. They hedged 70% and 22% of the exposure respectively - see chart 1 and 2 below.

Over the past couple of years, the USD hedge ratio has declined - it was above 80% in 2015 and 2016. One possible explanation for this is the growing share of US equities held by the L&P sector. Currency exposure on equities tends to be hedged to a lesser extent than bonds. The EUR hedge ratio was at the highest level it has been at over the past four years of available data. It rose during 2018, which may reflect the rise in EUR/DKK, which made it cheaper to increase hedging of EUR assets.

The total exposure in USD now exceeds the total exposure in EUR in the Danish L&P sector, cf. chart 3. It reflects a gradual increase in total USD exposure, while the total EUR exposure has been about stable over the past couple of years. The total unhedged exposure in EUR still exceeds the total unhedged exposure in USD by DKK341bn. However, it has fallen from around DKK450bn in 2017 and DKK550bn in 2016.

We have previously argued that hedging activity by the Danish L&P sector is an important determinant of EUR/DKK - see FX Edge Good reasons for higher EUR/DKK spot rate , 15 August 2018, and FX Strategy 'Risk on' helping DKK to recover , 19 February 2019 .