Investing.com’s stocks of the week

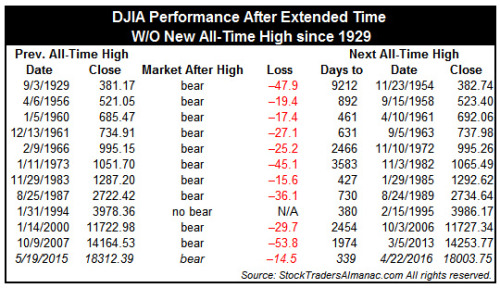

As of today it has been 339 calendar days without a new all-time DJIA closing high. This is the twelfth longest streak for DJIA going back to 1929. The longest streak was 9212 calendar days between September 3, 1929 and November 23, 1954. The longest DJIA has gone without falling into a Ned Davis defined bear market was 380 calendar days during 1994. That streak was essentially the middle of the last secular bull market that ran from 1982 to 2000. All others streaks resulted in DJIA suffering a Ned Davis bear or worse. Excluding 1994 and the present streak, the average loss was 31.7%, more than double DJIA’s present loss at the February lows.

During the previous secular bear that lasted from 1966-1982, DJIA failed on numerous occasions to clear and hold 1000. Because time since last new all-time high was the selection criteria for the above table, only two bear markets are listed from the 1966-1982 time period. There were actually five others for a total of seven. DJIA 18000 is increasingly looking like DJIA 1000 from the last secular bear. DJIA first closed above 18000 on December 23, 2014, 486 calendar days ago.