The Home Depot (NYSE:HD) is where you go for all those projects around the home. Whether it is painting, building a life size playhouse, creating a patio or enhancing your lawn. They have what you need. But most people would not think to go to Home Depot to spruce up their investment portfolio. Why not?

The stock of Home Depot has been a great place to put money to build a new portfolio. The price started to move higher out of consolidation in August of 2014. It rose through to January 2015 before a pause and a rounding up to a new leg higher. That made another high in November 2015.

It succumbed to the market forces in January and February, pulling back, but recovered to a new all-time high again in May, the height of the DIY season. It did pullback again to a higher low in June before the latest reversal higher.

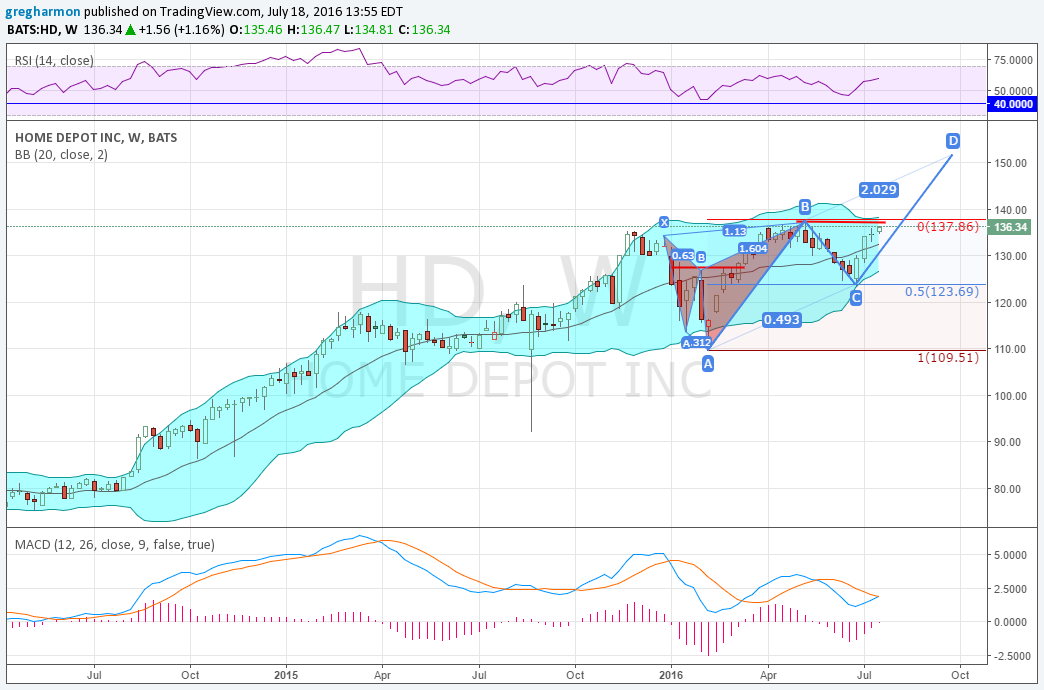

The chart above shows the price action from December through to the May high traced out a bearish Shark harmonic. It reversed lower at the second Potential Reversal Zone (PRZ) and retraced 50% of the pattern. This is where the last leg higher began. Sticking with the harmonics, this gives an AB=CD target to 151.75 at the end of September.

The momentum indicators support a continued move higher. The RSI has held in the bullish zone, over 40 on every pullback and is rising. The MACD is rising and positive as well. It is also about to cross up, a buy signal. Price confirmation will come on a move over ‘B’, the all-time high. That is when you can stick it in your portfolio for a move higher.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.