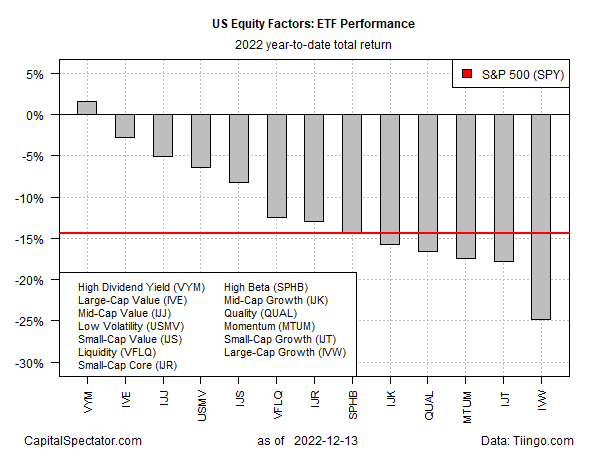

The US equity market has been clawing back some of its losses recently, but reviewing results through a factor-risk lens shows dividend yield leading the field with the only positive performance for 2022, based on a set of ETF proxies.

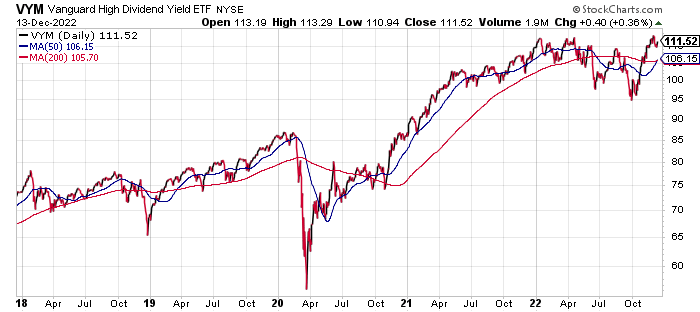

Vanguard High Dividend Yield Index Fund ETF Shares (NYSE:VYM) is now posting a modest 1.7% year-to-date gain through Tuesday’s close (Dec. 13). The increase stands out as the lone winner for our set of factor funds. iShares S&P 500 Value ETF (NYSE:IVE) may be close to shedding red ink, but at the moment VYM’s advance has no competition.

VYM has enjoyed a strong recovery in the past two months and current trades just below a record high. By contrast, the other flavors of US equity factors are nursing varying degrees of loss so far in 2022. The steepest year-to-date slide: iShares S&P 500 Growth ETF (NYSE:IVW), which is in the hole by roughly 25% this year. The US stock market overall (SPY) has shed nearly 15%.

In the wake of yesterday’s softer-than-expected inflation report, some analysts expect that growth stocks are set to rebound after getting clobbered this year. The reasoning is that peak inflation will, at some point, bring lower interest rates, which in turn will boost growth stocks anew.

Even if that calculus is correct, a Fed pivot is nowhere on the immediate horizon. The central bank today is expected to announce another rate hike, albeit a softer increase of 50-basis-points, according to Fed funds futures. Optimists expect a smaller increase, or perhaps no change, at the February FOMC meeting. The prospect of a cut, by contrast, is a more speculative forecast and, for now, doesn’t look imminent.

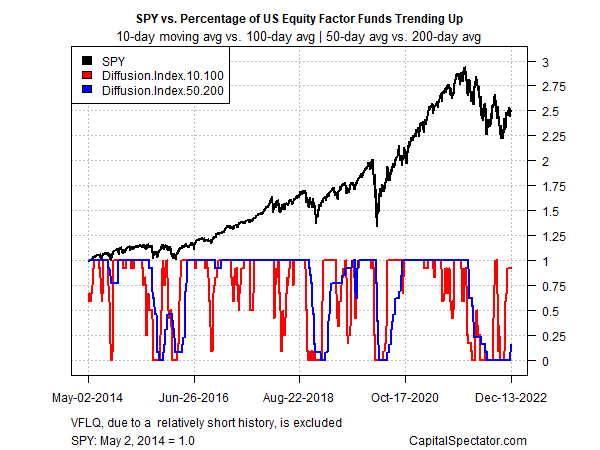

Betting on a growth-stock recovery may still be premature, but what is clear is that the trend in factor ETFs overall is turning. For the first time in many months, short- and medium-term trending behavior is rising, based on set of moving averages that aggregate price action in the factor ETFs listed above. It’s too soon to predict that a widespread rebound has started, but the upturn in both indicators suggests that the tide may be turning for these subsets of the broad market.