We’ve written quite a bit about the irresponsibility of the 'Zero Economy.' The Fed’s ultra-low interest rates have hurt lenders and encouraged corporations to borrow too much. But there’s another victim of this policy: retirees. Deprived of the bond yields they rely on for income, many senior citizens have piled into dividend stocks. In the process, they’ve led a big rally in high-yield equities.

Last month, the Fed finally pulled the trigger on the long-awaited interest-rate hike. Yields are still historically low, but they’re moving up for the first time in a year. And since then, many popular dividend stocks have taken hits.

Just how concerned should dividend investors be about this interest-rate increase? Many popular dividend payers are stable blue chips that aren’t going out of business anytime soon. But some investors worry that these stocks became overvalued in the low-interest environment after the Great Recession.

Will the big dividend payers recover from this sell-off? Are we seeing a bursting bubble in these stocks or a buy opportunity? Let’s take a look at the details to find out.

Bursting Bubble?

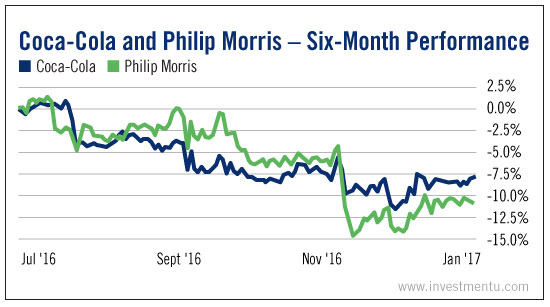

There certainly are some bubbly characteristics to the dividend stock market. Since the recession, we’ve seen a tremendous bull run in boring consumer goods stocks like Coca-Cola Company (NYSE:KO) and Philip Morris International (NYSE:PM). These reliable dividend payers saw their P/E ratios skyrocket in the last couple of years. Both were about 50% above historical averages in the summer of 2016.

But things started to go south after the September FOMC meeting. That’s when it became clear that interest rates were going up before the end of 2016. The election of Donald Trump also caused a sell-off. The president-elect’s fiscal stimulus rhetoric strengthened the case for a rate hike.

Of course, these stocks also wavered when the rate hike actually happened. Between all of these events, Philip Morris, Coca-Cola and many other big dividend payers finished the second half of 2016 in the negatives.

So let’s check the facts. Many dividend stocks hit high valuations before the rate hike. Then their prices dropped once it became a certainty. But does that a bubble make?

Back in August, Alexander Green described the two primary traits of a market bubble: sky-high valuations and a euphoric outlook.

We’ve seen some evidence of “sky-high valuations” of popular income stocks. But it’s hard to describe retirees desperately searching for yield as “euphoria.” The dividend stock rally is a product of bond income deprivation, not naïve optimism.

And as we’ll see below, the valuations of many other dividend stocks were less outlandish.

Or Buy Opportunity?

A look at diversified dividend-payer ETFs reveals a more positive take on the dividend stock market. The SPDR S&P Dividend (P:SDY_OLD) ETF (NYSE:SDY) and the Vanguard Dividend Appreciation ETF (NYSE:VIG) are both up in the last six months.

They too had some bad times after the September FOMC meeting and the election. But they promptly recovered before the end of the year -- and took only a small dive after the rate hike.

In the case of the ETF’s, these interest rate hiccups weren’t big enough to drag their six-month performance below zero. And that’s the situation that most dividend stocks are in.

Both of the graphs in this article show that dividend stocks took a hit in the lead-up to the rate hike. But truth be told, we had to cherry-pick Coca-Cola and Philip Morris to find examples of income stocks that went subzero as a result of the hike. It just wasn’t that bad for most of the market.

So that’s another mark against the “bursting bubble” theory.

What’s more, it’s important to remember that price and dividend yield have an inverse relationship for these stocks. When prices tanked in anticipation of the interest rate hike, dividend stock owners were able to get more bang for their buck by reinvesting their dividends.

The question remains... is the dividend stock rout a bursting bubble or a buy opportunity? If anything, it’s the latter. The market never had the kind of crazy euphoria that signals a bubble. Prices haven’t fallen too far, and besides, an occasional drop is good for income-seeking shareholders.

Interest rates went up last month, but they’re still extremely low compared to their historic averages. As a result, dividend stocks will continue to be a valuable income source for many investors. To learn about a foolproof method of generating retirement income with dividend investing, check out Marc Lichtenfeld’s best-selling book on the subject .

Thoughts on this article?