Brown-Forman (N:BFb) manufactures and sells alcoholic beverages globally. The business’ flagship brand is Jack Daniels.

Brown-Forman also own Sonoma wines, Korbel Champagne, Chambord, Tuaca, Southern Comfort, El Jimador, and Finlandia Vodka. The image below shows the company’s alcohol brands:

Brown-Forman has increased its dividend payments for 31 consecutive years. The company was founded in 1870 in Kentucky. Brown-Forman has grown significantly since that time – today it has a market cap of $22.8 billion

The company has stayed true to its roots. To this day, the Brown family still controls about 70% of the company’s voting shares.

Competitive Advantage

Brown-Forman’s competitive advantage comes from its brands. The Jack Daniels brand in particular has the strongest recognition.

The company has spent over $400 million a year on advertising in each of its last 3 fiscal years to support its brands. This comes to around 14% of sales spent on advertising – one of the highest numbers of any Dividend Aristocrat on a revenue percentage basis.

Brown-Forman’s massive advertising spending has caused a global resurgence in whiskey consumption. Fourth generation Brown family member and current Chairman of the board at Brown-Forman Gavin Brown IV had this to say about the company’s advertising in its 2014 annual report:

“Were it not for Brown-Forman’s focus on American whiskey, and in particular, its home states of Kentucky and Tennessee, I have no doubt that the industry would not be seeing this resurgence. It just seems difficult to imagine that there would be a global demand for American whiskey had Brown-Forman not painstakingly grown the Jack Daniel’s family of brands.”

The global whiskey market is still growing. It is expected to grow at 4.5% a year over the next 5 years. Brown-Forman’s advertising is working well domestically also. Total Whiskey and Bourbon revenue in the United States rose 9.6% in fiscal 2014.

The company’s Jack Daniels brand is the industry leader. The Jack Daniels brand in particular is what makes Brown-Forman a steady and reliable Dividend Aristocrat.

Growth Potential and Total Return Analysis

Brown-Forman grew earnings-per-share at a compound rate of 8.4% a year over the last decade. Dividends grew slightly faster at 9.4% a year.

The company’s earnings growth came from the following sources:

- Revenue grew at 5.3% a year

- Share repurchases reduced share count by 1.1% a year

- Net profit margin increases resulted in earnings growth of 2.1% a year

The primary growth driver for Brown-Forman has been revenue increases. This is the ideal growth driver for a company – it shows that the company’s products are in increasing demand.

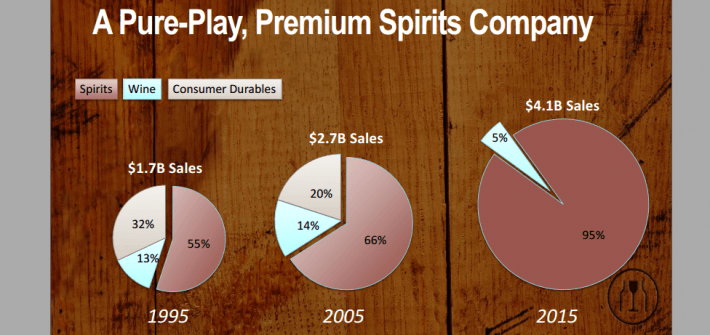

Net profit margin increases show that this revenue growth has been profitable. Profit margins have risen in large part due to Brown-Forman’s focus on higher margin spirits rather than wine and consumer durable products. The image below shows the company’s transition to a nearly pure spirits business:

Source: Brown-Forman 2015 Barclay’s Global Consumer Presentation

Going forward, I expect Brown-Forman to continue compounding earnings-per-share at around 8% to 9% a year.

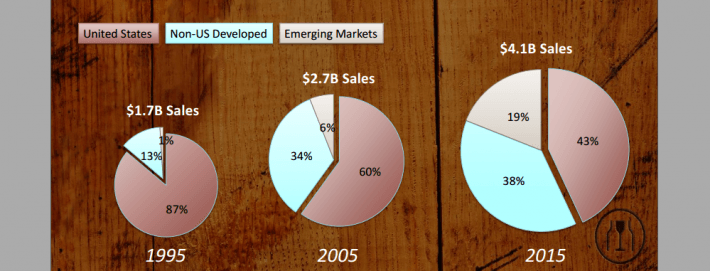

The company’s growth will come from continued revenue growth and share repurchases. Revenue growth will come increasingly from international markets. The image below shows the company’s international growth over the last 2 decades. This trend will continue.

Source: Brown-Forman 2015 Barclay’s Global Consumer Presentation

Brown-Forman currently has a below-average dividend yield of just 1.3%. The company’s dividend yield combined with its expected growth gives investors an expected total return of 9.3% to 10.3% a year.

Safety and Recession Performance

Brown-Forman’s business is exceptionally safe and stable. The company’s stock has a low beta of just 0.75. It sells an addictive product with a strong brand name that is in demand regardless of the economic climate.

The company’s earnings-per-share through the Great Recession of 2007 to 2009 are shown below:

- 2007 earnings-per-share of $1.90 (new high)

- 2008 earnings-per-share of $1.91 (new high)

- 2009 earnings-per-share of $2.06 (new high)

Brown-Forman had record earnings-per-share every year through the Great Recession. The company is very recession resistant.

Valuation & Final Thoughts

Brown-Forman is a fantastic business that sells premium spirits.

Unfortunately it also comes with premium pricing.

Brown-Forman investors should expect total returns of 9.3% to 10.3% a year before valuation changes.

The company is trading for a current price-to-earnings ratio of 32.6. This is far in excess of what a company with ~10% expected total returns should trade for.

As an example, Coca-Cola (N:KO) offers investors similar returns with a similar (meaning very little) level of risk – but it trades for a price-to-earnings ratio of under 20 (using adjusted earnings).

As a result of its overvaluation Brown-Forman is not a buy. The company does not rank well using The 8 Rules of Dividend Investing due to its high valuation and low dividend yield.

The company is of an exceptionally high quality and would make an excellent long-term holding if the right entry point presents itself.

If Brown-Forman stock ever trades for a price-to-earnings ratio of ~20, long-term dividend growth investors should consider adding it to their portfolio.