AbbVie (N:ABBV) ranks very highly using The 8 Rules of Dividend Investing.

The company’s stock has:

- A 3.9% dividend yield

- An adjusted price-to-earnings ratio of 14.5

- Double-digit expected earnings-per-share growth

AbbVie’s stock is beaten down right now due to fears over the future of the company. The company’s stock is down ~15% over the last 6 months.

Normally, this is exactly the kind of investment I look for: A high quality dividend growth business that is undervalued.

As of the January 2016 Sure Dividend newsletter, AbbVie was ranked 5th overall.

Here’s what I wrote about the company in the January 2016 Sure Dividend newsletter:

“This month AbbVie (ABBV) made the top 10 (it would have ranked 5th). I have removed it from the Top 10 because it generates 61% of its revenue from one drug (Humira) that goes off patent at the end of 2016. Qualitatively, the company is too risky for me to recommend in good conscience.”

The Problem with AbbVie

The problem with AbbVie stock is it generates ~60% of its revenue from one product; Humira.

Source: Drugs.com

Humira is a highly successful drug used to treat rheumatoid arthritis, plaque psoriasis, Crohn’s disease, ulcerative colitis, and other similar ailments.

For some businesses, generating the majority (or even all) of profit from one product is not bad – if that product is protected by a strong and durable competitive advantage. Think about how many company’s sell ‘coke-like sodas’ – yet none of them can touch Coca-Cola’s (N:KO) strong brand based competitive advantage.

AbbVie (and every other pharmaceutical company) protects its products with patents. Patents certainly provide a strong competitive advantage, but not a durable one. Patents expire at known intervals.

That’s where the risk with AbbVie comes in.

The company’s composition-of-matter patent for Humira expires at the end of 2016 in the United States. It expires in 2018 in Europe.

When these patents expire, Humira will lose its competitive advantage. Amgen (O:AMGN) has already submitted a biosimilar version AbbVie to the FDA (they did so in November of 2015). It is likely that other pharmaceutical companies will follow.

It’s difficult to know exactly how far revenue and profit will slide for Humira once it experiences competition.

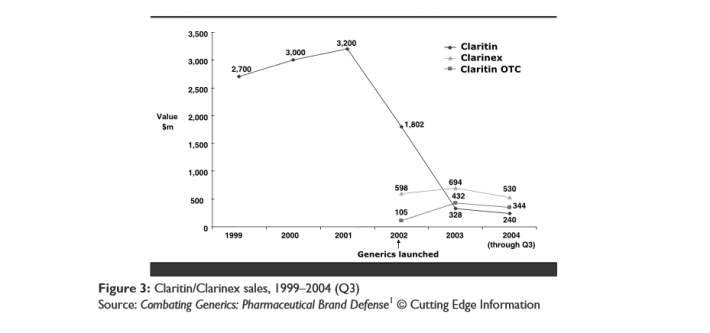

The image below shows the effects of generic drug competition on Claritin to give an idea of what happens when a drug loses market exclusivity:

Source: Battle for the Market by Hess and Litalien

It’s very unlikely generics have as strong of an effect on Humira as they did on Claritin. With that said, competition will decrease margins, revenue, and profit for Humira.

Can AbbVie Replace Lost Humira Revenue?

AbbVie is expecting to have revenues of $37 billion through 2020. The company is expecting $23 billion in sales through fiscal 2015.

The company expects Humira sales will be greater than $18 billion through 2020, or approximately 50% of total revenue. Currently, AbbVie accounts for ~60% of company revenue and should generate around $14 billion in revenue in fiscal 2015.

Using AbbVie’s management’s numbers (which are likely too optimistic), the company will add ~$10 billion in revenue over the next 5 years outside of Humira.

Looking at the numbers above, if Humira sales dropped by about 70% over the next 5 years, the company would have around the same amount of revenue it does now (if it manages to grow $10 billion in new revenue over the next 5 years).

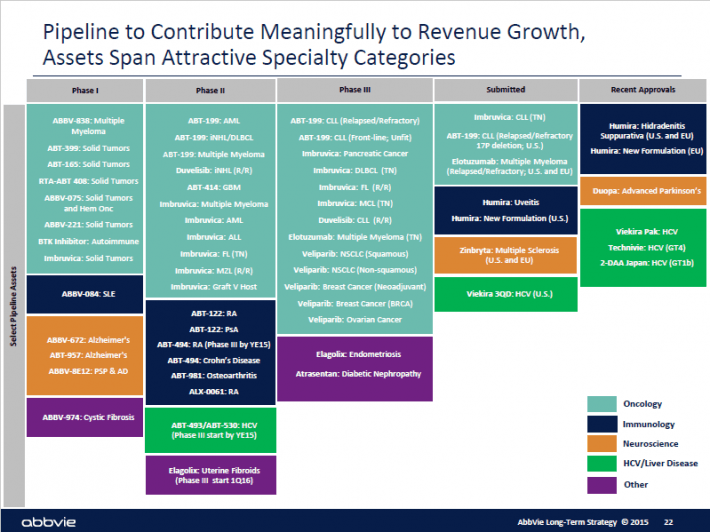

Can AbbVie replace its lost Humira revenue? Yes, it can, thanks to its large pipeline (shown in the image below) which is funded by $3+ billion a year in research and development expenditures. Revenue growth will likely not be able to offset lost Humira sales over the next few years, however.

Source: AbbVie October 2015 Strategy Presentation, slide 22

In Defense of Humira

AbbVie’s management is not just going to let generic Humira competitors steal market share without a fight.

Here’s what AbbVie CEO Richard Gonzalez had to say on the matter in AbbVie’s 3rd Quarter Conference Call:

“Beyond our composition of matter patent, we have more than 70 additional later expiring U.S. patents related to HUMIRA. The vast majority of these patents which reflect significant innovation and investment were granted by the U.S. patent and trademark office within the past two years. These patents expire between 2022 and 2034. The size of AbbVie’s patent estate is a direct consequence of the ground-breaking work of AbbVie scientists in a new field of biologics…

Any company seeking to market a biosimilar version of HUMIRA will have to contend with this extensive patent estate, which AbbVie intends to enforce vigorously…

While AbbVie’s formulation and manufacturing patents for HUMIRA also have broad coverage, without further information on the biosimilar we cannot know with certainty, the extent to which these patents will be infringed.”

This legal battle will likely not prevent large pharmaceutical companies from entering the United States markets that Humira serves, but it could be enough to scare off smaller would-be-competitors.

How Is AbbVie a Dividend Aristocrat?

You may be wondering how AbbVie is a Dividend Aristocrat if it is so risky. If a company has paid increasing dividends for 25+ years, hasn’t it already proven itself?

In general, yes. But…

AbbVie hasn’t paid increasing dividends for 25 or more consecutive years.

The company was spun-off from Abbott Laboratories (N:ABT) – which has now paid increasing dividends for 44 consecutive years.

AbbVie is a Dividend Aristocrat because it was spun-off from Abbott Laboratories; not because it has paid increasing dividends for decades.

To be fair, AbbVie has paid increasing dividends every year since it was created on January 1st, 2013.

The company’s qualitative risks combined with its shorter dividend history (post spin-off) are why I call AbbVie the riskiest Dividend Aristocrat.

Your Money Matters. Invest for Safety First.

There’s nothing wrong with investing in AbbVie.

In fact, I believe it to have favorable risk adjusted return potential.

If Humira fears are overblown and the company somehow continues to grow its Humira business (as well as other drugs), AbbVie stock could easily trade for an adjusted price-to-earnings ratio of 20 to 25 – around a 55% premium to current prices. Even if Humira losses 70% of its revenue over the next 5 years, AbbVie could very well be around as profitable as it is now – if it manages to grow its drug portfolio as management projects.

On the other hand, the company’s future is uncertain…

- How far will Humira sales fall when patents begin to expire?

- How effective will the company’s management be at growing non-Humira sales?

AbbVie makes an interesting value investment at current prices.

It does not, however, have the level of safety that dividend growth investors who rely on steadily increasing dividend income count on.

Dividend growth investors in the health care sector should take a closer look at Johnson & Johnson (N:JNJ) and Abbott Laboratories (ABT) – AbbVie’s parent company.

Both businesses have a much higher probability of paying rising dividends for years out than AbbVie.