Consumer products companies have it easy. When you buy a box (or 4) of Kimberly-Clark (N:KMB) Kleenex, you and Kimberly-Clark both know you will be buying more soon.

When you buy a Coca-Cola (N:KO) soda, you aren’t going to drink it forever… You’ll be back to buy more.

What if someone could apply this buy-dispose-repeat process to the medical supply industry? Certainly, that would be a very profitable company.

CR Bard (N:BCR) does just that.

In fact, 90% of the company’s products are single use products. You use them once, then toss them out.

The company sells catheters, stents, ports, drug-eluding balloons, and surgical repair products (among others). CR Bard’s products are the health industry’s answer to disposable consumer products.

CR Bard’s Business in Detail

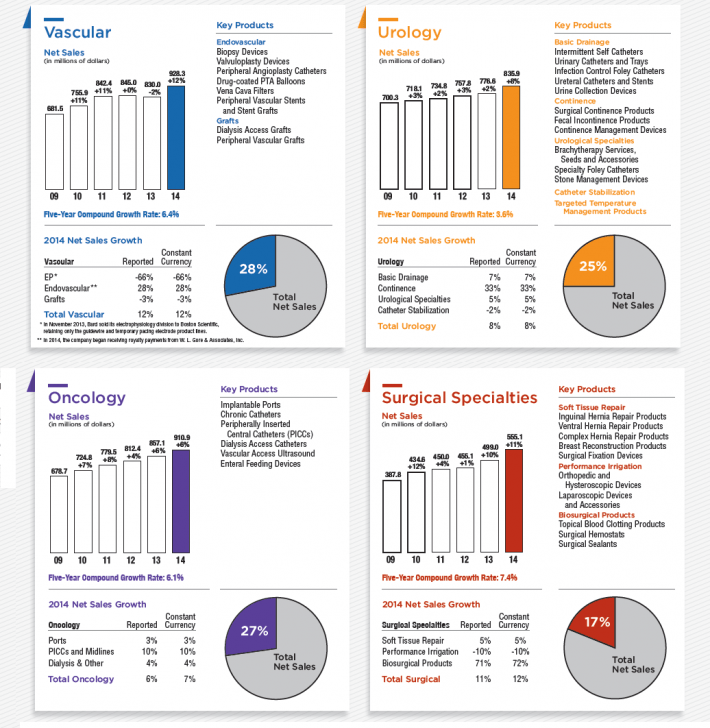

CR Bard breaks its operations into 4 primary segments. The image below gives a rundown of each segment, along with the percentage of total sales each segment generated in fiscal 2014 for C.R. Bard.

Source: C.R. Bard Annual Report, page 12

CR Bard currently has a market cap of $13.5 billion; it has grown for a long time. CR Bard was founded in 1907 in New York City by Charles R Bard (who named the company after himself).

CR Bard Is An Unusual Dividend Aristocrat

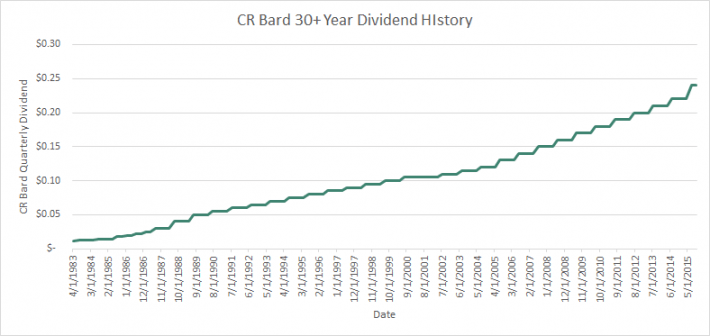

CR Bard has increased its dividend payments for 44 consecutive years. The company’s long history of consecutive dividend increases makes CR Bard a Dividend Aristocrat.

The image below shows the company’s consistent dividend growth since the 1980’s.

Source: Data from Yahoo (O:YHOO) Finance

What makes CR Bard unusual for a Dividend Aristocrat is its exceptionally low dividend yield. The company’s stock currently offers investors a paltry dividend yield of 0.5%.

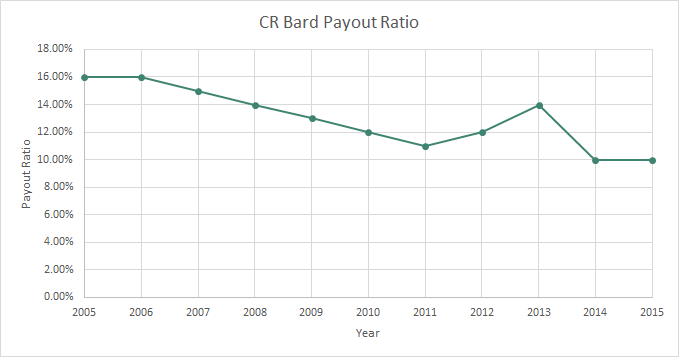

The reason the company’s dividend yield is so low is because it has a payout ratio of just 10%. Will CR Bard hike its payout ratio soon? That seems very unlikely. In fact, the company’s payout ratio has gone in the opposite direction.

Source: Data from Value Line

While CR Bard does pay increasing dividends, it pays out a very small percentage (just 10%) of its earnings as dividends. The company’s strong commitment to paying rising dividends AND commitment to paying very small dividends as a percent of earnings is very unusual.

But a low payout ratio does not mean CR Bard’s management is unfriendly to shareholders. The company has reduced its share count by 3.6% a year on average over the last decade. The company’s expected share repurchases and dividends combined give investors an expected shareholder yield of around 4.0%; a total payout ratio (including money spent on share repurchases) of around 80%.

CR Bard’s Total Return Potential

CR Bard has compounded its earnings-per-share at 12.0% a year over the last decade. The company’s above-average growth is a result of favorable trends in the health care industry, large share repurchases, and international expansion.

Going forward, CR Bard’s growth will come from new product innovations more than any other factor. The company has significantly increased its research and development spending in recent years to spur innovation.

From 2009 through 2012, CR Bard spent an average of 6.8% of revenue on research and development. In fiscal 2013 and 2014, the company spent an average of 9.4% of revenue on research and development – that’s a 34% increase! In monetary terms, the company now spends over $300 million a year on research and development.

While the company’s research and development will spur growth, I expect the company’s earnings-per-share growth rate to slow somewhat versus the rapid 12% CAGR the company has realized over the last decade.

I expect earnings-per-share growth (which includes share repurchases) of between 8% and 11% a year over the next several years (excluding the effects of currencies). This growth combined with the company’s current 0.5% dividend yield gives investors expected total returns of between 8.5% and 11.5% a year for CR Bard.

Valuing CR Bard

Since 1999, CR Bard has traded for an average annual price-to-earnings multiple of between 15 and 22. The company is currently trading for a price-to-earnings multiple of around 20 (using expected fiscal 2015 earnings).

CR Bard is trading near the higher end of its historical price-to-earnings ratio range. As a result, the company is certainly not a bargain at current prices. CR Bard is either fairly valued or slightly overvalued at current prices.

Recession Performance

CR Bard performed admirably through the Great Recession of 2007 to 2009. The company’s earnings-per-share each year through the Great Recession are shown below to illustrate this point:

- 2007 earnings-per-share of $3.84

- 2008 earnings-per-share of $4.44

- 2009 earnings per share of $5.09

People still need catheters, stints, and ports during recessions. These are products that hospitals and medical care providers simply cannot forgo purchasing. As a result, CR Bard grew its earnings-per-share each year through the Great Recession. This is a feat few businesses can match.

The health care industry in general is recession resistant. It should come as no surprise that 3 of the 10 most recession-proof Dividend Aristocrats are in the health care sector.

Final Thoughts

If I owned CR Bard, I certainly wouldn’t sell at current prices. I wouldn’t buy the stock at this time either. CR Bard has a competitive advantage in the medical supply industry that is enforced through patent protection and well-established connections within the medical industry.

The company is shareholder friendly despite its low yield. CR Bard’s management prefers to dole out cash to shareholders through share repurchases rather than dividends.

CR Bard will make a more interesting potential buy for total return investors when its price-to-earnings ratio drops below 18; around or below 15 would make it a very compelling purchase.

The company currently ranks above-average using The 8 Rules of Dividend Investing thanks to its stability and growth prospects. CR Bard’s low dividend yield and somewhat high valuation prevent it from ranking higher.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.