Clorox (N:CLX) was founded in Oakland California in 1913. The company is still headquartered in Oakland, and currently employees around 7,700 people.

Since 1913, Clorox has grown significantly. The company now has a market cap of $15.8 billion. The company is remarkably consistent. Clorox has increased its dividend payments for 38 consecutive years and has a history of rewarding shareholders with share repurchases as well.

Clorox sells branded consumer products. Several of the company’s most well-known brands are listed below:

- Pine-Sol

- Clorox Bleach

- Glad trash bags

- Brita water filters

- Kingsford charcoal

- Fresh Step cat litter

- Burt’s Bees natural products

- Hidden Valley Ranch Dressing

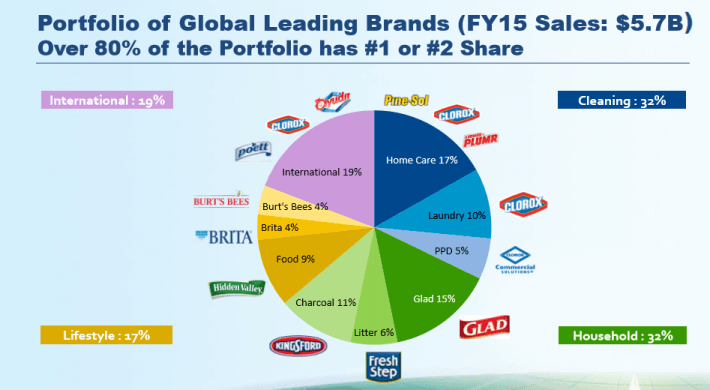

The image below gives a concise breakdown of Clorox’ brands, including a revenue breakdown. Note that 80% of the company’s brands are either #1 or #2 in their respective categories:

Source: Clorox 2020 Vision Presentation

Competitive Advantage

Clorox’ competitive advantage is derived from its strong brands. The company has a long history of building, strengthening, and acquiring consumer branded products.

The company has dominant market share in the United States over several product categories, including:

- ~60% market share in bleach (Clorox brand)

- ~75% market share in charcoal (Kingsford brand)

- ~60% market share in water filtration (Brita brand)

The company supports its brands by investing heavily in advertising. Clorox’ advertising budget over the company’s last 3 full fiscal years is shown below:

- 2015 advertising spend of $523 million

- 2014 advertising spend of $503 million

- 2013 advertising spend of $498 million

Clorox spends around 9% of its total sales a year directly on advertising. The company’s large advertising budget helps it to sell its products for premium prices by highlighting the specific benefits of its products.

In addition to build up brand equity through advertising spending, Clorox also spends significantly on research and development. The company is constantly attempting to improve its products to better serve its customers. Clorox has spent about $130 million a year on research and development over the last 3 years.

Clorox’ full competitive advantage is a combination of its well-known brands, economies of scale and efficient supply chain, and its focus on product improvement through research and development.

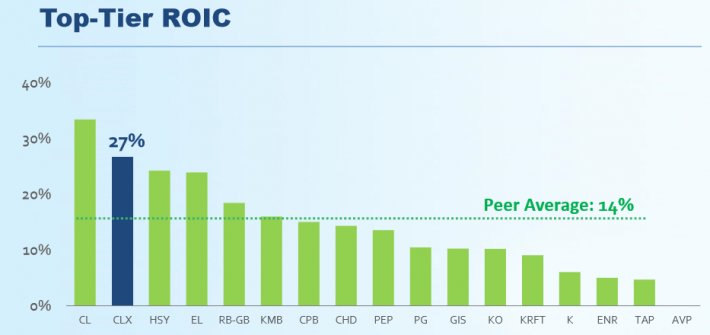

Clorox’ competitive advantage gives it excellent margins relative to competitors. The image below shows Clorox’ return on invested capital (abbreviated as ROIC) relative to its peers:

Source: Clorox 2020 Vision Presentation

Growth Prospects

Clorox has grown its earnings-per-share at just 5.2% a year over the last decade. Dividends have grown much faster – at 11.3% a year – as the company has nearly doubled its payout ratio over the last decade.

Over the long run, Clorox’ dividend payments can only grow as fast as earnings-per-share.

Clorox’ earnings-per-share growth over the last decade is from:

- Sales growth of ~2% a year

- Share count reductions of ~2% a year

- Net profit margin gains of ~1.5% a year (from 9.5% to 10.7%)

As you can see, Clorox’ has only managed to grow its sales at around the pace of inflation over the last decade. This, of course, is not preferable.

Going forward, Clorox management is expecting 3% to 5% sales growth a year. The company realized 5% constant-currency sales growth in its most recent full fiscal year.

Factoring in the company’s 10 year history of 2% sales growth, I estimate future sales growth for Clorox at between 2% and 5% a year.

Share repurchases have helped increase earnings-per-share for Clorox over the last decade. Unfortunately, the company cannot keep repurchasing 2% of shares outstanding every year at current prices.

Clorox has a shareholder yield (dividend yield + share repurchases) of 4.5%. The company has an earnings yield (earnings dividend by price) of 4.0%… A company can’t keep paying out more than it makes for long.

I expect total returns of 7% to 11% a year going forward for Clorox shareholders, from the following sources:

- Dividend yield of 2.5%

- Sales growth of 2% to 5% a year

- Share count reductions of 1.5% a year

- Net profit margin gains of 1% to 2% a year

Recession Performance

Clorox performed exceptionally well through the recession of 2007 to 2009. The company managed to grow earnings per share each year of the Great Recession.

Clorox’ earnings per share from 2007 to 2010 are listed below:

- EPS of $3.23 in 2007

- EPS of $3.24 in 2008

- EPS of $3.81 in 2009

- EPS of $4.24 in 2010

The company’s excellent performance through the recession shows that consumers continue to buy the company’s branded products in times of economic hardship.

If the last recession is any indication, Clorox’ underlying business will perform well through the next recession (whenever that may be).

Valuation and Final Thoughts

Clorox is currently trading for a price-to-earnings ratio of 25. The company is trading well above its historical average price-to-earnings ratio of 19.7. A fair price-to-earnings ratio range for the company is between 18 and 20 given the company’s excellent performance over a wide variety of economic conditions and extremely low stock price standard deviation of just 18.5%.

There’s no question that Clorox is a high quality shareholder friendly business with a strong competitive advantage. The company’s low stock price standard deviation makes holding Clorox relatively easy, versus more volatile stocks.

Unfortunately, the company’s stock is very likely overvalued at current prices. As a result Clorox is a hold at current prices using The 8 Rules of Dividend Investing.