If you’re trading commodities, make sure you aren’t pigeonholing yourself by only following the standard XAU/USD, CL-OIL etc. Make sure you diversify your commodities trading.

Speaking of diversification, we have taken a slightly different look at gold today, with the level in focus being on the XAU/AUD daily chart.

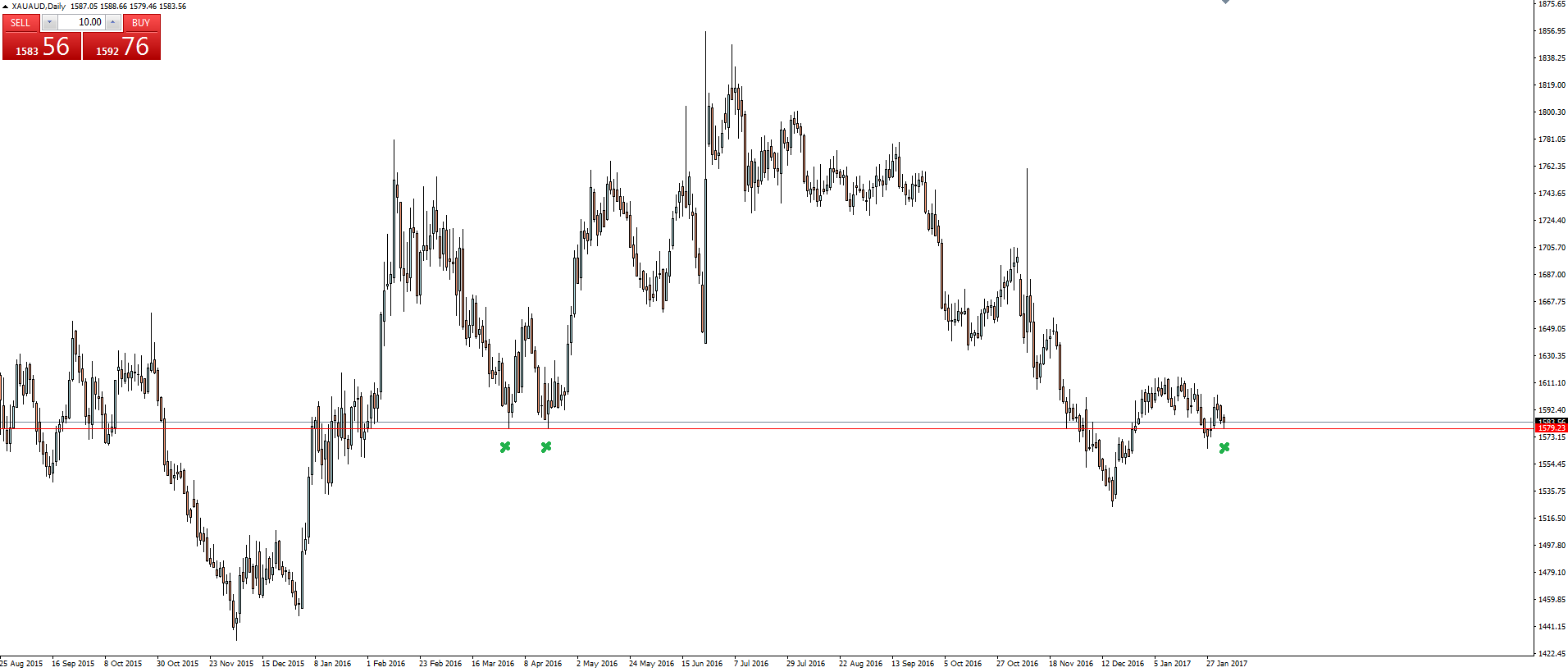

XAU/AUD Daily:

As you can see, price has come back to test a daily horizontal level that has previously been an area of interest. As always, it’s not just that the level held in the past that makes it significant, but the way in which the level holds. That is, did price simply hover around the level for a long period of time, or was there a V shaped bounce straight off it?

Look at the wick and hard bounces on the two previously marked rejections off the level. It is definitely a level of significance!

While the most recent swings saw price chop through it, the fact that Friday’s daily low was the exact level shows it’s still significant in using it as a higher time frame level to manage risk around heading forward.

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, forex news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.