There is an old saying on Wall Street that if you aren’t worried about something in your portfolio, then you probably aren’t diversified enough. This notion certainly comes to mind when identifying positions with varying degrees of correlation to create a unified investment strategy.

In my opinion, diversification is a tremendous tool to spread risk among multiple asset classes. The more diversified you are, the greater chance you are going to own some investments that are doing well and others that are falling behind. These trends can often extend for very long periods of time.

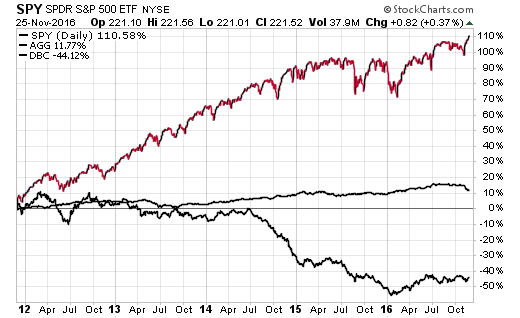

Just look at the 5-year returns of stocks, bonds, and commodities through the lens of diversified exchange-traded funds. The performance of each asset class varies widely.

Of course, no one knows exactly which type of investment or sector is going to be the best ahead of time. That is why we tend to be foolhardy and focus on short-term performance of individual positions rather than the sum of the parts.

Investors are constantly worried about what isn’t working right. Should I sell my municipal bond fund? It’s down -4%. Am I in the right stock fund? Others are doing better than mine. Do I need to own gold? It’s up +7% this quarter. The comparative analysis goes on and on.

The concept that gets lost along the way is how the overall account is performing. Is your asset allocation in line with your risk tolerance? Do you own low-cost investments that are keeping pace with the market? Is your one, three or five-year total return similar to a diversified benchmark?

If the answer is yes, then you are going to have an easier time relinquishing some anxiety over small positions that underperform for a time. If the answer is no, then you are going to face a much higher degree of stress about each individual holding.

It’s the difference between being able to see just the individual trees or the entire forest.

I also want to emphasize the danger of your portfolio being too overtly correlated even if its technically in multiple asset classes. Put simply, if everything is firing on all cylinders, then you probably own assets with similar risk and performance characteristics.

For example, stocks and high yield bonds typically move in a similar fashion. If your portfolio is primarily made up of these two areas, a downturn in both equity and credit conditions can lead to a protracted period of underperformance. It may behoove you to consider broadening your portfolio to higher quality bonds or other areas demonstrating diverging price correlations.

I’m not one to advocate that you need to own the total global investable marketplace. You can gently shape your exposure to certain themes without wild deviation from a sensible investment strategy. That may include discretion over security selection, position sizing, and even minimum or maximum exposure limits.

In my opinion, ETFs and low-cost mutual funds are the best vehicles to achieve this outcome in a sensible and cohesive manner. These tools come with the diversification baked right into the cake and are appropriate for virtually every style of investor.

Disclosure: FMD Capital Management, its executives, and/or its clients June hold positions in the ETFs, mutual funds or any investment asset mentioned in this article. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI